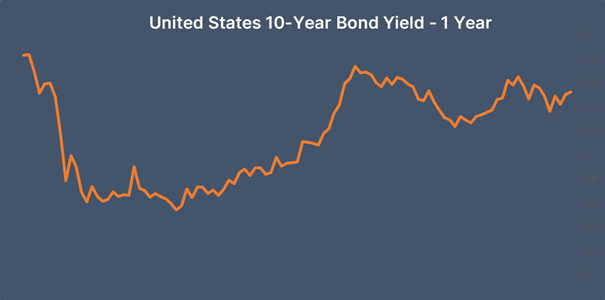

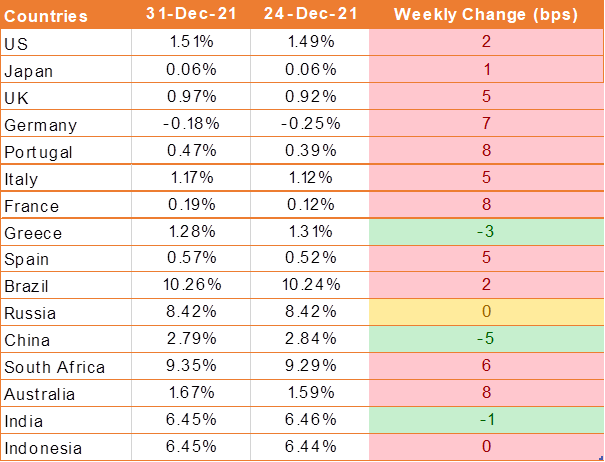

UST yield ended 2021 above 1.5%

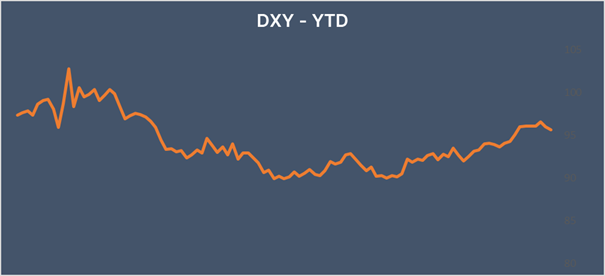

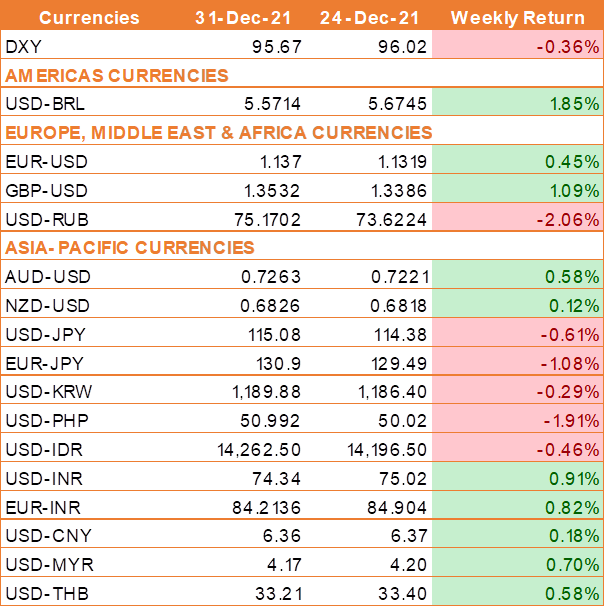

USD fell last week amid quiet trading but has ended the year 2021 with a gain of nearly 7% as market participants bet the U.S. Federal Reserve will raise rates earlier than most other major economies amid surging inflation driven by COVID-19 stimulus initiatives. The UST 10-year yield finished 2021 above 1.5%.

The central bank in January plans to accelerate the reduction of its monthly bond purchases. The Fed then expects to start raising interest rates after tapering concludes.

Last week, USD weakened amid growing optimism over the global economic outlook, despite Omicron cases surging. Investors' risk appetite improved as many governments refrained from re-imposing lockdowns despite surging number of the highly-transmissible Omicron variant of coronavirus globally.

Sentiment for riskier assets was boosted also after the World Health Organization said that COVID-19 cases worldwide increased by 11% last week led by the US but hospitalizations have been lower so far.

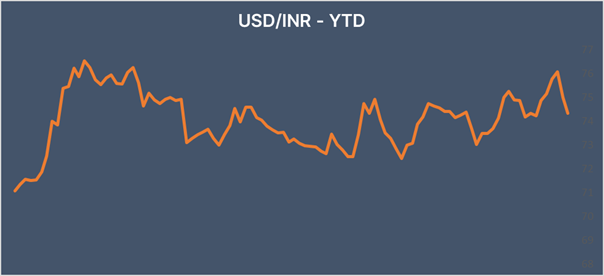

INR higher as risk sentiment improves

INR traded higher tracing domestic equities. The Sensex and the Nifty are pushing higher amid improving risk sentiment as investors worldwide expect that the impact of the Omicron variant of COVID-19 on the economy is likely to be limited despite a surge in cases across the world.

Meanwhile, Omicron cases in India crossed the 1,000-mark. India's daily tally of COVID-19 cases continued to surge.

We would love to hear back from you. Please Click here to share your valuable feedback