US non-farm beats expectation

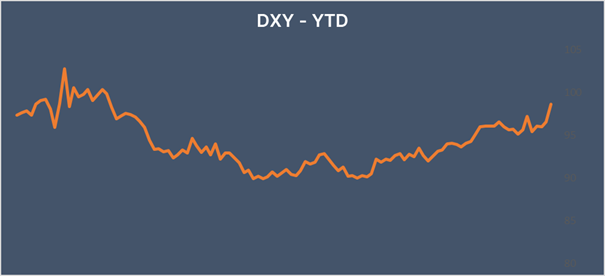

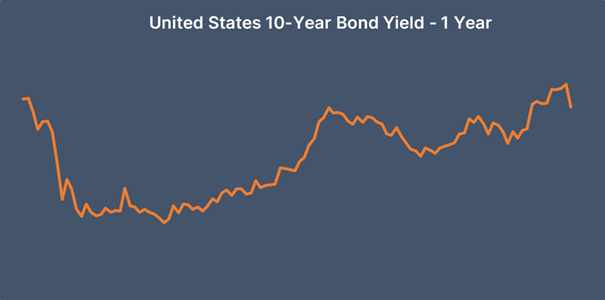

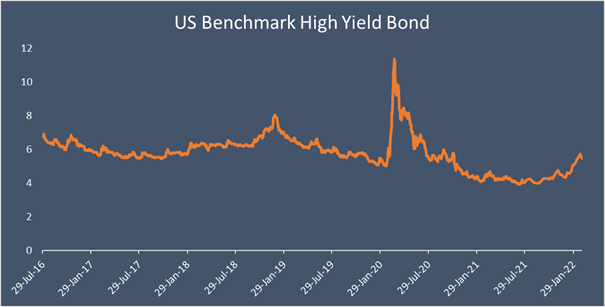

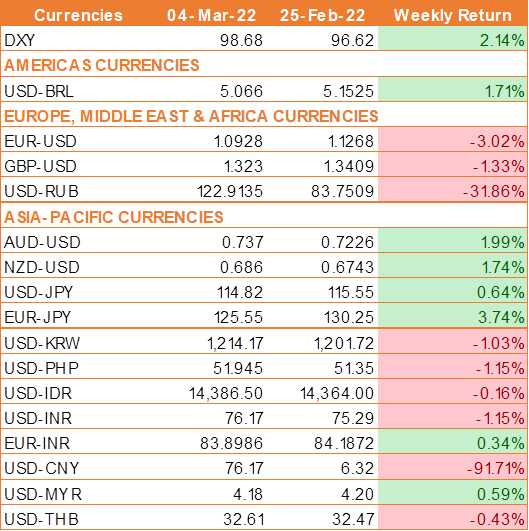

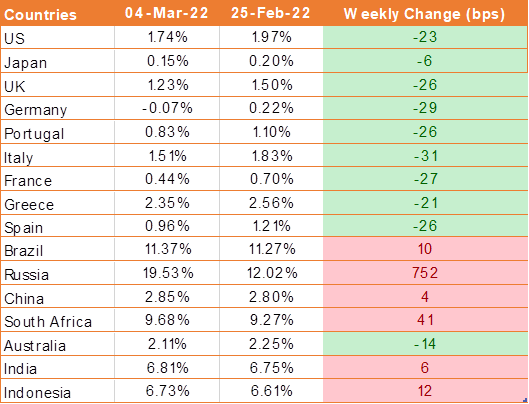

Safe-haven flows are lifting the USD as the Russian invasion into Ukraine deepens. As well as safe-haven demand the USD is also being supported by strong data and by expectations of the Fed hiking rates this month.

The West applied strong sanctions to Russia for invading Ukraine. The sanctions sent the Rouble 30% lower and the central bank of Russia hiked interest rates to 20%. Fears that the sanctions could hurt global growth saw investors seek out the safety of the USD.

Federal Reserve Chair Jerome Powell gave a second testimony before Congress on Thursday and confirmed that the US central bank would hike rates at the FOMC meeting on 17th March.

Non-farm payroll showed that the US economy added 678,000 jobs in February, this was above the expectation of 400,000 jobs and also well above January’s figure of 481,000. The unemployment rate fell from 4% to 3.8%.

US ISM manufacturing PMI rose to 58.6 in February, up from 57.6 in January. This was ahead of the 58 level expectation and well over level 50 which separates expansion from contraction.

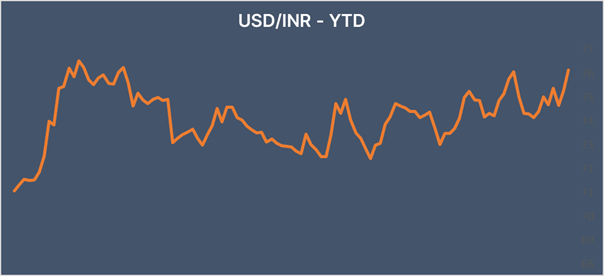

INR continued its last-week fall as Risk aversion continues to dominate the global financial markets as Russia continues its military assault on Ukraine. Sanction on Russia from the west raises supply concerns and drives Oil prices higher. Higher oil prices is bad news for oil-importing countries such as India.

West Texas Intermediate trades at USD 113 up 23% so far this week, while Brent hit USD 118. The OPCE+ countries decided to stick to their current plan of small, gradual increases to the production of just 400,000 barrels per day.

We would love to hear back from you. Please Click here to share your valuable feedback