US labour shortage and domestic inflation

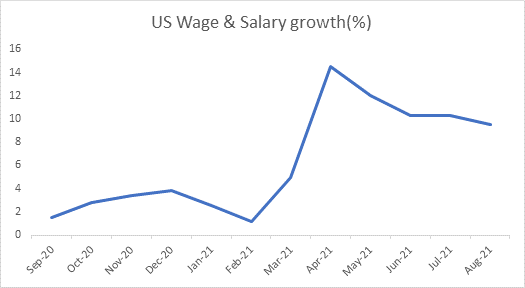

Millions of jobs in the US are lying vacant and there is insufficient supply to fill the jobs, causing an upward pressure on wages that is growing at 4.9% annually as of October 2021. The sharp rise in wages is causing high inflation in the US with CPI at 6%, a 3-decade high and core CPI at 4.6%. Wage pressure will sustain as high wages cause more spending leading to high inflation that in turn cause wages to rise further.

India’s CPI inflation was at 4.48% in October after staying well over 6% levels over most months of the year while core inflation was around 6.1%, staying at these levels for the year. India inflation is being pressured by rise in fuel prices with retail petrol and diesel prices at record highs, rise in global demand coupled with supply shortages causing domestic prices of goods and services to rise and also low interest rates and high liquidity causing demand to rise in the economy.

The labour shortage in the US will force US companies to aggressively look at India to fill in the demand for both labour and goods and services. This will cause rise in wages in India as well as rise in prices of goods and services and this will lead to high inflation expectations.

Gsec yields will rise on higher inflation expectations and on RBI having to raise rates sooner than expected.

Domestic Inflation- India’s consumer inflation stood at 4.48% on yearly basis in October 2021 as compared to 4.35% in previous month. During the month, food inflation picked up to 0.85% from 0.68% a month ago with a rise in prices of vegetables.

Domestic industrial production-India's index of industrial production (IIP) for September 2021 expanded by 3.1% against 9.9% in previous month. During the month, manufacturing sector rose by 2.7% while electricity sector grew by 0.9%.

Government bonds, SDL and OIS yield movements

During last week, 6.10% 2031 yield rose by 1 bps to 6.37% while 5.85% 2030 yield decreased by 1 bps to 6.43%. 5-year benchmark bond, 5.63% 2026 yield lost 1 bps to 5.72%. 6.64% 2035 yield declined by 3 bps to 6.81%. 6.57% 2033 yield came down by 1 bps to 6.78%. Long-term paper, 7.16% 2050 yield came down by 6 bps to 7.02%.

The spread of 10-year bond over 5-year bond rose to 65 bps from 63 bps in previous week. The 15-year benchmark over 10-year benchmark spread decreased to 41 bps from 43 bps, while 30-year benchmark over 10-year benchmark spread declined to 62 bps to 67 bps on weekly basis.

Average 10-year SDL auction cut-off came down to 6.93% from 7% in previous week while spread rose to 64 bps from 61 bps in previous week.

On weekly basis, 1-year OIS yield rose by 8 bps to 4.36% while 5-year OIS yield decreased by 7 bps to 5.51%.

We would love to hear back from you. Please Click here to share your valuable feedback