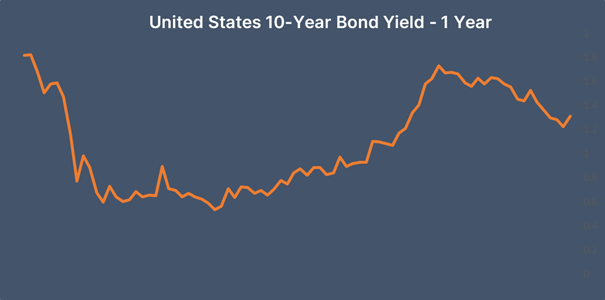

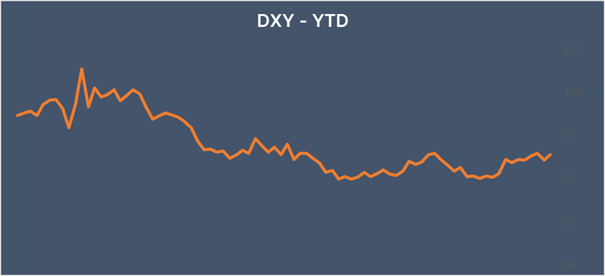

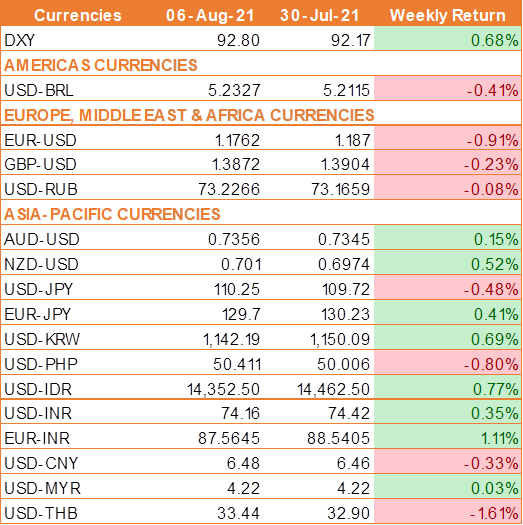

USD gains as strong jobs report stokes bets on Fed tapering

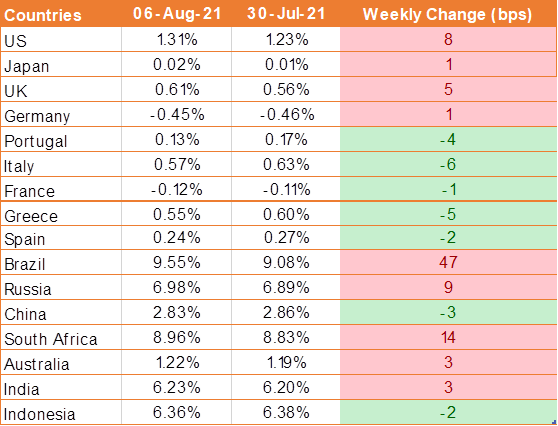

USD and UST yields rose after hawkish comments made by Fed official Richard Clarida and better-than-expected monthly jobs report stoked expectations that the Federal Reserve will begin to tighten policy sooner rather than later.

The U.S. economy created 943,000 jobs in July, above expectations for a gain of 870,000, while the unemployment rate fell to 5.4% from 5.9%. Average hourly earnings rose to 4% from 3.7% as employers were forced to hike wages to attract new workers amid a dearth in labor supply. The trend of rising wages is expected to continue and could keep inflation higher for longer.

Fed Vice Chair Richard Clarida said that he was in favor of the Fed announcing this year that it will start tapering its bond purchase program. He added that he considered that the necessary conditions to raise interest rates will be met by the end of 2022 paving the way for a rate hike.

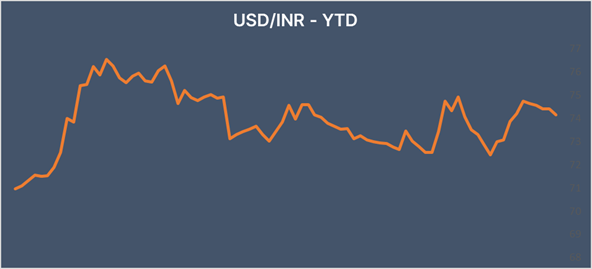

INR edges higher as stocks hit record highs

INR edged higher largely boosted by an upbeat domestic equity market and inflows towards initial public offerings. However, INR came under pressure on Friday after RBI kept interest rates at record lows in its last policy meeting. The central bank’s policymakers voted unanimously to keep the key lending rate at 4%. RBI also raised its inflation forecast.

We would love to hear back from you. Please Click here to share your valuable feedback