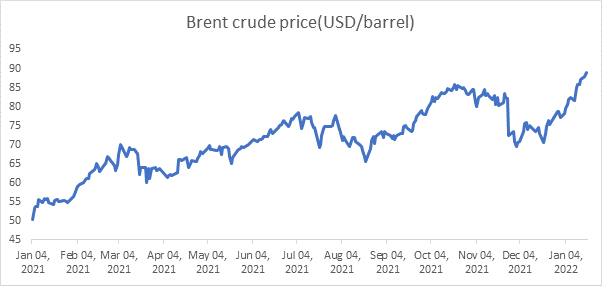

Oil prices hit 7-year highs, weighing on budget for fiscal 2022-23

Oil price rise globally is hurting bond market sentiments in India, on worries of rising subsidy bill of the government in its budget for fiscal 2022-23. Given that core CPI inflation in India is trending at over 6%, the government will have to absorb the rising fuel costs in its budget that will increase the fiscal deficit and lead to higher government borrowing for the next fiscal year.

The government is also grappling with rising fertilizer prices due to shortages caused by supply shocks and high oil prices. Other public services such as public transport will also require higher subsidies as pass through of oil prices is not fully possible given the sensitivity of the consumers.

RBI will have to take into account the rising inflation expectations on high oil prices, higher fiscal deficit and rate hike by the Fed, in its policy review. The central bank cannot protect bond yields if it indicates rates hikes due to inflation and fiscal deficit.

Bond yields will continue its upward trend going into budget on 1st of February and RBI policy review after that.

Fertilizer Subsidy in Unio Budget-FY22

Urea Subsidy (Rs billion) | |

Payment for Indigenous Urea | 432.26 |

Payment for Import of Urea | 195.5 |

Direct Benefit Transfer (DBT) in Fertiliser Subsidy | 0.11 |

Recovery | -40.3 |

Net | 587.67 |

Nutrient Based Subsidy (Rs billion) | |

Payment for Indigenous P and K Fertilizers | 124.6 |

Payment for Imported P and K Fertilizers | 82.6 |

Payment for City Compost | 0.42 |

Total- Nutrient Based Subsidy | 207.62 |

Total Subsidy | 795.29 |

Government bonds, SDL and OIS yield movements

6.54% 2032 paper yield stood at 6.62%. On weekly basis, 6.10% 2031 yield rose by 5 bps to 6.63%. 5-year benchmark bond, 5.63% 2026 yield increased by 6 bps to 5.94%. 6.64% 2035 yield gained 5 bps to 7.07%. Long-term paper, 7.16% 2050 yield rose by 2 bps to 7.26%.

The spread of 10-year bond over 5-year bond declined to 69 bps from 70 bps in previous week. The 15-year benchmark over 10-year benchmark spread stood steady at 45 bps, while 30-year benchmark over 10-year benchmark spread decreased to 64 bps from 66 bps on weekly basis.

Average 10-year SDL auction cut-off rose to 7.24% from 7.14% in previous week. Consequently, spread rose to 61 bps from 57 bps in previous week.

On weekly basis, 1-year OIS yield rose by 7 bps 4.41% while 5-year OIS yield increased by 7 bps to 5.62%.

We would love to hear back from you. Please Click here to share your valuable feedback