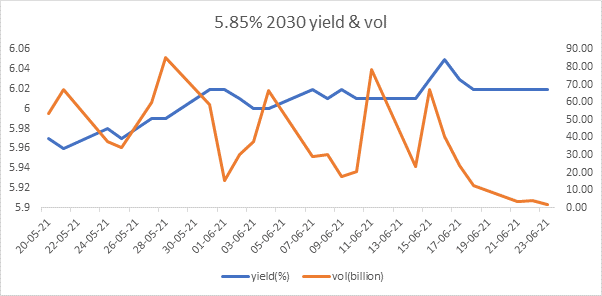

5.85% 2030 is still the 10-year benchmark g-sec but trading volumes have dropped sharply

The 5.85% 2030 g-sec is a 9-year bond with an outstanding issue size of close to Rs 1.2 trillion. RBI is continuing to auction this bond as the 10-year benchmark g-sec and the central bank also purchases this bond in its open market operations and GSAP auctions.

The bond market has almost stopped trading this bond with volumes plunging. The reason for the market to stop trading this bond is due to the fact that RBI is becoming the sole buyer and seller of the bond and market has no say in determining the yield.

Hence the reference rate for the 10-year bond has lost its sanctity and any bond priced off the 10-year g-sec is not correctly priced.

RBI has to issue a new 10-year benchmark bond maturing in 2031 and let the market decide the yield to keep the sanctity of the reference rate of the bond.

Why is the lack of volatility worrying?

When any market is held stable by a powerful force, which is RBI for bond markets, the tendency in the market is to build highly leveraged and risky positions in any asset class that benefits from low interest rates and high liquidity. Equities, commodities, credit spreads are beneficiaries of central bank largesse, and all these markets have seen surge in prices or fall in spreads in case of credits. There is talk of market bubbles on high valuations and excessive speculation.

Such rise in asset prices cannot be sustained if economy does not deliver to forecast and something or the other acts up, which is seen in the spike in inflation. While central banks may say that inflation is transitory, they can never be certain, as they always go by data, which is a past indicator and no one can predict the future with certainty, else there will never be market and economic meltdowns.

Market volatility constantly readjusts positions, enabling the market to calibrate leverage and speculation. It is necessary for markets to correct, may be for short term if long term outlook is positive or for long term if there is a bubble burst. This is normal market behaviour and the system emerges stronger after each market correction. Hence when there is lack of volatility in markets, the foundations get weaker and weaker, making the whole system wobbly.

Government bonds, SDL and OIS yield movements

During the week, 5.85% 2030 yield rose by 2 bps to 6.03% while the 5.77% 2030 yield increased by 4 bps to 6.24%. 5-year benchmark bond, 5.22% 2025 yield rose by 30 bps to 5.56%. 6.57% 2033 yield came down by 2 bps to 6.60%. Long-term paper 7.16% 2050 yield gained 10 bps to 7.09%.

The spread of 10-year bond over 5-year bond (5.22% 2025) declined to 47 bps from 60 bps in previous week. The 15-year benchmark over 10-year benchmark spread came down to 57 bps from 61 bps while 30-year benchmark over 10-year benchmark spread increased to 109 bps from 99 bps.

Average 10-year SDL auction cut-off rose to 6.86% from 6.80% during previous week. Consequently, spread increased to 84 bps from 76 bps during previous week.

On weekly basis, 1-year OIS yield rose by 10 bps to 3.93% while 5-year OIS yield increased by 15 bps to 5.43%.

We would love to hear back from you. Please Click here to share your valuable feedback