Gsec yields unlikely to react downwards to UST yield plunge

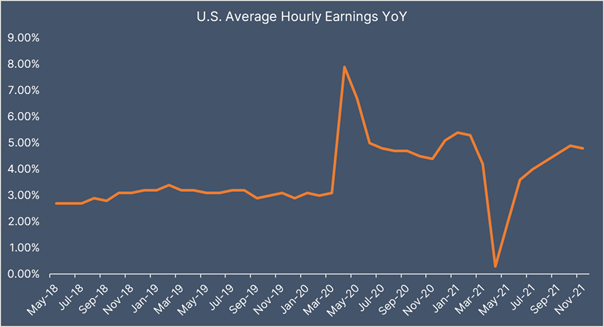

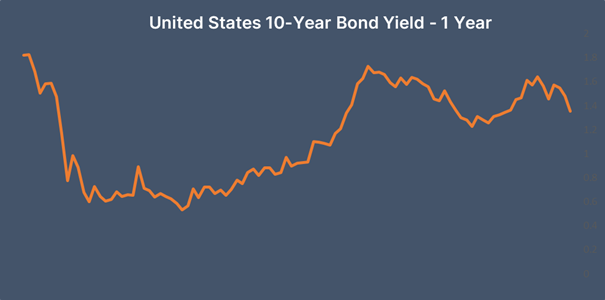

10 year UST yields have fallen sharply by 30bps in the last couple of weeks, despite the Fed sounding alarm on inflation. Fed said that risk to inflation staying high for long periods of time has risen. US CPI inflation is at 3 decades high of 6% on the back of a tight labour market, US unemployment rate fell to 4.2% levels in November, lowest since the start of covid in 2020.

UST yield fall is driven by two factors, one is the risk aversion in markets on the back of a new covid variant that is forcing many countries to close borders and impose lockdowns and the other is the fact that Fed will start to raise rates soon on red hot labour markets.

Given the US scenario, government bond yields in India will have to contend with risk aversion and Fed raising rates. Risk aversion can drive down INR as capital flows out of Indian assets while a Fed rate hike can heighten the risk aversion. This could keep RBI on their toes and lead to rate hikes sooner than later.

However, any threat to economic growth on fresh covid fears will lead to RBI protecting government bond yields from rising too fast. This will keep government bond yields steady at higher levels.

Government bonds, SDL and OIS yield movements

During last week, 6.10% 2031 yield fell by 1 bps to 6.36% while 5.85% 2030 yield decreased by 4 bps to 6.39%. 5-year benchmark bond, 5.63% 2026 yield lost 2 bps to 5.70%. 6.64% 2035 yield declined by 4 bps to 6.77%. 6.57% 2033 yield came down by 12 bps to 6.66%. Long-term paper, 7.16% 2050 yield came down by 8 bps to 6.94%.

The spread of 10-year bond over 5-year bond rose to 66 bps from 65 bps in previous week.� The 15-year benchmark over 10-year benchmark spread steady at 41 bps, while 30-year benchmark over 10-year benchmark spread declined to 58 bps from 62 bps on weekly basis.

Average 10-year SDL auction cut-off came down to 6.84% from 6.93% in previous week while spread rose to 51 bps from 64 bps in previous week.

On weekly basis, 1-year OIS yield rose by 11 bps to 4.25% while 5-year OIS yield decreased by 19 bps to 5.32%.

We would love to hear back from you. Please Click here to share your valuable feedback