GOI FRB

The issuance of floating rate bonds (FRBs) by the Government of India was started in FY 02. The interest rate payable on a half-yearly basis on FRBs is linked to the variable base rate calculated as the weighted average rate of the implicit yield at cut-off prices of the specified number of auctions of Government of India 182-day T-Bills held up to the commencement of the half-yearly fixation/ reset of coupon date which is known as base rate and a pre-determined spread.

Valuation of floating rate bonds

Ø Valuation of floating rate bond are made considering only the current floating rate which is re-set at pre-announced intervals (generally in every 6 month).

Ø Forwards rate which is implicit from term structure from zero coupon bond yield can be used for valuation of FRBs.

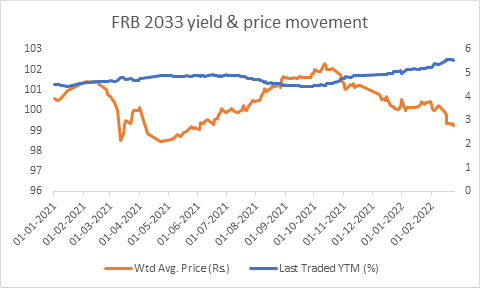

Price change of FRB 2033

Date | Price |

01-Jan-21 | 100.56 |

24-Feb-22 | 99.26 |

Price fall | -1.29% |

Auction of GOI FRB 2033 during FY22

Date | Cut-off yield | Price |

13-Aug-2021 | 4.58 | 101.05 |

30-Jul-2021 | 4.74 | 100.32 |

16-Jul-2021 | 4.85 | 100.02 |

02-Jul-2021 | 4.92 | 99.90 |

18-Jun-2021 | 4.92 | 99.36 |

03-Jun-2021 | 4.89 | 99.16 |

21-May-2021 | 4.88 | 98.98 |

07-May-2021 | 4.87 | 98.50 |

23-Apr-2021 | 4.93 | 98.40 |

09-Apr-2021 | 4.86 | 98.50 |

Coupon Rate of FRB 2033 announced in FY22

Date | Coupon Rate | Average 182 T-Bill auction yield |

19-Mar-21 | 4.70% | 3.48% |

21-Sep-21 | 4.62% | 3.40% |

Outstanding GOI Floating rate Bonds (as of 8th Feb 2022)

GOI Floating Rate Bonds | Maturity | Outstanding amount (Rs billion) |

FRB 2024 | 07-Nov-24 | 896.35 |

FRB 2028 | 04-Oct-28 | 248.16 |

FRB 2031 | 07-Dec-31 | 1399.15 |

FRB 2033 | 22-Sep-33 | 1494.81 |

FRB 2034 | 30-Oct-34 | 428.00 |

FRB 2035 | 25-Jan-35 | 3.50 |

Total | 4469.97 | |

Floating Rate Debt Fund Returns (%)

1-month | 3-month | 1-year | 3-year | 5-year | 10-year |

0.27 | 0.57 | 4.17 | 6.64 | 6.72 | 7.68 |

Source: value research online

Government bonds, SDL and OIS yield movements

Last week, 6.54% 2032 paper yield rose by 9 bps to 6.75% while 6.10% 2031 yield increased by 7 bps to 6.77%. On the other hand, 5-year benchmark bond, 5.63% 2026 yield rose by 13 bps to 5.94%. 6.64% 2035 yield gained 3 bps to 7.02%. Long-term paper, 7.16% 2050 yield rose by 2 bps to 7.10%.

The spread of 10-year bond over 5-year bond fell to 83 bps from 89 bps in previous week. The 15-year benchmark over 10-year benchmark spread declined to 22 bps from 26 bps while 30-year benchmark over 10-year benchmark spread decreased to 32 bps from 38 bps on weekly basis.

Average 10-year SDL auction cut-off rose to 7.12% from 7.09% in previous week while spread declined to 34 bps from 39 bps.

On weekly basis, 1-year OIS yield rose by 4 bps 4.30% while 5-year OIS yield increased by 6 bps to 5.76%.

We would love to hear back from you. Please Click here to share your valuable feedback