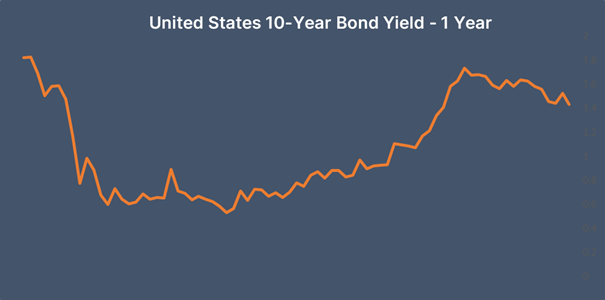

UST yields fall after US jobs data

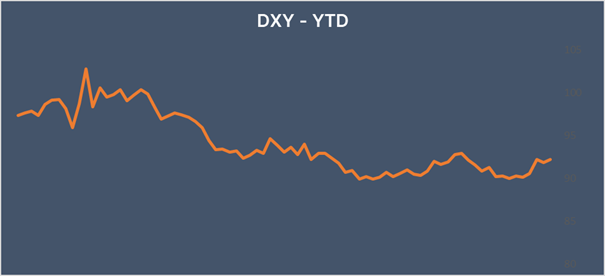

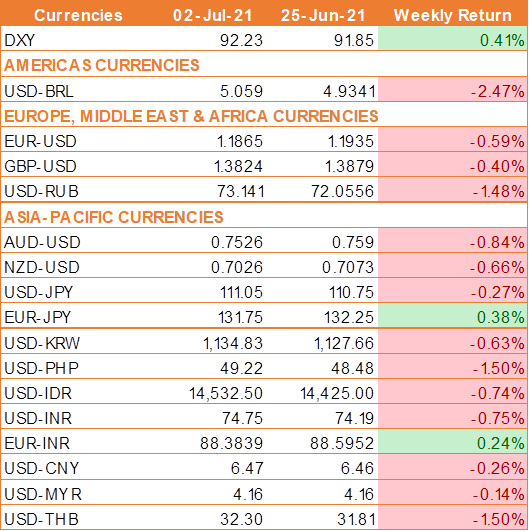

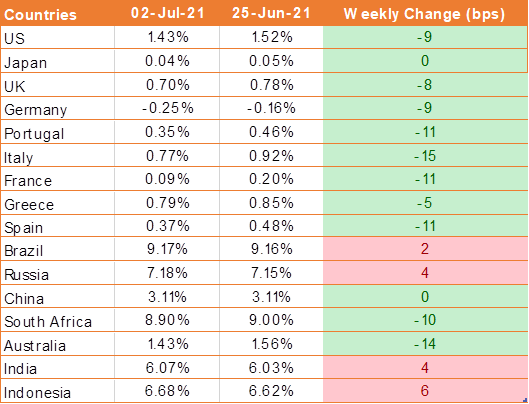

USD rose across the board last week amid the release of upbeat consumer confidence data but fell on Friday as U.S. monthly job report indicated that the labor market recovery is on the right track but not picking up so fast so as to prompt a sooner move by the Fed. U.S. 10 -year treasury yield fell sharply by 9 bps and is currently at 1.43%.

Consumer confidence surged in June to a fresh pandemic high as Americans became increasingly more upbeat about the outlook for the US economy and the job market. The Conference Board index surged to 127.3 in June from an upwardly revised 120 in May. This was well above analysts’ estimates.

U.S. labor market report revealed that 850,000 new jobs were created in the US in June against the expectation of 700,000 jobs. The upbeat number came following two straight months of misses. The unemployment rate unexpectedly ticked higher to 5.9% in June, up from 5.8% against an expectation of 5.7%.

Earnings growth showed a mixed picture, rising to 3.4% in June, up from 1.9% in May. However, on a monthly basis earnings rose by 0.3% against the expectation of 0.4%, down from a downwardly revised 0.4% in May.

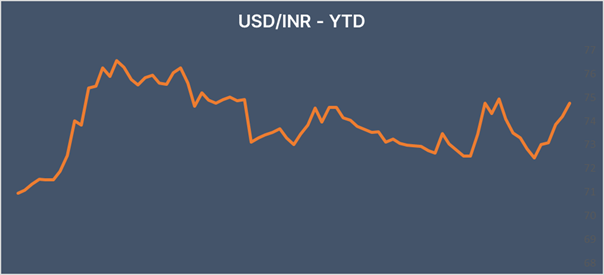

INR falls despite exports & foreign exchange reserves hitting record levels

INR came under pressure due to broad USD strength and amid rising crude oil prices.

Oil prices continue to add pressure to the INR. Oil prices continue to trade around two and a half year highs. As countries reopen their economies, fuel demand has picked up driving the demand outlook higher.

Adding to the downbeat sentiment, Indian factory activity shrunk in June for the first time in 11 months amid lockdown restrictions imposed to contain the second covid wave. The Nikkei Manufacturing PMI declined to 48.1 in June, down from May’s 50.8.

India’s foreign exchange reserves surged by USD 5.066 billion to reach a record high of USD 608.999 billion in the week ending June 25. Reserves had declined by USD 4.418 billion in the previous week.

India recorded its highest-ever merchandise export of USD 95 billion in the first quarter of FY2022. Total exports in June hit USD 32 billion, an 85% year-on-year increase.

We would love to hear back from you. Please Click here to share your valuable feedback