Weak U.S. consumer sentiment raises concern over economic recovery

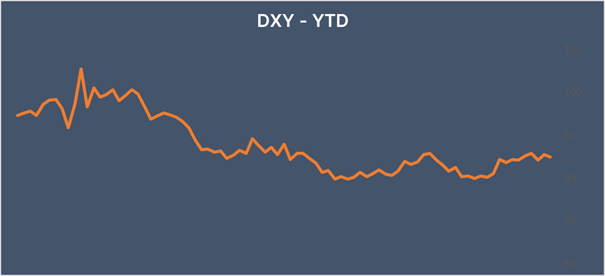

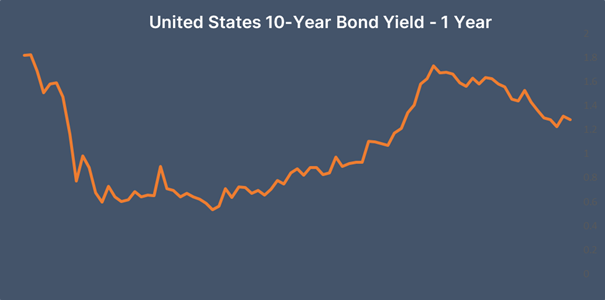

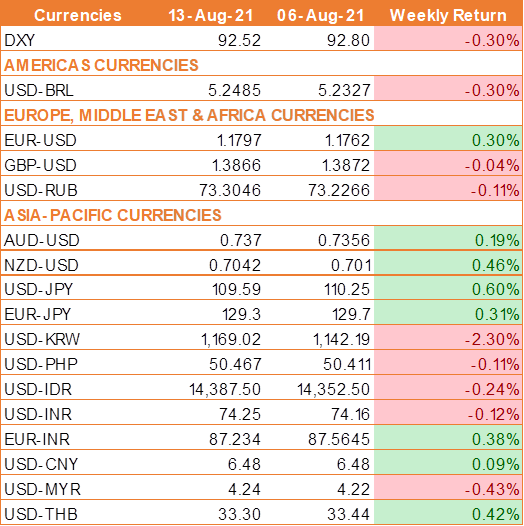

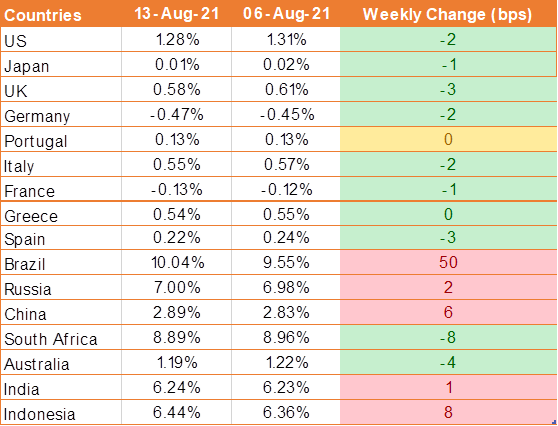

USD fell on Friday and10-year Treasury yields edged down with concern about the Delta variant finally catching up to financial assets. However, USD remained supported on the expectation that the Federal Reserve is on course to rein in loose monetary policy measures by year-end.

The University of Michigan Consumer Sentiment index slumped to a reading of 70.2 in the preliminary August survey from 81.2 in July, the weakest reading since December 2011.

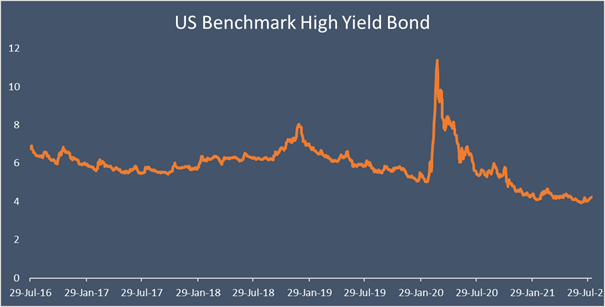

US CPI inflation stayed steady in July at 5.4%, against the expectation of 5.2%. However, on a monthly basis, CPI rose just 0.5% against the 0.9% expectation. Core inflation also came in below expectation.

US PPI posted its largest annual increase in over a decade in July. The data came on Friday a day after weaker than expected CPI suggested that consumer inflation could be peaking. However, PPI often feeds through to CPI, in which case CPI may not have reached a ceiling-boosting expectation that the Fed is on course to tightens its loose monetary policy measures by year-end.

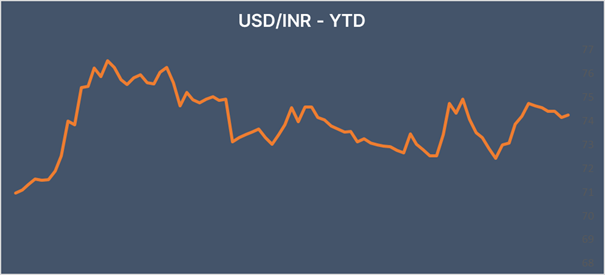

INR falls as inflation cools

INR edged lower as India’s retail inflation cooled in July after pushing above 6% for two consecutive months. Inflation eased as supplies improved amid the easing of pandemic restrictions. Consumer prices rose 5.59% in July compared to the same month last year, which was below the expectation of 5.78%.

We would love to hear back from you. Please Click here to share your valuable feedback