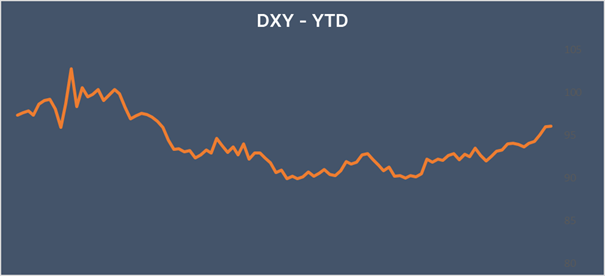

USD weakens against Yen on new virus fears

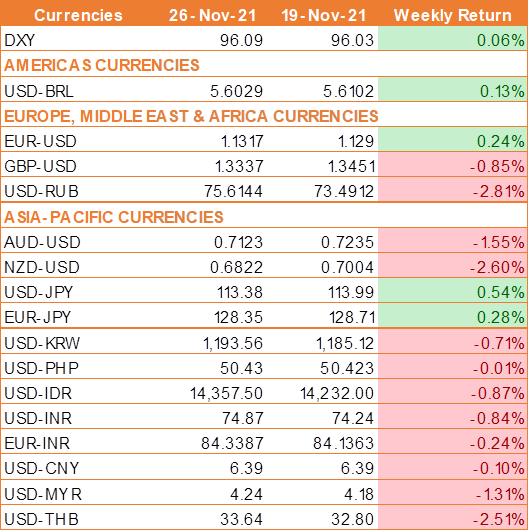

USD edged lower on Friday, weighed by gains to the safe-haven yen and Swiss franc, as market participants turned risk-averse in the wake of the discovery of a new highly-mutated coronavirus variant. However, the hawkish tone by the Fed in the minutes from its latest meeting extended support to the USD.

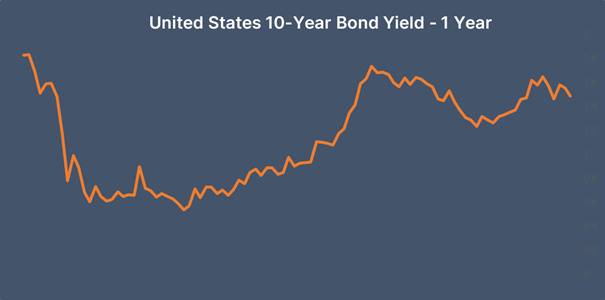

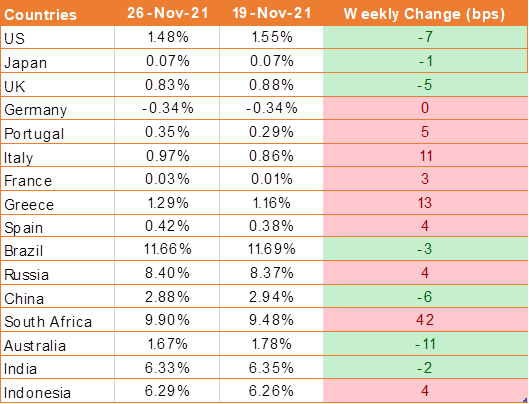

The Fed indicated that it could pick up the pace oF its asset tapering program, and hike interest rates quicker than expected if high inflation persists, in its minutes released on Wednesday.

San Francisco Fed President Mary Daly also said on Wednesday that she could see a case being made to speed up asset tapering.

The World Health Organisation (WHO) has classified the new Covid variant detected in southern Africa this week as the 'Variant of Concern' following the Technical Advisory Group meeting on Friday.

The U.K. Health Security Agency said that the variant has a spike protein that was dramatically different from the one in the original coronavirus, which the current generation of Covid-19 vaccines are designed to fight.

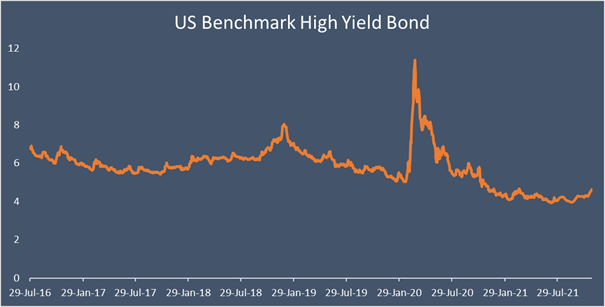

Falling oil prices limit losses

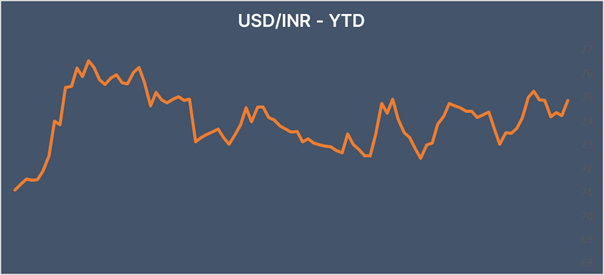

INR fell on risk-off trade after the discovery of a new COVID variant in South Africa. However, falling oil prices are offsetting the losses due to weakness in the market sentiment.

Oil prices are falling lower paring gains from the previous session on growing expectations that the US, China, Japan, and India will release strategic reserves in an attempt to lower the price of oil, even as COVID cases in Europe surge higher.

We would love to hear back from you. Please Click here to share your valuable feedback