US – Russia meeting on Tuesday

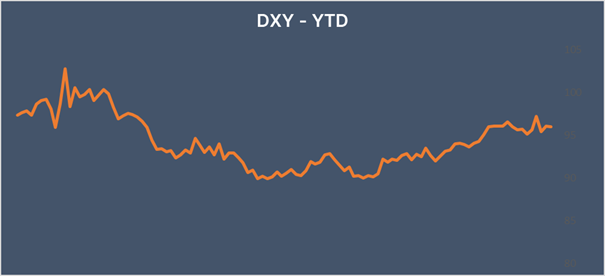

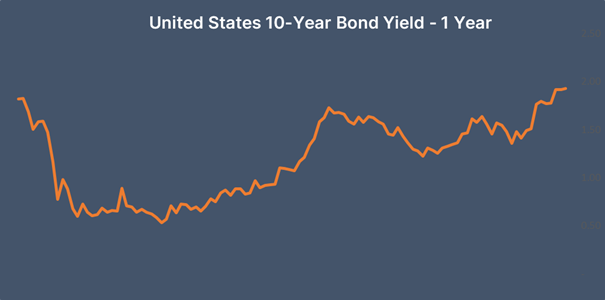

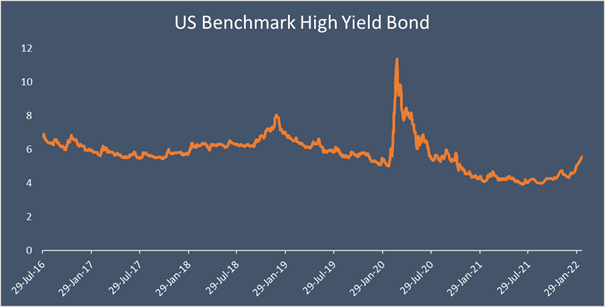

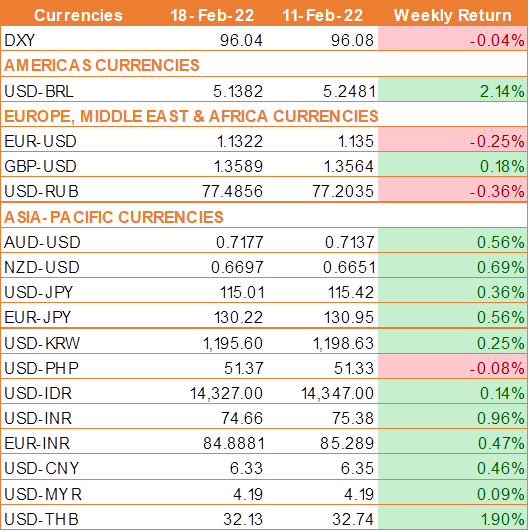

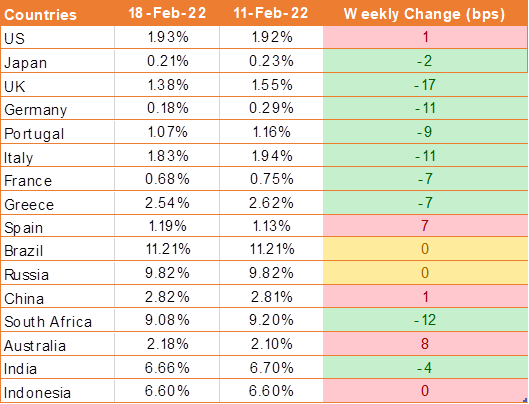

USD ended marginally lower as risk sentiment improved on Friday by the news that the U.S. and Russia were set to discuss the Ukraine crisis next week, raising hopes for a diplomatic solution. Additionally, the minutes from the January Federal Reserve monetary policy meeting were also less hawkish than what was expected, which sent USD lower.

The minutes indicated that the Fed was not looking to rush the tightening process, instead opting for a measured approach, although the meeting was before US inflation reached 7.5%.

USD started the week on a higher note after inflation reached 7.5% which boosted the expectation that the US Federal Reserve would raise interest rates by 0.5% in March. The Fed could then go on to raise interest rates up to 6 times across this year in order to tame runaway inflation. In addition to expectations of a more hawkish Fed, the USD was higher in the early week on safe-haven flows as Russia- Ukraine tensions rise.

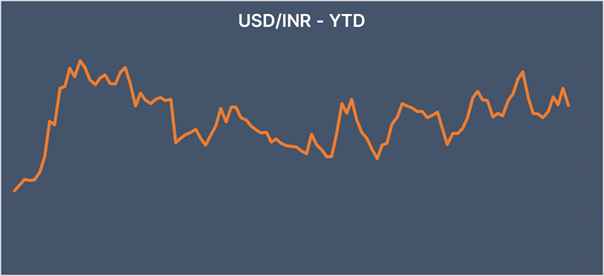

INR gains on risk-on trade

INR was higher as the risk sentiment improved as fears eased as Russia pulled some of its troops back from the border with Ukraine. Separately, falling oil prices supported the INR. West Texas Intermediate traded 2% lower as the US and Iran inch edcloser to reviving the 2015 nuclear deal.

We would love to hear back from you. Please Click here to share your valuable feedback