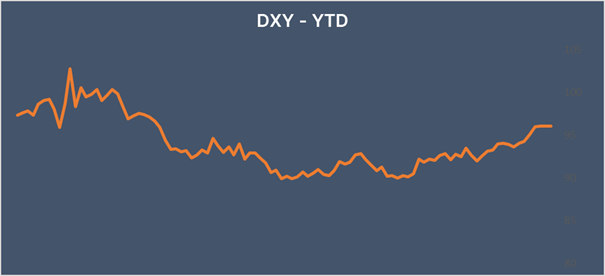

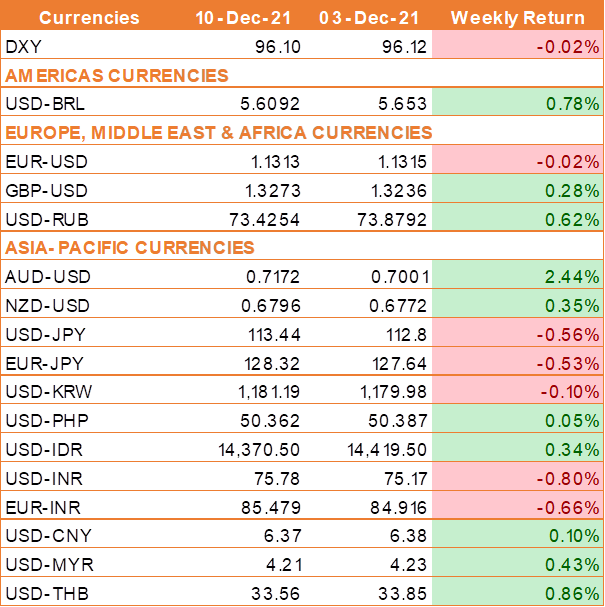

USD exihibits high volatility amid Omicron & inflation concerns

USD exhibited high volatility during the week amid increased restrictions in parts of the world to contain the spread of COVID-19, including the new Omicron variant, which tempered investors' appetite for riskier currencies. The Omicron concern eased after US medical advisor Dr. Anthony Fauci said that so far symptoms tend to be mild.

The November consumer price index surged 6.8% year over year, the fastest rate since 1982

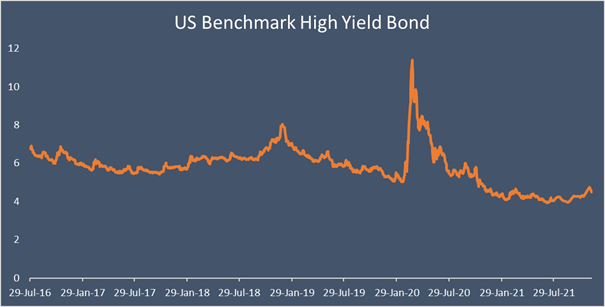

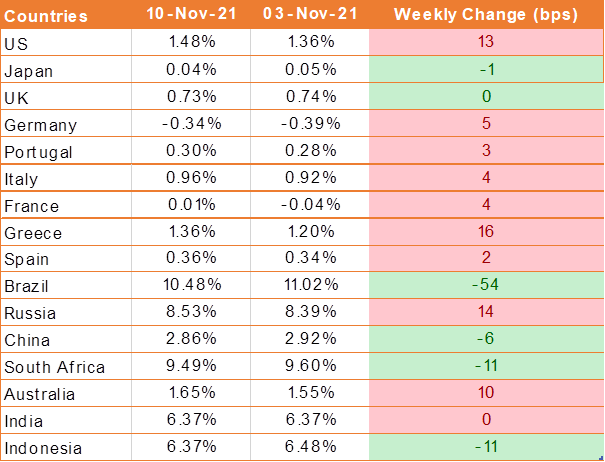

With Omicron concerns easing and inflation at a multi-decade high level, the Fed and the timing of the first-rate hike is back in focus. The Federal Reserve will hold its two-day meeting on Dec. 14 and 15.

US medical advisor Dr. Anthony Fauci calmed fears over the newly discovered Omicron COVID variant, noting that so far symptoms tend to be mild. Experts in Japan echoed Dr. Fauci’s observation suggesting that those infected with Omicron suffer mild or no symptoms.

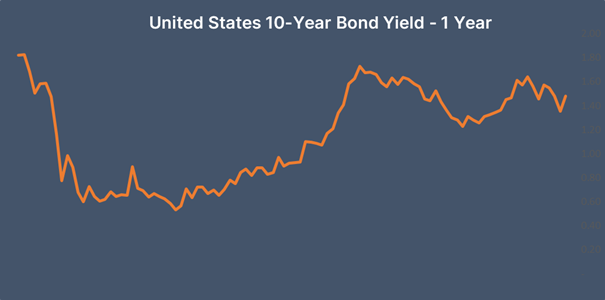

U.S. consumer prices increased roughly in line with expectations in November. Labor Department data showed an increasing consumer price index (CPI) as the cost of goods and services rose broadly amid supply constraints for the largest annual gain since 1982.

The CPI rose 0.8% last month after surging 0.9% in October while in the 12 months through November, it rose 6.8%, following a 6.2% advance in October. The yield on the 10-year UST inched higher immediately following the CPI release.

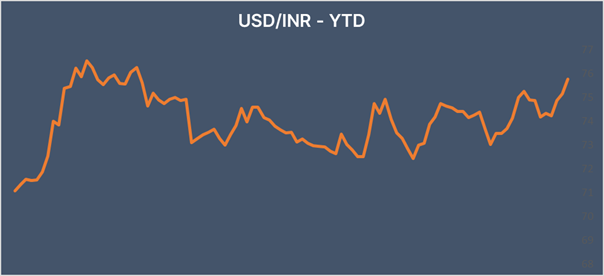

INR falls on central bank divergence

INR is under pressure at an 18 month low on central bank divergence. The Federal Reserve is keen to tighten monetary policy while the Reserve Bank of India is showing no signs of raising interest rates soon.

The RBI left monetary policy unchanged in their meeting this week. The RBI said that it expects CPI at 5.1% for Q3 and 5.7% for Q4. Separately, industrial output increased by 4% in October compared to a year ago, up from 3.1% in September.

We would love to hear back from you. Please Click here to share your valuable feedback