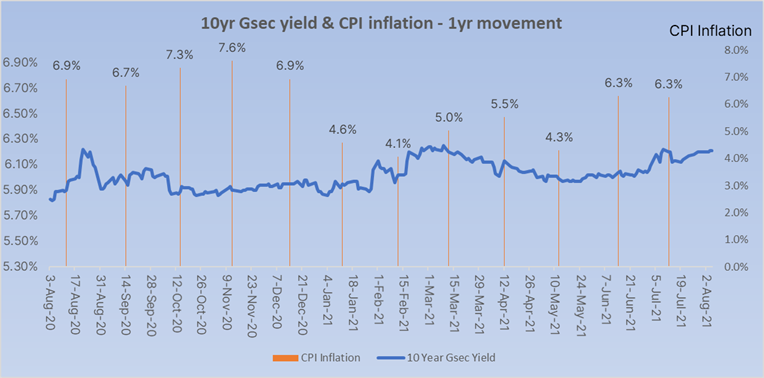

RBI seems over optimistic on inflation staying down

RBI in its policy review last week maintained an accommodative stance and postured that current high inflation levels of over 6% is largely due to supply shocks and demand is yet to attain its optimum levels.

Investors believe otherwise as demand for floating rate bonds is increasing and there is more interest in short maturity bonds. Corporates including Tata Capital, Tata Cleantech, PFC, Cholamandalam Finance are all issuing floating rate bonds while the government too is issuing floating rate bonds as a regular part of its borrowing program, which is seeing reasonable demand despite its lack of liquidity and issues in terms of pricing the bond.

RBI has forecast inflation at 5.7% for the end of this fiscal year and this looks over optimistic given the huge liquidity flows into Indian equities and sustained high global commodity prices. The sharp rise in US wage growth is potentially highly inflationary in nature as higher wages lead to higher demand in the world’s largest economy and this could push up prices globally as supply falls short of demand.

RBI will need to recalibrate its inflation assumptions and rather than keeping inflation forecast at levels it wants bonds to trade, RBI should let bond yields trade at more reasonable levels of inflation forecast.

Government bonds, SDL and OIS yield movements

During last week, 6.10% 2031 yield rose by 3 bps to 6.23% while 5.85% 2030 yield rose by 5 bps to 6.28%. 6.64% 2035 yield rose by 6 bps to 6.87%. 5-year benchmark bond, 5.63% 2026 yield gained 5 bps to 5.78%. 6.57% 2033 yield rose by 20 bp to 6.86%. Long-term paper, 7.16% 2050 yield increased by 4 bps to 7.19%.

The spread of 10-year bond over 5-year bond came down to 45 bps from 47 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 63 bps from 46 bps while 30-year benchmark over 10-year benchmark spread decreased to 87 bps from 91 bps.

Average 10-year SDL auction cut-off rose to 7% from 6.99% during previous week while spread declined by 1 bps to 80 bps from 81 bps during previous week.

On weekly basis, 1-year OIS yield rose by 9 bp to 3.97% while 5-year OIS yield increased by 4 bps to 5.27%.

We would love to hear back from you. Please Click here to share your valuable feedback