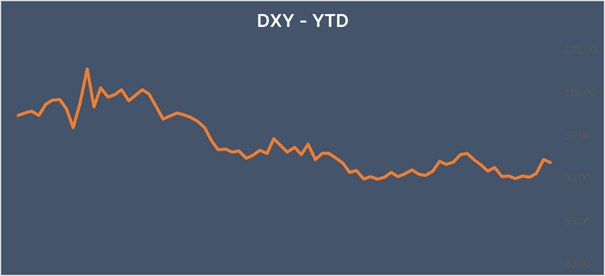

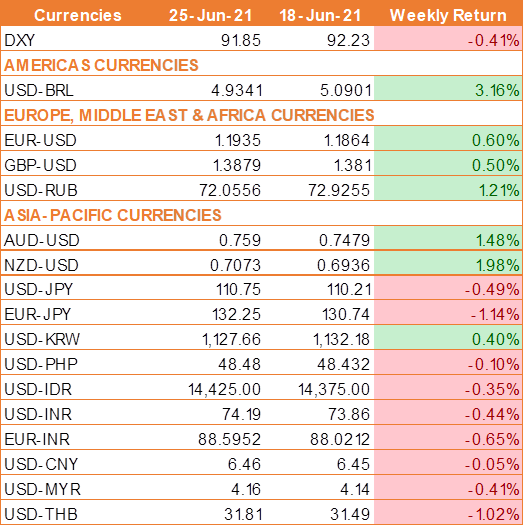

USD falls after Fed Powell’s calming testimony

USD fell last week following commentary from Federal Reserve Chair Jerome Powell that again indicated the central bank will take time to tighten monetary policy. Fed Powell’s comments were repeated by New York Fed President John Williams, who sees any tightening of monetary policy as still a long way off. These comments come after the Federal Reserve unexpectedly projected two interest rate rises in 2023 in its policy meeting last week.

In his testimony before Congress, Fed Chair Powell once again reassured that the recent spike in inflation was transitory. He also insisted that the Fed would not raise rates pre-emptively. The data, particularly labor market data, needs to improve considerably before the Fed looks to start tightening policy.

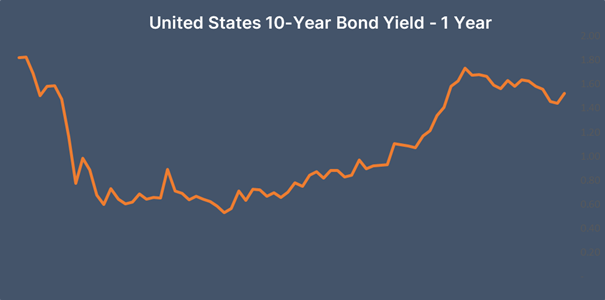

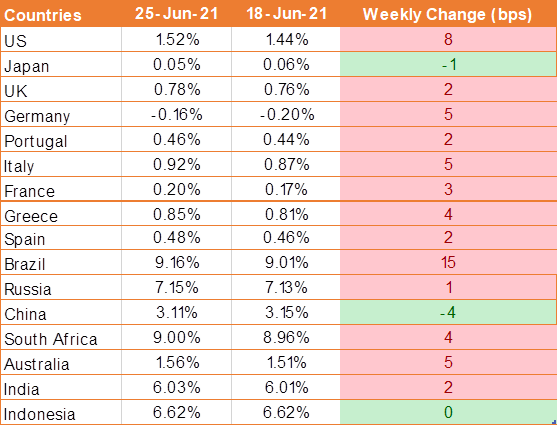

The 10-year U.S. Treasury yield rose last week after the release of PCE inflation data, which is the Federal Reserve’s preferred measure of inflation, showed that consumer prices rose sharply again in May.

PCE inflation rose 3.9% year on year in May, up from 3.6% in April. However, this was marginally off the 4% forecast. Meanwhile, core PCE came in at 0.5% month on month in May, down from 0.7% in April and below the 0.6% forecast. The slight easing in PCE data has helped calm concerns of runaway inflation.

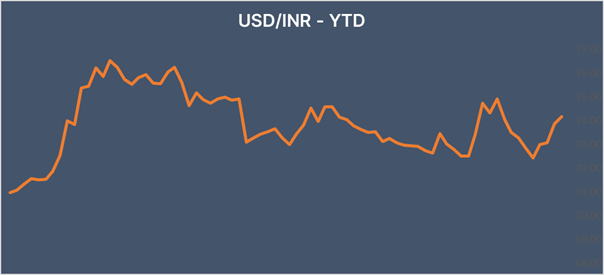

INR falls as S&P downgraded GDP to 9.5%

INR fell against USD last week as oil prices hit fresh multi-year highs as the demand outlook continued to improve.

S&P Global Ratings cut India’s growth forecast for the current fiscal year to 9.5%, down from 11%, in addition to warning of further waves of covid. The agency downgraded the growth outlook after the second wave of covid led to lockdown restrictions and a sharp contraction in economic activity. Analysts at the rating agency expect GDP growth of 7.8% in the coming fiscal year ending March 2023.

We would love to hear back from you. Please Click here to share your valuable feedback