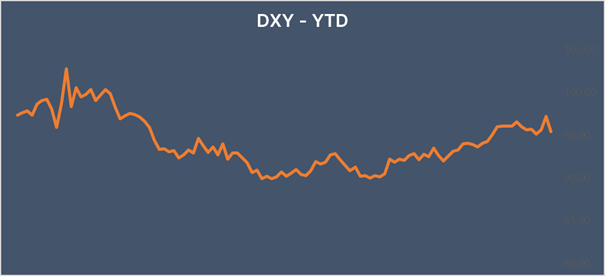

USD down as BOE and ECB made hawkish shifts

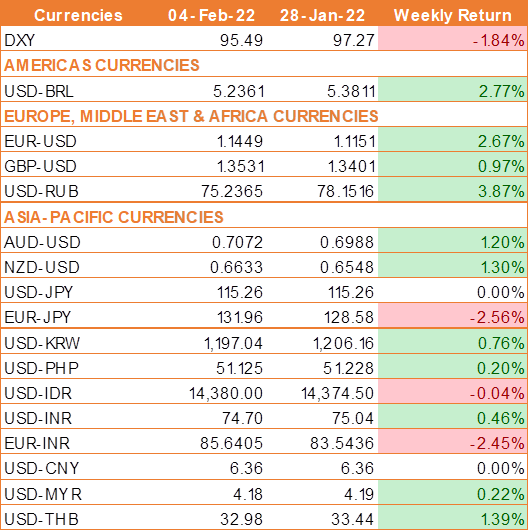

USD ended the week sharply lower in nearly two years, as the Bank of England (BOE) and European Central Bank (ECB) tightened their monetary policies. USD sharp fall comes on Friday after rising on the expectation faster-than-expected interest rate hikes from the U.S. Federal Reserve. The Fed took a hawkish stance of its own as it handed down its policy decision earlier in the month.

The BoE issued its first consecutive interest rate increase since 2004 at the conclusion of its policy meeting on Thursday. The central bank raised the bank rate by 25 basis points, the second time in a row, to 0.50%.

Meanwhile, the ECB acknowledged mounting inflation risks and asserted the path for winding down pandemic-related asset purchases that it had laid out in December.

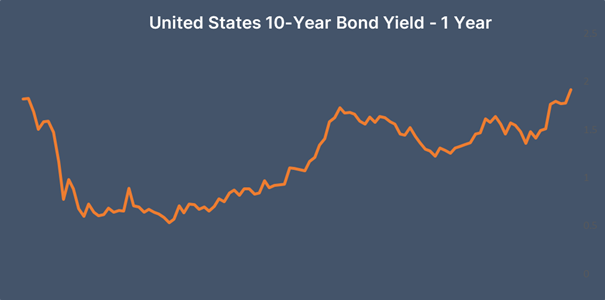

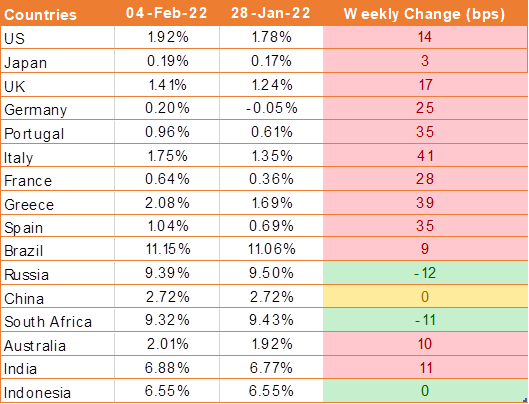

Job growth rose far more than expected in January despite surging omicron cases diriving 10yr UST yields higher by 11 bps to 1.93% on Friday.

Nonfarm payrolls surged by 467,000 for the month against the expectation of 150,000 jobs addition, while the unemployment rate edged higher to 4%, according to the Bureau of Labor Statistics. Data for December was revised higher to show 510,000 jobs created instead of the previously reported 199,000.

Average hourly earnings, a measure of wage inflation and a closely-watched metric, also rose 0.7% last month, and 5.7% on a year-on-year basis.

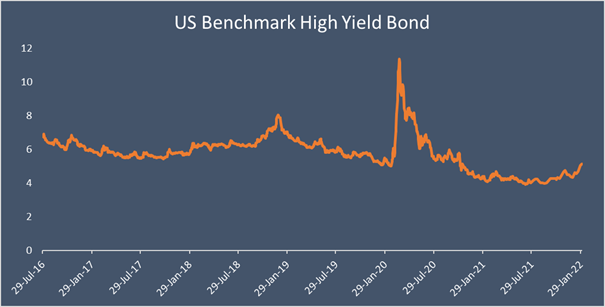

Concerns over record borrowing are unnerving investors

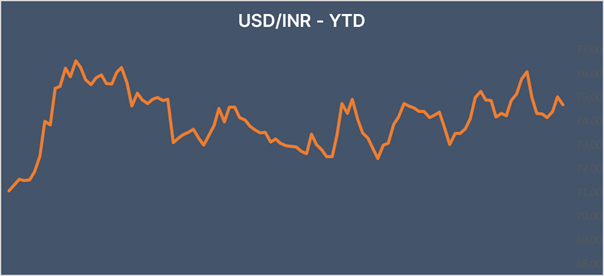

INR manages to end higher last week, snapping its losing streak during the week as USD trades broadly lower on Friday following hawkish policy statements by the European Central Bank and the Bank of England.

INR was under pressure post union budget as a record level of borrowing has fueled fears that the Reserve Bank of India will be forced to act against rising inflation, despite its current dovish stance.

Further, the prices of crude oil continued to surge and were near USD 90 per barrel amid tensions between Russia and Ukraine and worries related to the tight supply of oil globally.

We would love to hear back from you. Please Click here to share your valuable feedback