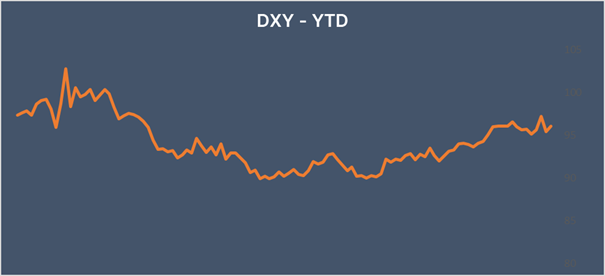

USD & UST yields higher as inflation surpasses expectation.

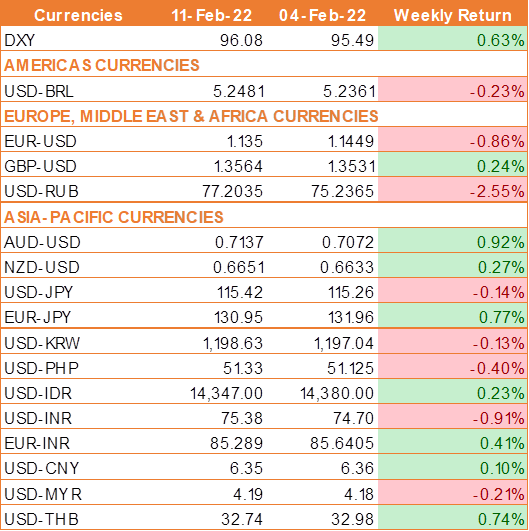

USD trades higher as soaring inflation boosted expectations that the Fed will look to aggressively raise interest rates across the year. Inflation, as measured by the consumer price index jumped to 7.5% year on year in January, its highest level since 1982. This was also up from 7% in December and significantly higher than the 7.3% expectation.

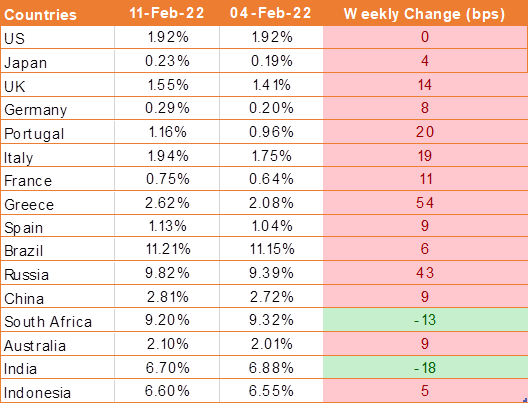

Following the reading, Federal Reserve policymakers increased the hawkish tone. Expectations are now for the US central bank to raise interest rates by 0.5% in March. Expectations had been for a 0.25% interest rate rise previously.

St. Louis Federal Reserve President James Bullard followed the release by stating that he has become "dramatically" more hawkish, calling for a full percentage point of interest rate hikes over the next three U.S. central bank policy meetings.

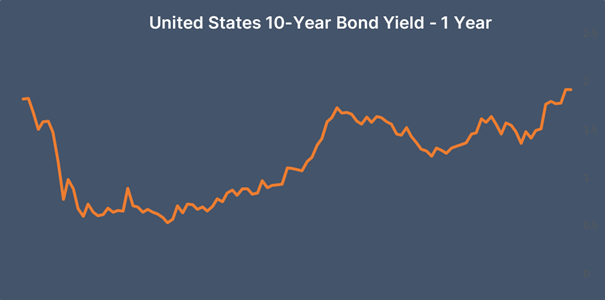

The market has responded, with the yield on benchmark 10-year UST climbing past 2% for the first time since August 2019.

Additionally, the USD also gains as safe-haven assets see rising demand after the United States said Russia has massed enough troops near Ukraine to launch a major invasion. A Russian attack could begin any day and would likely start with an air assault, White House national security adviser Jake Sullivan told a media briefing.

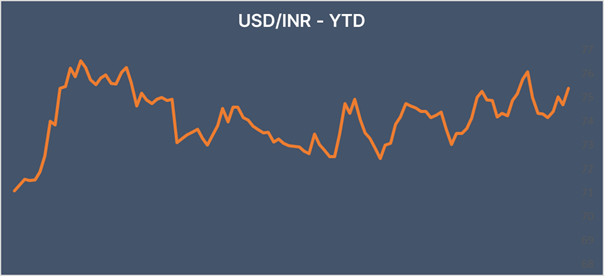

Dovish RBI vs hawkish Fed drags INR

The policy divergence between India and other developed nations is dragging demand for the INR. There are strong expectations that the Fed could move faster to hike rates while RBI maintained its dovish stance in its recent MPC meeting.

Foreign investors have sold a net of USD 5.58 billion in Indian equities so far this year compared to a net purchase of USD 5.08 billion in the same period last year.

RBI MPC voted unanimously to keep the repo rate unchanged and voted 5-1 to stick with its accommodative policy to help the economy recover from the pandemic. RBI Governor Shaktikanta Das noted an improving inflation outlook but said that continued policy support was needed for a durable broad-based economic recovery in India.

We would love to hear back from you. Please Click here to share your valuable feedback