Omnicron fears & Fed policy uncertainty brings in volatility

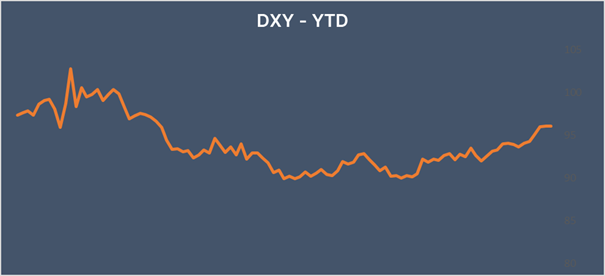

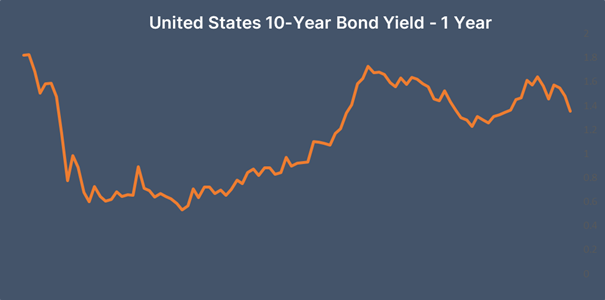

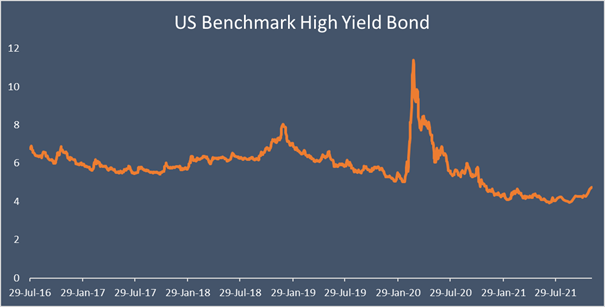

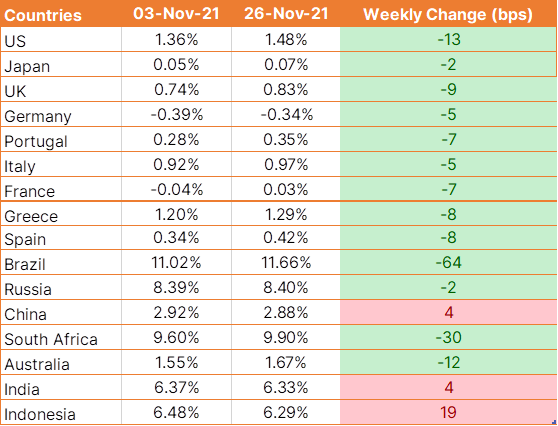

The safe-haven yen and Swiss franc trade higher on Friday as global equities and bond yields fell on fears about the spread of the Omicron variant of COVID-19, which has resulted in renewed restrictions in parts of the world, and concerns about possible aggressive action by the Federal Reserve to curb surging inflation.

U.S. non-farm payrolls increased by 210,000 jobs last month against the expectation for the payrolls to rise by 550,000. October's job growth was revised up to 546,000 from the initial estimate of 531,000. The unemployment rate also dropped to 4.2% from 4.6%, the lowest level since February 2020.

Average hourly earnings rose by 0.3% month over month in November, the slowest monthly pace since March, bringing the annual pace of wage growth to 4.8%.

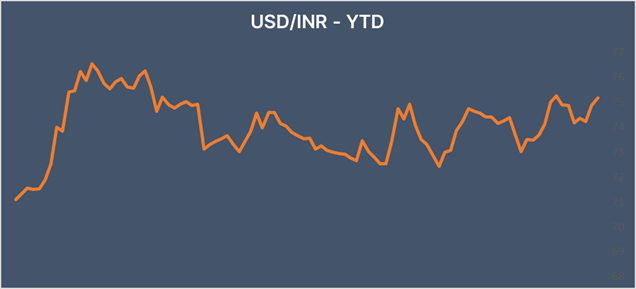

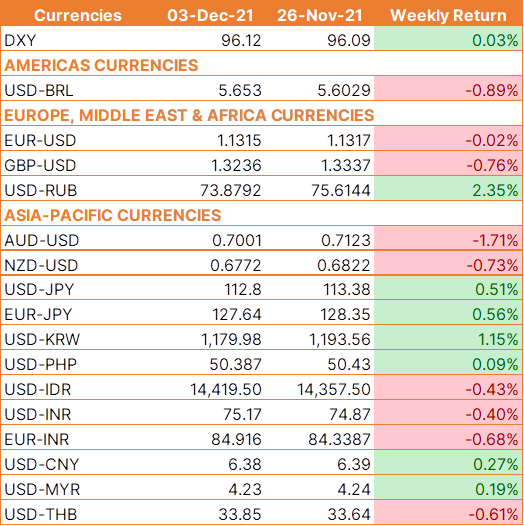

INR eases against a stronger USD.

INR fell on risk-off trade and on oil prices� plunging 13% on previous week on fears that Omicron the new covid variant could spark widespread travel and mobility restrictions.

The IHS Services PMI eased to 58.1 in November, down from 58.4 in October. The data comes following GDP data earlier in the week which showed that the Indian economy grew at 8.4% annually in the July � September period.

We would love to hear back from you. Please Click here to share your valuable feedback