BOE and ECB Follow Fed’s Hawkish

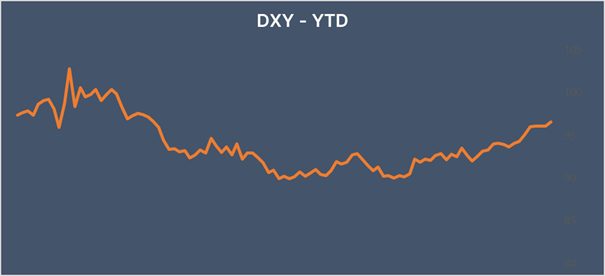

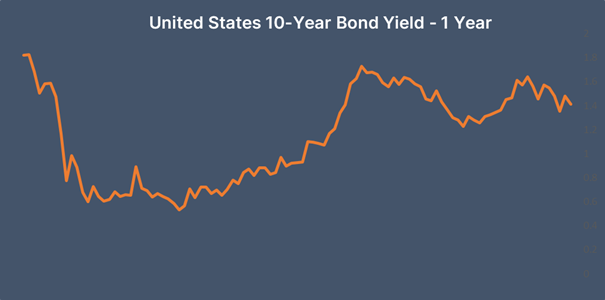

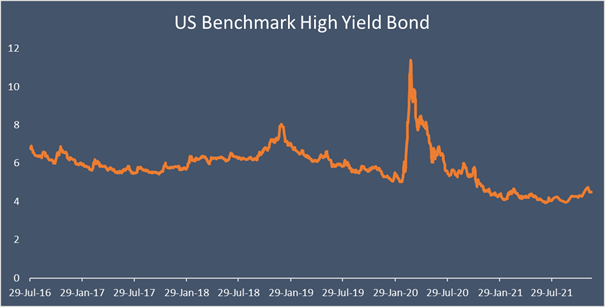

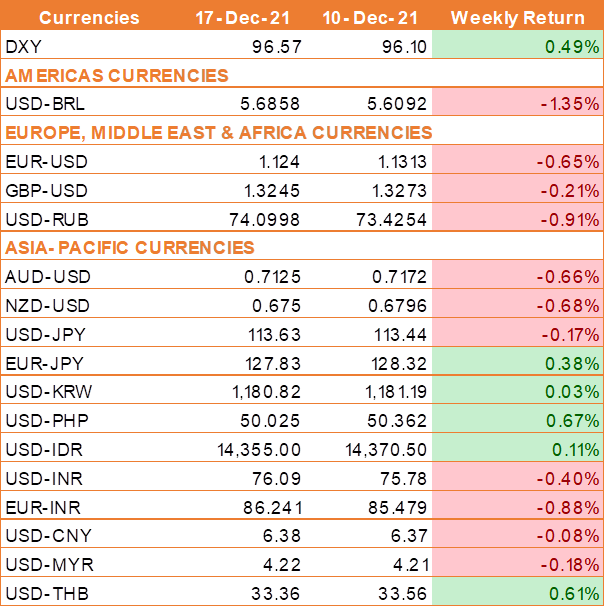

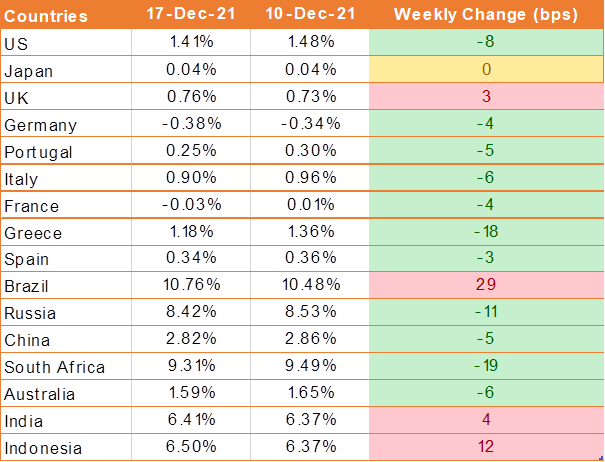

USD ended the week higher amid talk of interest rate hikes by central banks and concerns about the spread of Omicron cases. Key central banks have adopted different policies as uncertainty about the omicron COVID-19 variant’s impact on economic recovery remains. The debate on the extent to which central banks should act to curb high inflation also continues.

However, USD was under pressure on Thursday after a surprise interest rate hike from the Bank of England (BOE), and the European Central Bank (ECB) also adopts a more hawkish stance. European Central Bank said it will slow down its bond-buying from April.

Federal Reserve Governor Chris Waller said an interest rate increase will likely be warranted "shortly after" the Fed ends its bond purchases in March. New York Fed President John Williams said that the Fed will gain "optionality" to raise interest rates in 2022 by ending bond purchases by March.

The risk of reinfection with the Omicron coronavirus variant is more than five times higher than the Delta variant and has shown no sign of being milder, a new study from England showed. The findings were released as European countries weigh further travel and social restrictions.

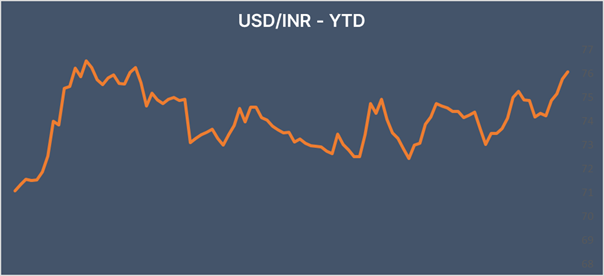

INR falls as global central banks turn hawkish

INR traded lower last week as hawkish policy tilts by major central banks worsened concerns of portfolio outflows from the country. Growing concerns over the Omicron variant of coronavirus and its impact on economic recovery continue to pressure on INR.

Foreign investors have been net sellers in equity for a fifth straight day on Friday, taking out USD 2.34 billion so far in December.

We would love to hear back from you. Please Click here to share your valuable feedback