US GDP was upwardly revised to 7.2%

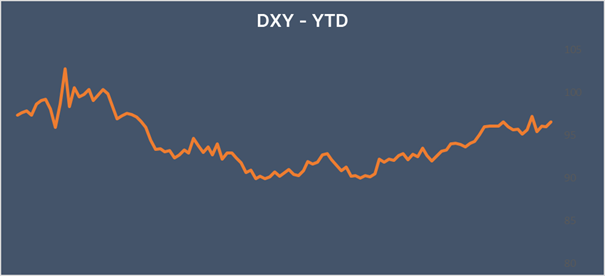

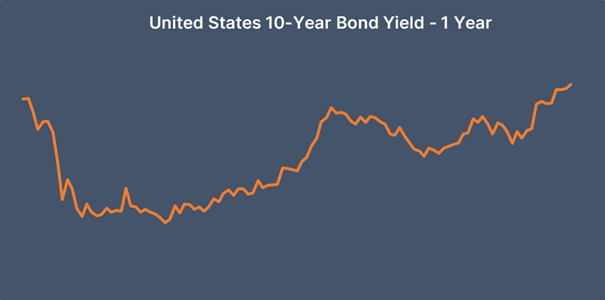

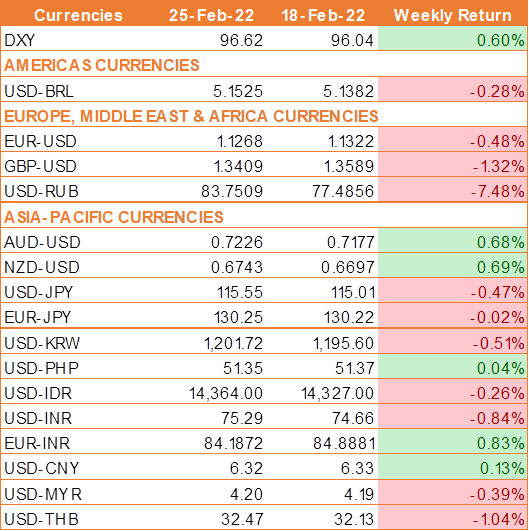

USD traded higher last week amid safe-haven flows and further being boosted by upbeat economic data. In the central bank's latest monetary policy report to Congress, the Fed warned inflation could last longer than anticipated should labor shortages and fast-rising wages continue.

The US GDP was upwardly revised to 7.2% quarter on quarter in the final three months of last year. US jobless claims also fell to 232,000, down from 249,000 the previous week.

However high inflation did not stop consumers from spending. Personal spending rose faster than expected, up 2.1% year on year in January, ahead of the 1.5% expectation and up from a -0.8% decline in December.

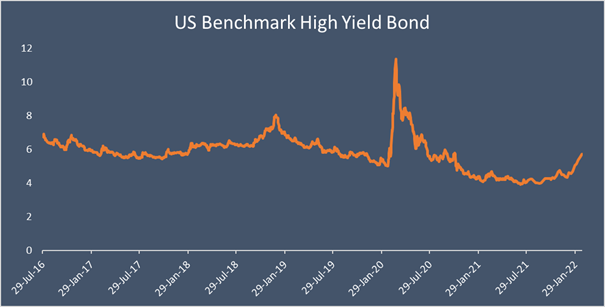

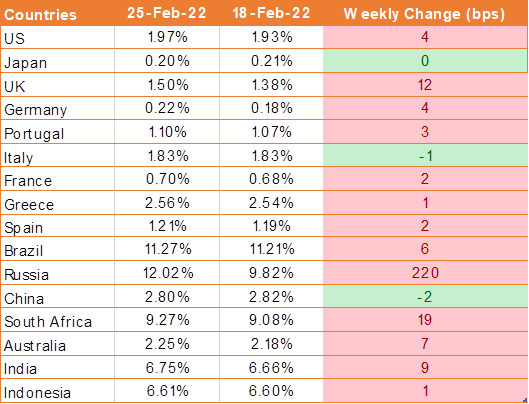

The European Union on Friday said that it is planning a third round of sanctions against Moscow, minutes after Ukraine's president pleaded with the bloc for faster, more forceful steps to punish Russia for its invasion of his country. Policymakers at the European Central Bank (ECB) said the situation in Ukraine could cause the ECB to slow its exit from stimulus measures.

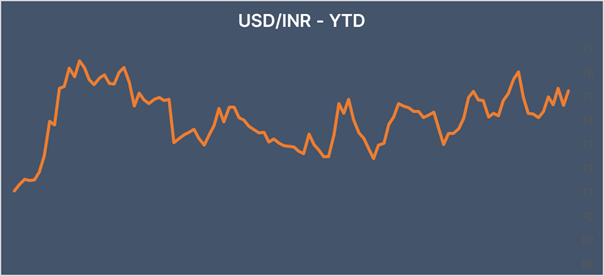

INR falls as oil prices rises over USD 100 a barrel

INR ended the week lower despite rising on Friday as risk sentiment improved slightly. Any sense that the situation between Russia-Ukraine tussle is improving could help the INR rebound. Meanwhile, any deterioration of the conflict could push the INR lower.

Prices of crude oil surged globally after Russia attacked Ukraine, leading to concern that a war in Europe could disrupt the global energy supply. Brent crude prices rose above USD 105 a barrel for the first time since 2014.

Crude prices came off record highs after US President Joe Biden said Washington was working with other countries on a combined release of additional oil from global strategic crude reserves.

We would love to hear back from you. Please Click here to share your valuable feedback