Fed to stay full throttle with 6 rate hikes in 2022

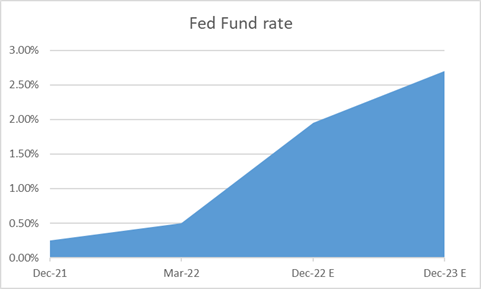

Inflation, strong economy, wage growth and rising commodity prices left the Fed policymakers on edge, as they hiked rates by 0.25% for the first time since December 2018. Policymakers expect the inflation to be at 4.3% by end of 2022 cooling-off from 4-decade highs of 7.9% reported in February 2022, which is far from 2% target zone. FOMC committee guided to increase rates by 6 times in this year and 3 times in 2023, pointing to rates settling at 1.95% in 2022.

Dec 21 0%-0.25%, Mar-22 0.25%-0.50%, Dec-22E 1.95% and Dec-23E 2.70%

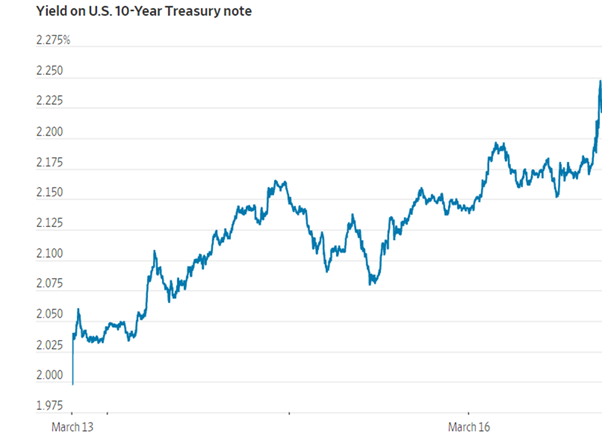

Russia-Ukraine conflict caused sharp rise in commodity prices across the globe. Food prices rose sharply, especially wheat as Russia exports 30% of total wheat supply. Aluminum, Copper, Iron ore and Nickel prices rose sharply, and few metals have crossed highs seen in 2007. Brent crude prices touched as much as USD 130 per barrel, which is 14 years high due to supply crunch amid sanctions over Russia by western countries. To control inflation and bring it back to targeted zone of 2%, FOMC is aggressively hiking rates. This could also put brakes on wage growths and sharp salary hikes. ECB also sounded in similar lines, surprisingly speeded up the asset purchase schedule for the coming months during its March 2022 policy-meeting and said that the PAPP could end in the third quarter if the medium-term inflation outlook will not weaken. 10-year UST yields touched 2.24%, Wallstreet indices initially gave up gains but bounced back and gold came down by 0.5%.

On the balance-sheet front, Fed is likely to start to shrink by next policy-meeting which is scheduled in May 2022. March 2022 policy-meeting minutes should further guide investors on the pace of reduction.