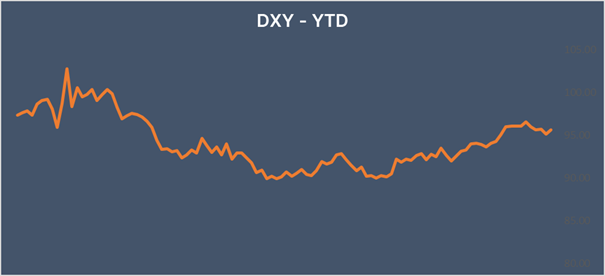

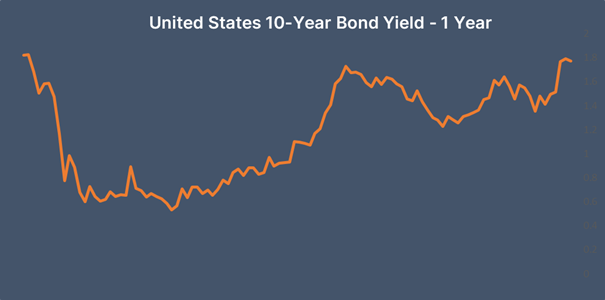

High inflation & Fed fears boosted the USD

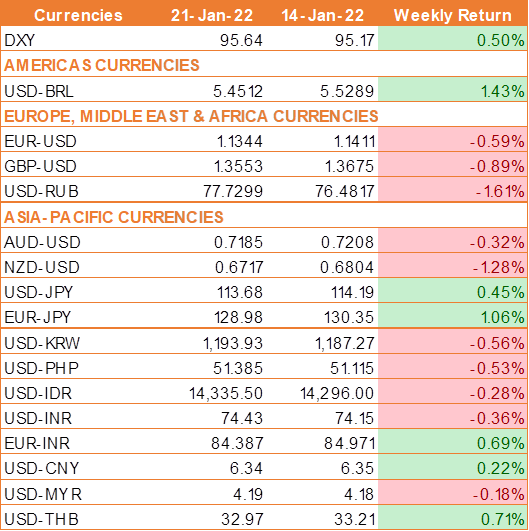

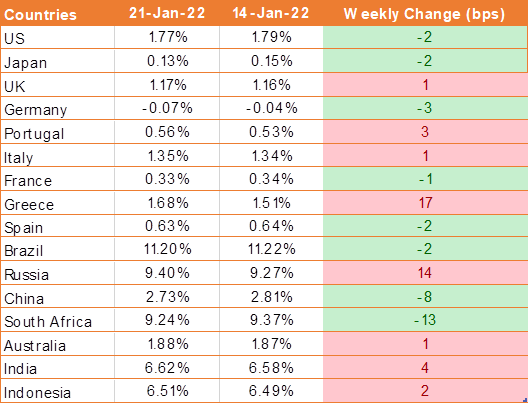

USD ended the week higher tracing UST yield movement as it touches 1.87% level during the week amid expectation of a rate hike in March by the Fed. However, USD eased in the latter part of the week but was well supported as the week was dominated by fears of inflation, higher interest rates, and the impact on the U.S. economy due to the Omicron variant of Covid-19.

Further, market reports suggest that the market participants are pricing in as many as four rate hikes this year, starting from March, and expect the Fed to start trimming its USD 8 trillion-plus balance sheet within months. Next week's Fed meeting could give some indication on how fast it will tighten.

The number of U.S. citizens claiming unemployment benefits for the first time unexpectedly rose to 281,000 last week, up from 231,000 the previous week. Expectations had been for a decline in claims to 220,000.

Geopolitical concerns are also keeping risk appetite limited, with U.S. President Joe Biden warning on Wednesday that he expects Russia to invade neighboring Ukraine again.

Oil prices hover around 7-year highs

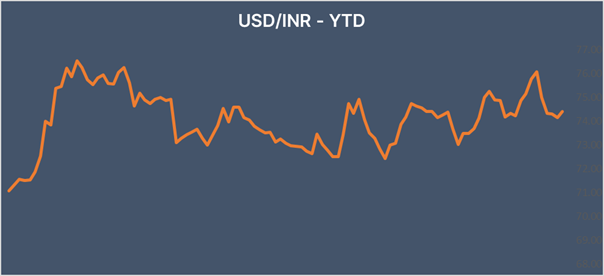

INR ended the week lower amid broad strength exhibited by the USD during the week and as oil prices continued to be at elevated levels.

Oil prices continued to trade around 7-year highs on tight supply concerns and even after API data revealed that crude oil stocks piles unexpectedly rose 1.4 million barrels last week.

We would love to hear back from you. Please Click here to share your valuable feedback