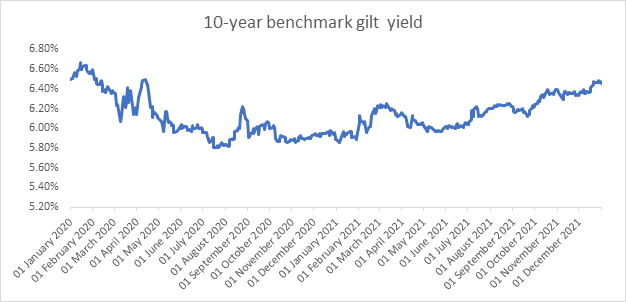

10-year g-sec yield outlook still negative

Fed is looking to raise rates in 2022 while ECB and other central banks are either indicating policy normalisation or actually raising rates like the Bank of England. RBI is still in an accommodative mode but with USD gaining 7% last year on Fed rate hike stance, the focus will be on market stability as INR threatened to fall to record lows in December 2021 on capital outflows before RBI stepped in to stem the fall.

RBI had to cancel the bids in the 10 year Gsec auction last week as it did not want to signal higher yields going into 2022 and budget 2022-23. The yield closed at year highs of 6.45% and is not indicative of true market levels as RBI is protecting the yields through interventions in auction by either devolving the auction on to underwriters or by cancelling auction bids.

Economic data was mixed with Current Account Deficit (CAD) showing a deficit in the 2nd quarter of 2021-22 against a surplus in the previous quarter on the back of higher trade deficit. Balance of Payments was still positive given capital inflows and this is keeping the INR steady.

GST collections were well over Rs 1 trillion in December 2021 indication robust government finances. However with states borrowing over Rs 3 trillion in the last quarter of 2021-22, g-sec yields will be pressured on supply.

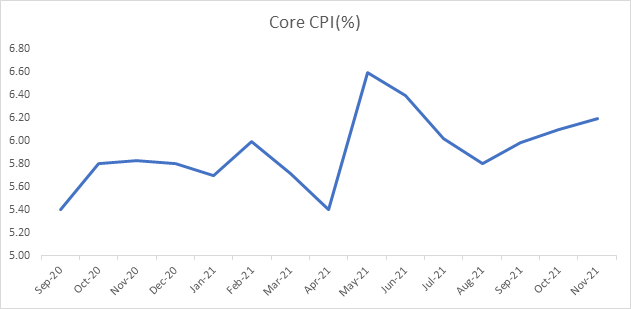

Core CPI is still sticky at over 6% and this will worry RBI and markets as government announces growth measures. Overall outlook for G-sec yields is still negative for 2022.

Current Account Deficit-India’s current account balance recorded a deficit of US$ 9.6 billion (1.3% of GDP) in Q2:2021-22 as against a surplus of US$ 6.6 billion (0.9% of GDP) in Q1:2021-22 and US$ 15.3 billion (2.4% of GDP) in Q2:2020-21. The deficit in the current account in Q2:2021-22 was mainly due to widening of trade deficit to US$ 44.4 billion from US$ 30.7 billion in the preceding quarter and an increase in net outgo of investment income.

Fiscal Deficit-India's fiscal deficit in April-November stood at 46.2% of the full-year budgeted target driven by a rise in tax collections. The fiscal deficit had surged to 135.1% of the full-year target during the corresponding period last fiscal year.

GST Collection-India’s GST revenue collected stood at Rs 1.29 trillion in December 2021 as compared to Rs 1.31 trillion in previous month.

Government bonds, SDL and OIS yield movements

During last week, 6.10% 2031 yield declined by 1 bp to 6.45% while 5.85% 2030 yield increased by 1 bp to 6.50%. 5-year benchmark bond, 5.63% 2026 yield lost 3 bps to 5.79%. 6.64% 2035 yield was unchanged at 6.9%. 6.57% 2033 decreased by 5 bps to 6.68%. Long-term paper, 7.16% 2050 yield declined by 4 bps to 7.04%.

The spread of 10-year bond over 5-year bond rose to 66 bps from 64 bps in previous week. The 15-year benchmark over 10-year benchmark spread declined to 23 bps from 27 bps, while 30-year benchmark over 10-year benchmark spread increased to 59 bps from 58 bps on weekly basis.

Average 10-year SDL auction cut-off rose to 7.03% from 7% in previous week. Consequently, spread rose to 55 bps from 53 bps in previous week.

On weekly basis, 1-year OIS yield was unchanged at 4.35% while 5-year OIS yield increased by 3 bps to 5.38%.

We would love to hear back from you. Please Click here to share your valuable feedback