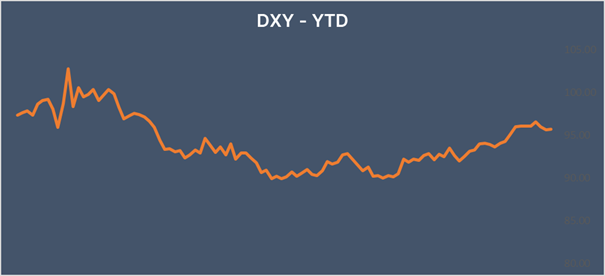

USD falls sharply after U.S. jobs report

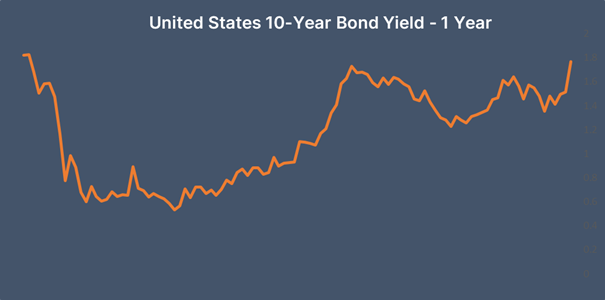

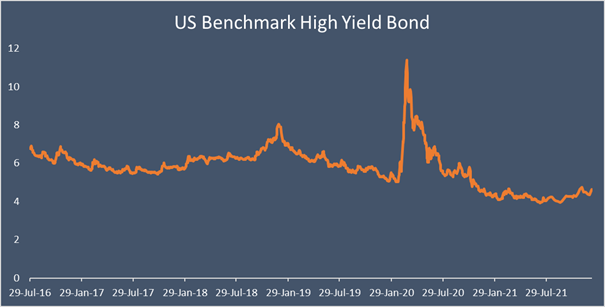

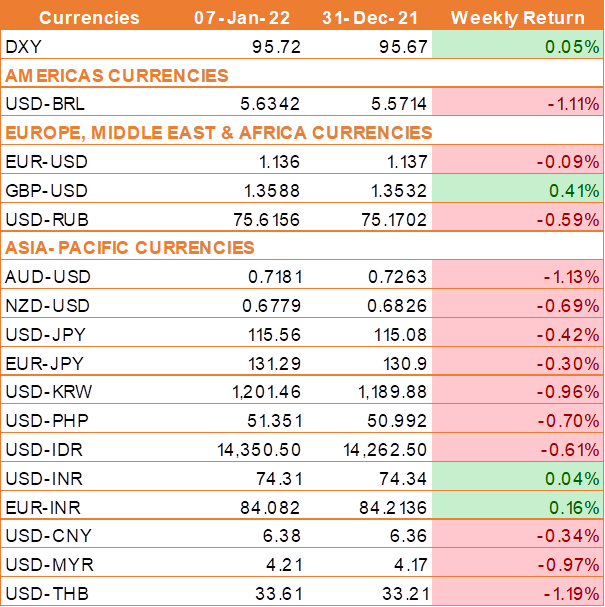

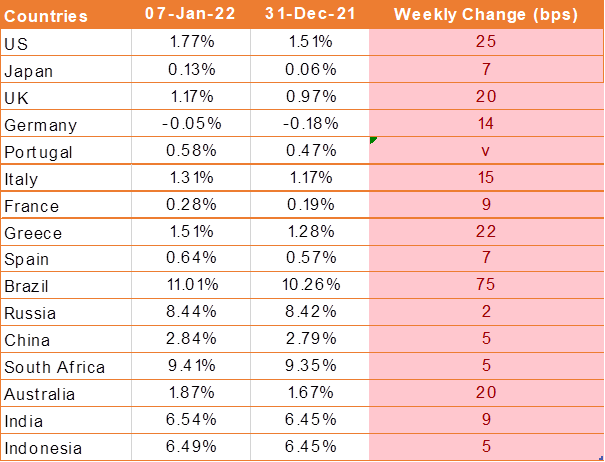

USD ended marginally higher last week after hawkish minutes from the Fed's Dec meeting, released on Thursday, firmed up the expectations that the US central bank could raise interest rates at a faster pace this year.

Federal Reserve Bank of St. Louis President, James Bullard, said on Thursday that the Fed could begin increasing the policy rate as early as in its March meeting in order to be better-positioned to control inflation.

Further, San Francisco Fed President, Mary Daly, said the central bank should raise interest rates this year, given the "very strong" labour market and high inflation.

USD drops sharply on Friday after December U.S. jobs report that missed expectations. U.S. labor department said nonfarm payrolls rose by 199,000 last month, well short of the 400,000 expectation. However,the underlying data in the report appeared sturdier, with the unemployment rate falling to 3.9% against expectations of 4.1% while earnings rose by 0.6%, indicating tightness in the labor market.

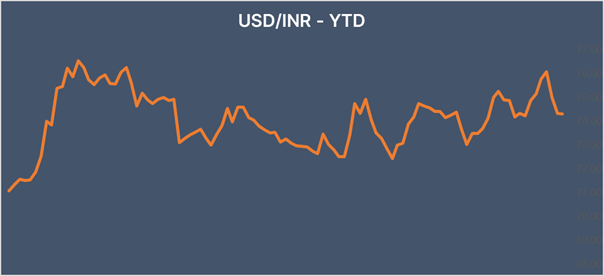

INR ends up amid thin trading

INR ended the week marginally higher after gaining sharply on Friday as USD exihibited broad weakness. INR was under pressure during the week due to the re-imposition of strict COVID-19 restrictions across the country amid a surge in the number of COVID cases.

We would love to hear back from you. Please Click here to share your valuable feedback