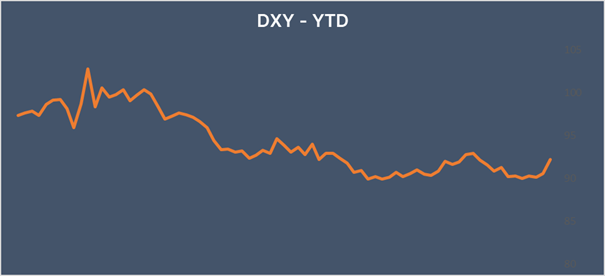

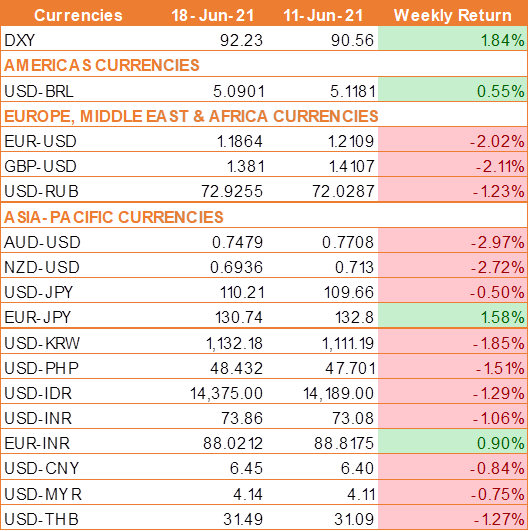

USD surges to fresh 2 months high

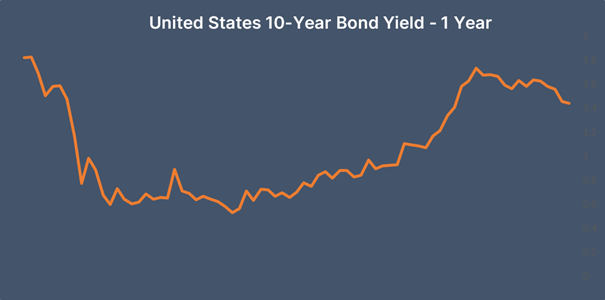

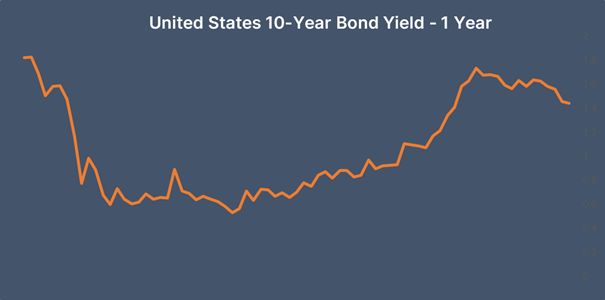

USD jumped last week against all of the major world currencies and the US 10 year benchmark bond yields posted their biggest one-day rise in three months on Wednesday after U.S. Federal Reserve officials surprised markets by projecting a hike in interest rates and end to emergency bond-buying sooner than expected.

US Federal Reserve surprised the market on Wednesday by signaling that two interest rate hikes might take place in 2023. This was a significant change of thinking from the last Fed meeting when no policymaker was in favor of hiking before 2024.

The Fed pointed to an improved economic outlook as the reason for accelerating the path to monetary policy normalization. The US central bank upgraded its growth outlook for 2021 to 7% and also upgraded the inflation forecast to 3.4%.

Investors' risk appetite took another hit after St. Louis Federal Reserve President James Bullard said on Friday that the U.S. central bank's shift toward a faster tightening of monetary policy was a "natural" response to economic growth and particularly inflation moving quicker than expected as the country reopens from the coronavirus pandemic.

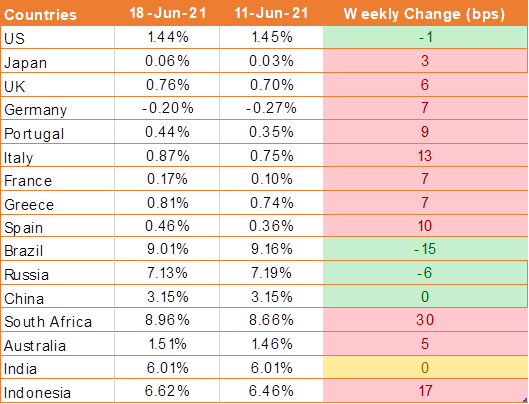

However, US 10 year bond yields gave up the early week gains and ended the week at 1.44% as market participants were eying a significant sell-off in commodities. Prices for metals like copper continued their weekly decline amid actions by China to crack down on inflation.

Long-dated U.S. Treasury yields fell on Friday and the yield curve continued to flatten as market participants bet that the Federal Reserve will act sooner to clamp down on inflation pressures if they persist.

INR falls as inflation surges to a 6-months high level

INR fell sharply against USD last week amid hawkish Fed and as India’s inflation surged to a 6-month high level.

India's retail inflation surged by 6.30% on yearly basis in May 2021 from 4.23% in the previous month. The rise has been driven by higher food, fuel, and energy prices. In the same line, Consumer Food Price Index (CFPI) experienced a sharp rise to 5.01% in May 2021 against 1.96% in April 2021. Core inflation also rose to 6.6% in May 2021 from 5.4% in April 2021.

We would love to hear back from you. Please Click here to share your valuable feedback