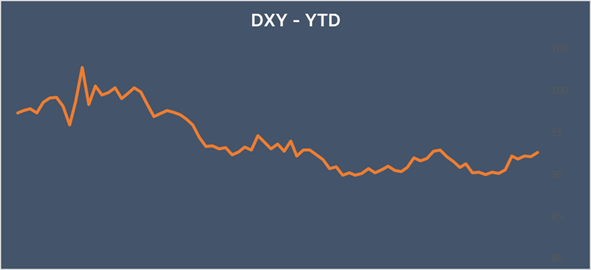

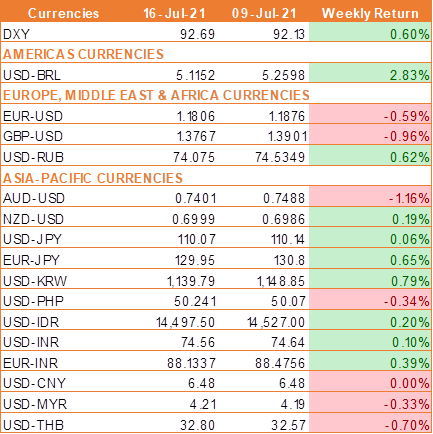

USD stabilizes after dovish Powell testimony

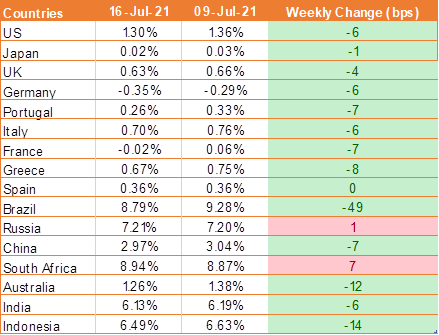

USD gained while UST and other global benchmark bond yields fell last week on a safe haven demand amid rising Covid-19 cases worldwide. High U.S. inflation is lifting expectations of an early reduction in the Federal Reserve’s USD 120 billion in monthly bond purchases. However, Fed chair Jerome Powell once again shrugged off the spike in U.S. inflation as only temporary in its testimony to congress.

Rising Covid-19 cases, mainly in southeast Asia, Europe, and the U.S., have turned many market participants risk-averse, benefiting the USD.

Soaring U.S. inflation, with consumer prices rising by 5.4% in June and producer prices by 7.3%, has prompted some FOMC members to suggest the time was coming for the U.S. central bank to rein in its massive bond-buying program.

However, Fed chair Jerome Powell reiterated that it was too soon to withdraw the central bank’s support to the economy, saying in testimony before Congress on Wednesday that it would be a mistake to act prematurely and that economic conditions for tapering bond-buying is "still a ways off".

U.S. retail sales unexpectedly increased in June as demand for goods remained strong, bolstering expectations that economic growth accelerated in the second quarter.

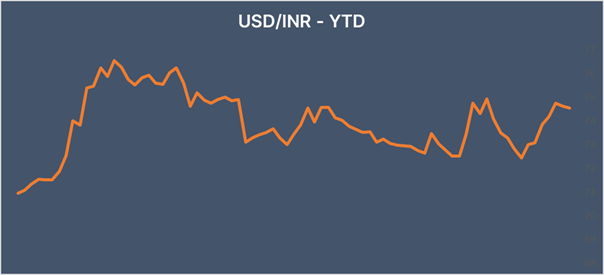

INR gains as inflation eases slightly

INR showed some resilience against the surging USD last week as better than expected retail inflation data helped calm investors. India’s retail inflation rose by less than expected at 6.26%, supporting the view that the central bank could keep policy unchanged to support the economy.

Inflation was still above the RBI’s comfort zone of 2-6% for a second straight month but slowed on a month on month basis.

We would love to hear back from you. Please Click here to share your valuable feedback