The Federal Reserve on Wednesday left its interest rate unchanged at 0.25% and said it could soon raise interest rates for the first time in more than three years as part of a broader tightening of historically easy monetary policy to cope with surging inflation. Chairman Jerome Powell added that the Fed could move on an aggressive path given quite a bit of room to raise interest rates without threatening the labor market and added that the Fed would likely begin hiking interest rates in March 2022.

In addition, the committee noted that the central bank’s monthly bond-buying will proceed at just USD 30 billion in February, indicating that program is expected to end in March as well at the same time that rates increase.

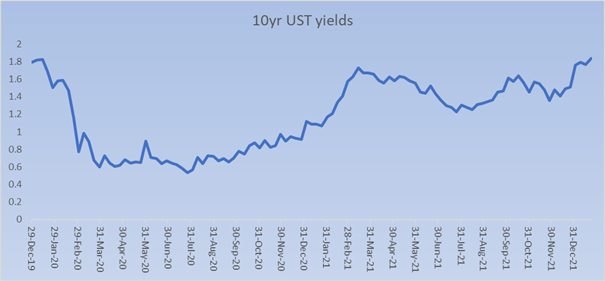

A hawkish stance by the Fed, on Wednesday, has pushed up short-term rates, flattening the closely followed yield curve on U.S. Treasuries.

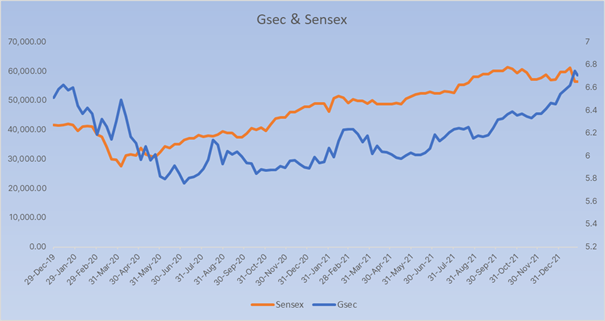

For Indian markets. the Fed’s aggressive rate hike approach is likely to impact the availability and cost of overseas borrowing. Foreign portfolio flows into the Indian equity and bond markets could slow. The rate hike could also lead to global funds pulling out money from Indian government securities. This could result in the RBI raising interest rates to prevent FPI outflows from the Indian bond market.

FPIs pulling money out of the equity and bond markets could weaken the INR as the USD gets stronger with the rate hikes.

Equity markets reacted negatively to the hawkish tone of Fed, US equity indices closed lower. 10-year UST yield trend higher and closed at 1.85%. Sensex & Nifty continued its downtrend, fall by 1.70% and INR down sharply and trades above Rs 75 a USD. 10-year G-sec yield rose sharply to 6.71% and is trading close to pandemic highs.

Fed January 2022 policy-meeting highlights:

· The Fed's tapering of bond purchases will continue as announced in December 2021, leading to zero net purchases by March 2022.

· Keeping higher inflation from becoming "entrenched" is a major policy goal for the Fed.

· Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run.

· While the economy and the job market are showing strength, the ongoing implications of COVID-19 "remain uncertain."