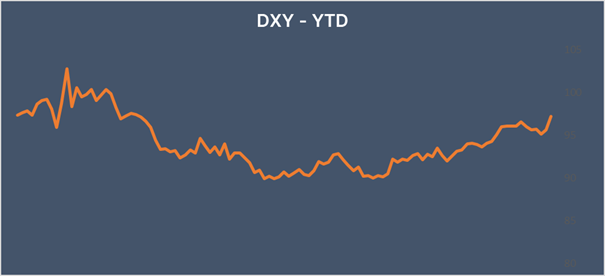

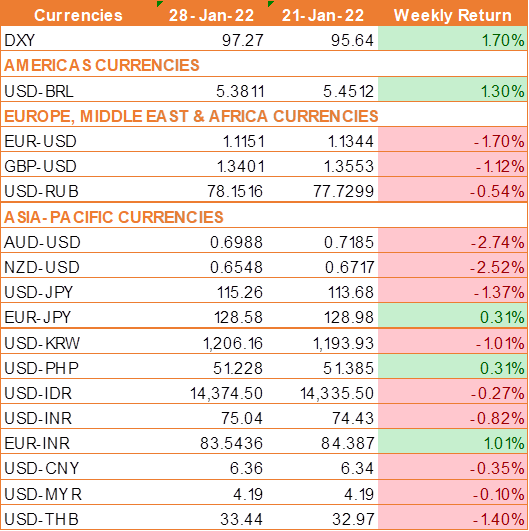

High inflation & Fed fears boosted the USD

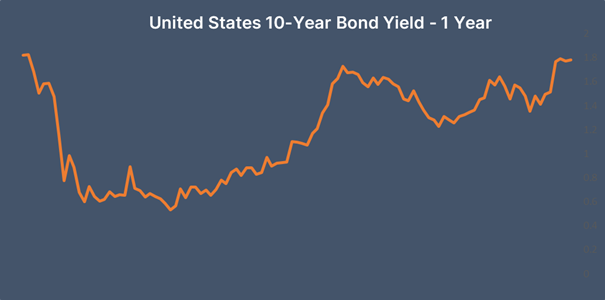

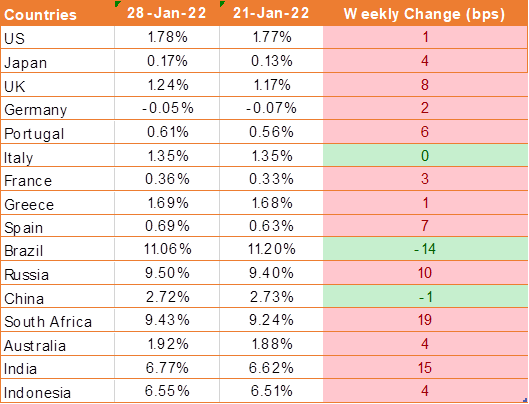

USD consolidated gains on Friday and posted its biggest weekly rise in seven months as markets priced in a aggressive hikes in U.S. interest rates.Fed kept interest rates on hold this month but prepared the market for a rate hike in March. �The bond buying programme is also due to end in March. The Fed has indicated that there will be 4 rate hikes across the year.

The hawkish Fed has sent the USD surging, although stocks have fallen sharply amid concerns over whether the US economy can handle such an aggressive Fed.

Th data showed that the US economy powered ahead in the final three month of the year. GDP rose to 6.9% on an annualized basis and was well above the 5.5% expectation. This means that the US experienced it strongest full year growth since 1984, ending 2021 on a high.

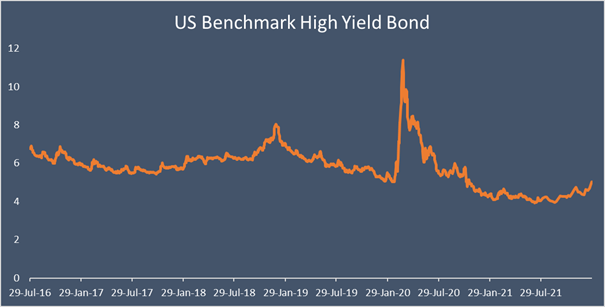

Federal Reserve preferred gauge to measure inflation rose, PCE index rose sharply by 5.8% in Dec 2021, underscoring why the central bank is moving to raise interest rates for the first time in four years.

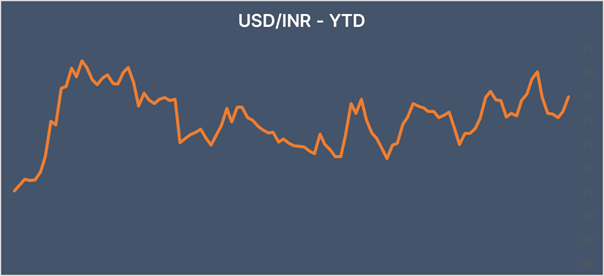

INR down as USD exihibited broad strength

INR ended the week lower as risk sentiment is once again deteriorating on the back of an aggressive US Federal Reserve and as geopolitical tensions continue to rise in eastern Europe. Meanwhile oil prices are rising, reaching fresh 7-year highs on the back of geopolitical troubles in Ukraine. West Texas Intermediate trades at USD 87.70 a barrel.

IMF has cut India�s GDP outlook for FY22 to 9%, down from expectations of 9.5% made in October. The IMF has joined a host of other agencies which have said that they expect growth to slow owing to the impact of Omicron on the economy. The government forecasts economic growth of 9.5%.

We would love to hear back from you. Please Click here to share your valuable feedback