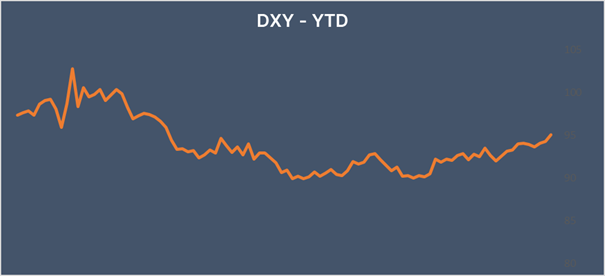

USD trades at 16 months high after US CPI jumps

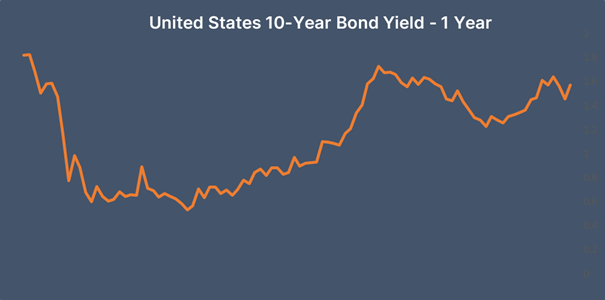

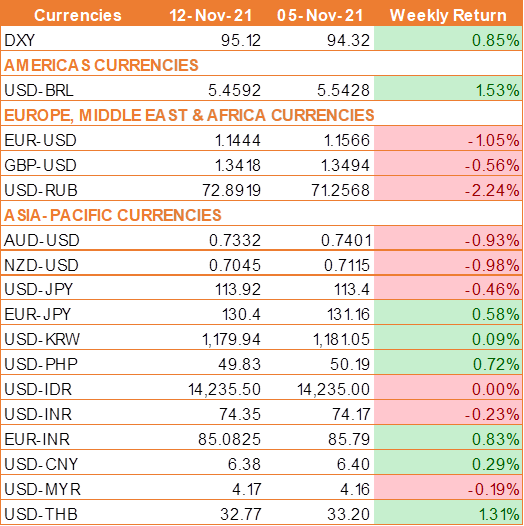

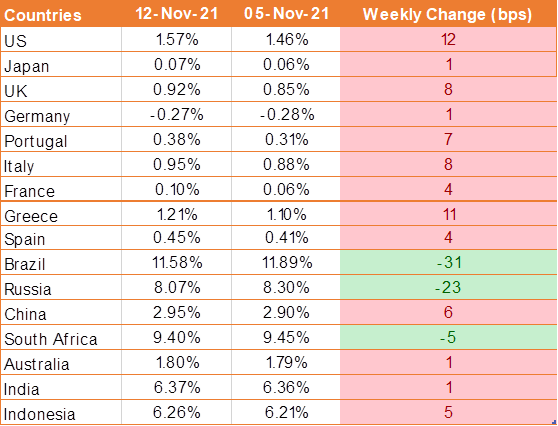

USD lost little ground on Friday but posted its biggest weekly gain in almost three months after a surprisingly strong U.S. inflation data on Wednesday, which prompted market participants to advance their bets for a U.S rate hike. UST yield in tandem with USD rose sharply.

U.S. inflation data released on Wednesday showed that the consumer price index (CPI) grew 6.2% year-on-year and 0.9% month-on-month in October, while the core CPI rose 4.6% year-on-year and 0.6% month-on-month.

The U.S. job market data came in stronger in October, with nonfarm payrolls rising more than expected while the unemployment rate fell to 4.6%. Nonfarm payrolls increased by 531,000 for the month, against the expectation of 450,000. The jobless rate had been expected to edge down to 4.7%.

Wages increased 0.4% for the month, in line with estimates, but rose 4.9% on a year-over-year basis, reflecting the inflationary pressures that have intensified through the year.

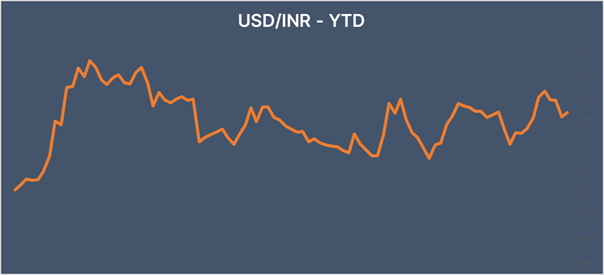

INR trades lower amid broad USD strength

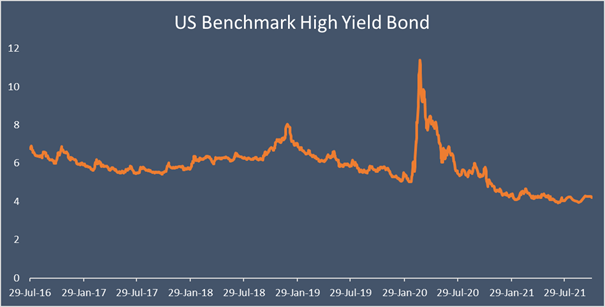

INR ended the week lower last week amid concerns over higher inflation following the US CPI data, dragged on demand for Indian equities. India's CPI rose to 4.48% in October from 4.35% a month ago as food prices inched up along with high input costs, fuel, and commodity prices.

Oil prices are also on the rise for a third straight session. Oil prices remain supported by tight supply after OPEC+ failed to lift output further than the 400,000 barrels per day agreed back in July.

We would love to hear back from you. Please Click here to share your valuable feedback