US jobless claims beats forecasts

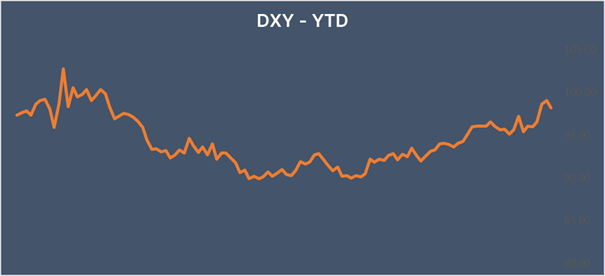

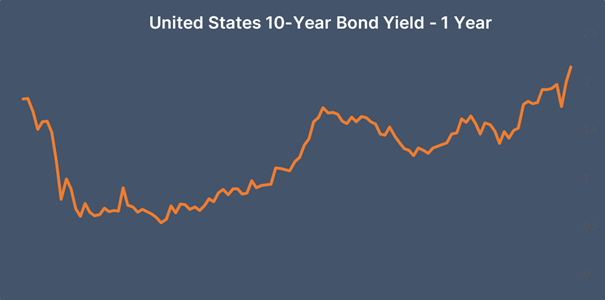

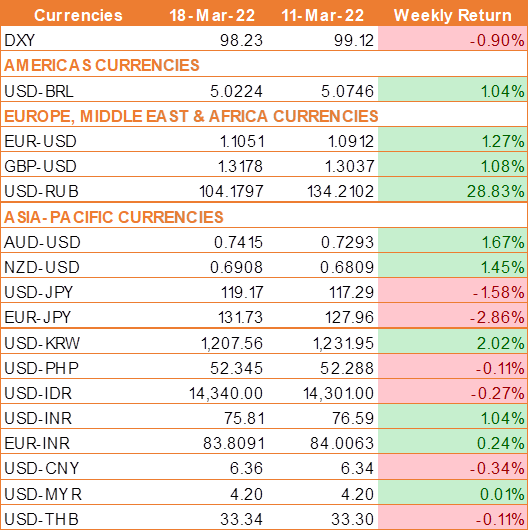

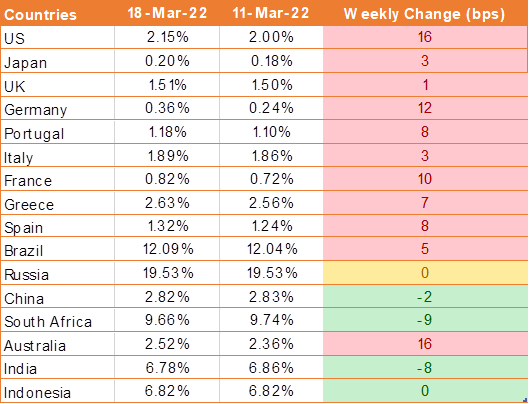

USD ended the week lower despite the US Federal Reserve hiking interest rates. The US central bank raised interest rates by 25 basis points in a move that was widely expected by investors. The Fed also indicated that there will be a further 6 rate hikes across the year. Fed Chair Powell reassured the market that the US economy was strong enough to absorb all the rate hikes that were coming.

US jobless claims showed that the number of US citizens signing up for unemployment benefits for the first time fell to 217,000, this was down from 229,000 in the previous week and below the expectation of 220,000.

Additionally, the USD came under pressure as risk sentiment improved. Optimism surrounding peace talks between Russia and Ukraine which took place on Thursday is helping drive demand for riskier assets and currencies while hurting demand for the safe-haven USD.

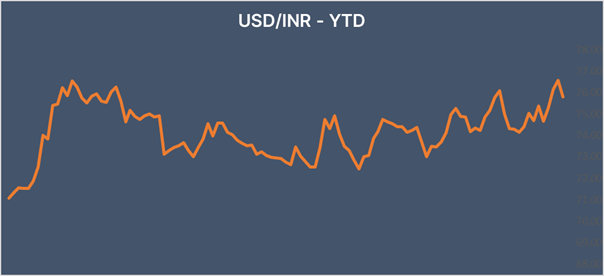

INR rises despite ongoing global economic risks

INR ended higher last week despite warnings from the RBI as it confirmed that India’s macroeconomic fundamentals remained strong but the latest global developments pose a downside risk for the Indian economy, in terms of the potential spillover effect.

India’s retail inflation jumped in February. Consumer prices rose 6.07% year on year in February, this was up from 6.01% in January against the expectation of 5.93%, within the central bank 2% – 6% tolerance band.

We would love to hear back from you. Please Click here to share your valuable feedback