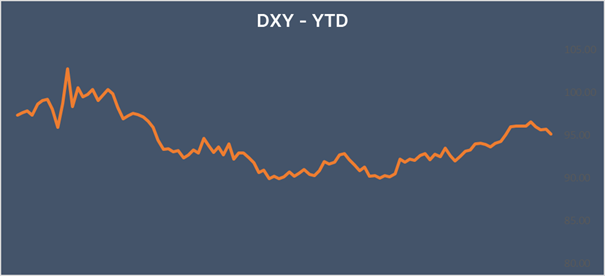

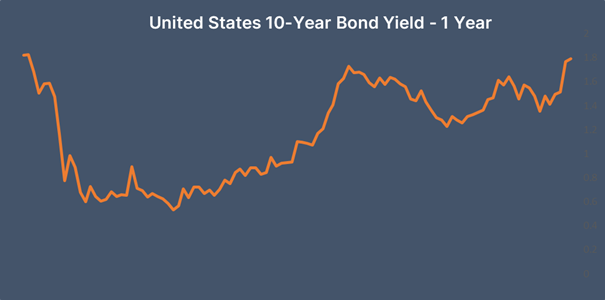

USD falls as PPI misses & jobless claims gain

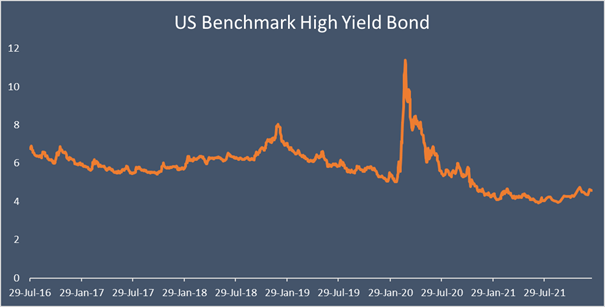

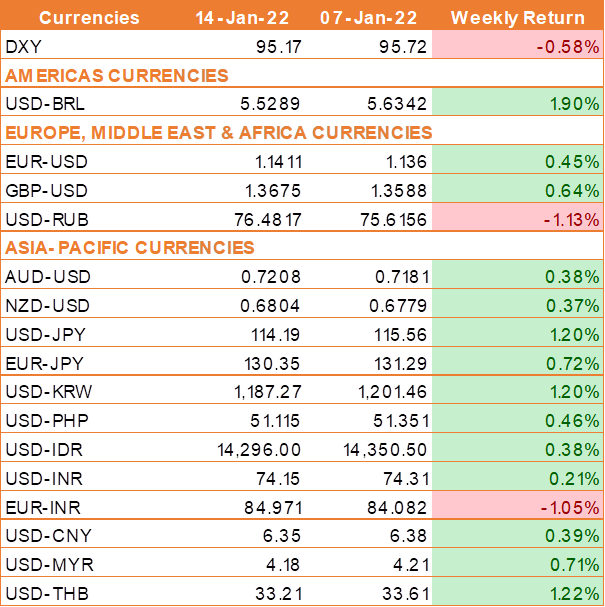

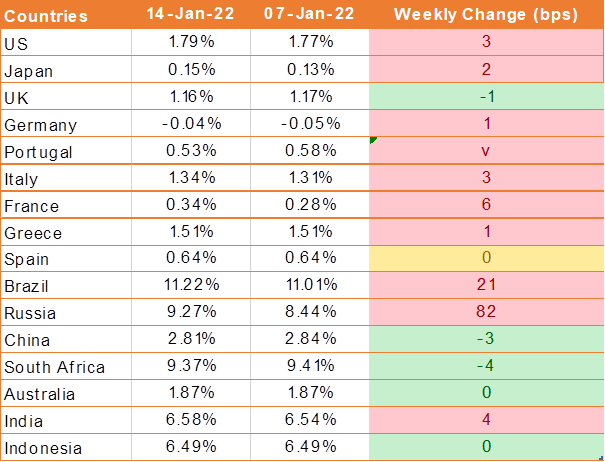

USD lost ground after the producer price index, which measures inflation at the wholesale level rose by less than expected in December. The fall in USD came even after US Federal Reserve Chair Jerome Powell said that the Fed could raise interest rates more if needed and after data revealed that inflation jumped to 7% in December a 40 year high.

PPI rose 9.7% in December, up from 9.6% in November. However, this was less than the 9.8% expectation. PPI is often considered a lead indicator for consumer price inflation (CPI). US CPI reached 7% in December. However, the slower increase in PPI could be an early sign that inflation in the US may be starting to slow.

US jobless claims rose in the week ending 7th January to 230,000 as US citizens signed up for initial claims. This was up from 207,000 the previous week and well ahead of the decline to 200,000 that was expected. The increase in jobless claims comes as COVID cases rise steeply.

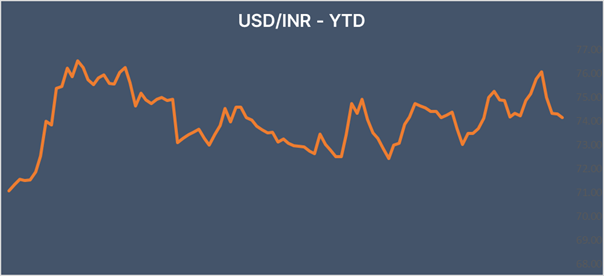

INR traces domestic equities higher

INR ended the week higher tracing domestic equities and amid weakness in USD. However, Inflation in India rose to 5.59% in December, up significantly from 4.91% in November and the highest level in six months and above the Reserve Bank of India’s 4% medium-term target. This was however below the 5.8% rate that was expected.

Omicron cases continue to rise. The country reported the highest number of new daily infections since mid-May. However, some experts say that cases could peak as soon as next week in some big cities such as the capital New Delhi and Mumbai.

We would love to hear back from you. Please Click here to share your valuable feedback