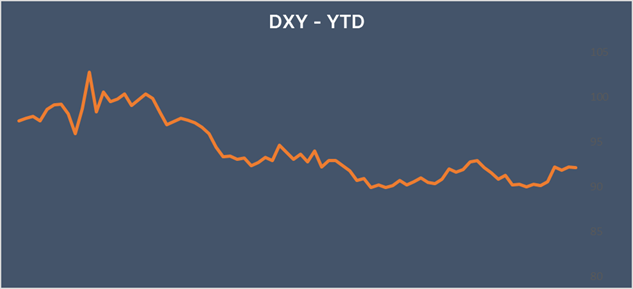

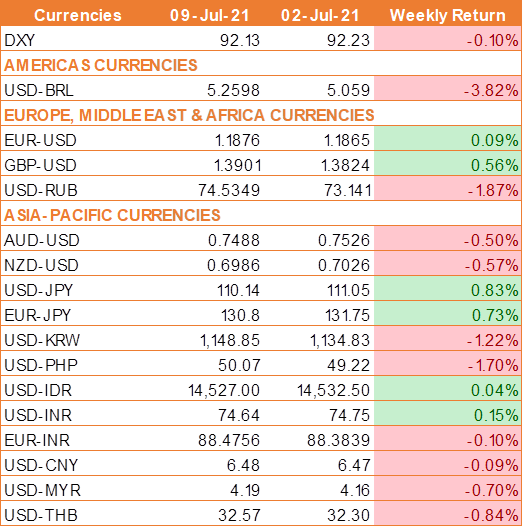

Recovery in risk sentiment sends USD lower

USD fell last week amid mixed messages in the FOMC minutes. The minutes from the June meeting confirmed that the US central bank is moving towards tapering bond purchases, possibly as soon as this year. However, the Fed policymakers also said that while there has been progress on the economic recovery, but the recovery is yet to be achieved.

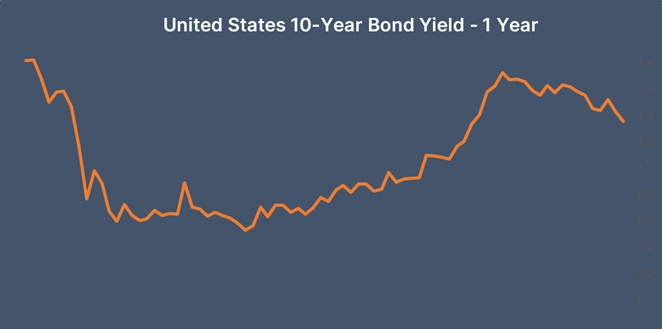

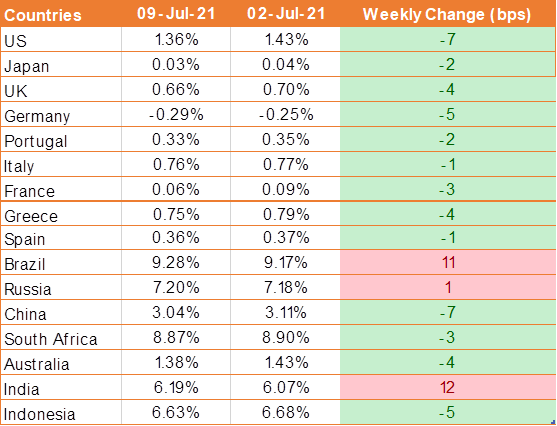

Despite the minutes, the US treasury market seems to be less concerned over rising inflation and interest rates. The benchmark 10-year Treasury yield fell by 7 bps to fresh 4 month lows.

US ISM services PMI showed a larger than expected decline in June from a record high hit in May. The PMI slipped nearly 4 points to 60.1, down from 64 and well short of the 63.5 forecasts.

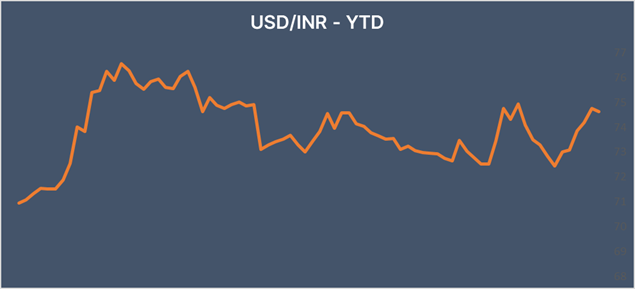

INR snaps 6-week losing streak

INR ended the week marginally higher snapping a 6-weeks losing run despite being under pressure throughout the week amid the release of weak economic data and surging oil prices. However, the sharp gain on Friday was largely driven by broad USD weakness and inflows for initial public offerings.

The oil cartel failed to unanimously agree to ease production curbs that were put in place during the pandemic. As a result, the price of oil skyrocketed, which is bad news for countries like India that import oil.

Activity in the services industry contracted sharply in June as tighter restrictions were imposed to contain the spread of the second wave of covid. The IHS Markit Services PMI Index dived to 41.2 last month, down from an already weak 46.4 in May.

We would love to hear back from you. Please Click here to share your valuable feedback