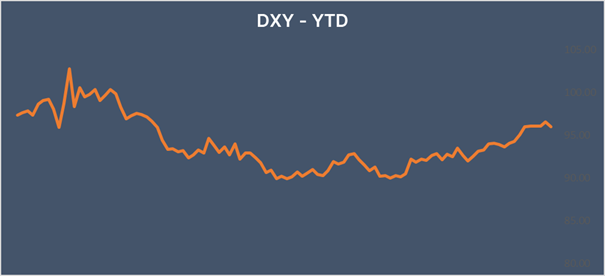

USD lower amid fading Omicron fears

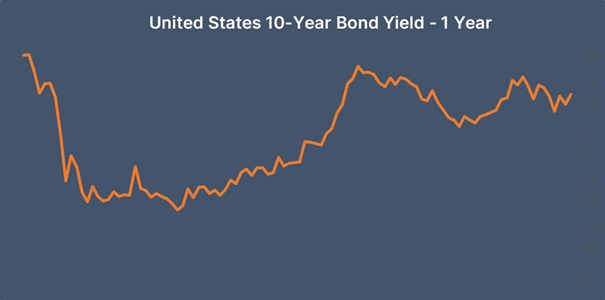

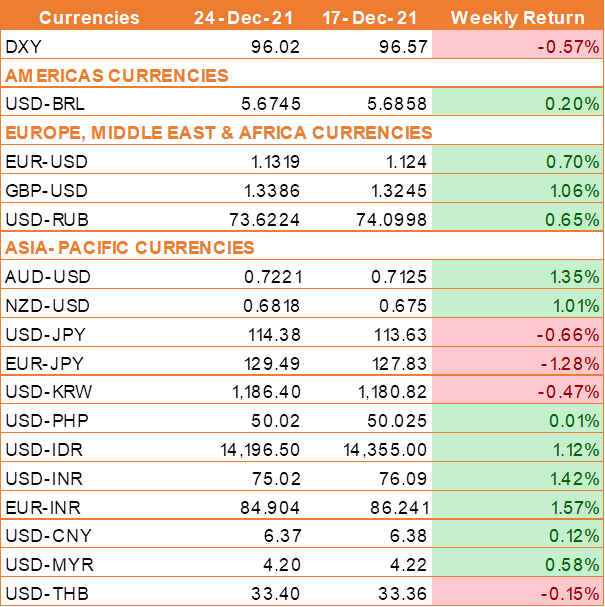

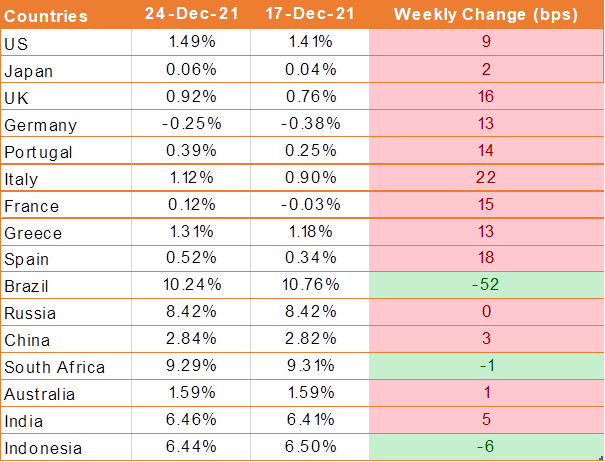

USD fell last week amid growing optimism for the global economic outlook despite the surge of Omicron-variant Covid cases. The positive development on the vaccines front boosted the investors' appetite for risk, lifting stocks and pushing U.S. Treasury yields higher.

Data from a new laboratory study showed that AstraZeneca’s Vaxzevria vaccine significantly boosted levels of antibodies against the Omicron variant following a booster dose.

Risk sentiment further improved, as couple of studies suggest that patients with the Omicron variant face a lower risk of hospitalization and severe disease compared with the Delta variant, the previously dominant strain.

Also helping the sentiment was the release of positive U.S. economic data on Wednesday, with GDP growing 2.3% quarter-on-quarter in the third quarter and existing home sales rising 1.9% in November. However, it was U.S. consumer confidence improving more than expected in December despite the resurgence in Covid-19 infections which had the biggest impact.

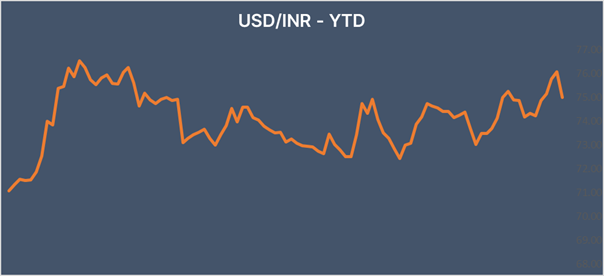

INR higher amid improving risk appetite

INR traded sharply higher last week as the sentiment for INR strengthened on signs that the Omicron variant of COVID would not significantly derail global economic growth. Meanwhile, health officials globally continue to warn about the threat of the latest variant of coronavirus.

As per the reports, the RBI intervened in the foreign exchange market by around USD 200 million on select days, to ensure liquidity in currency markets but did nOt target any specific level.

We would love to hear back from you. Please Click here to share your valuable feedback