RBI will start to hike rates in April 2022

RBI policy stance will factor in global central bank actions and Fed clearly leads the way. Given that domestic inflation threats are visible with CPI and WPI inflation at over 6% and 13% respectively and high oil and commodity prices that have spiked in the recent past, inflation outlook is on the higher side. RBI also has to manage a record borrowing program for the government in the coming fiscal year and holding back yields will only give bonds to market at unsustainable yields. Over and above these factors is the impact on capital flows and the INR due to the Fed rate hike.

In this context, keeping rates down will only send worry signals to the market and this will cause disruption in the government borrowing program. RBI is better off guiding markets on the trajectory of policy normalisation and smoothen out the rise of the yield curve than trying to act brave and brush off Fed rate hikes.

US Fed Meeting outcomes-

As per earlier indications, US FOMC they hiked rates by 0.25% for the first time since December 2018. Policymakers expect the inflation to be at 4.3% by end of 2022 cooling-off from 4-decade highs of 7.9% reported in February 2022, which is far from 2% target zone. FOMC committee guided to increase rates by 6 times in this year and 3 times in 2023, pointing to rates settling at 1.95% in 2022.

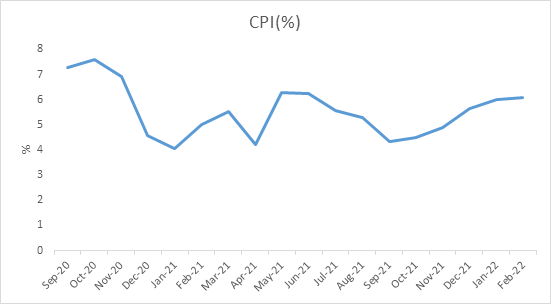

Domestic Inflation- India’s consumer inflation rose to 6.07% in Feb 22 from 6.01% in previous month. During last month, core inflation stood at 5.95%.

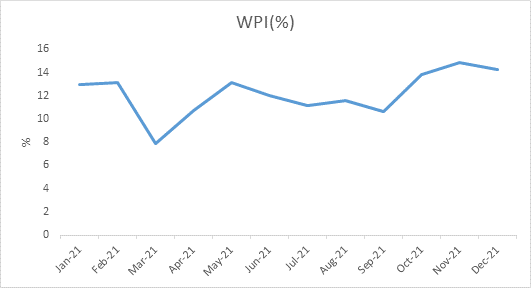

Domestic WPI data-The annual wholesale price inflation rate in India rose to 13.11% in February 2022 from a four-month low of 12.96% in previous month.

Government bonds, SDL and OIS yield movements

Last week, 6.54% 2032 paper yield came down by 3 bps to 6.78% while 6.10% 2031 yield decreased by 3 bps to 6.81%. The 5-year benchmark bond, 5.63% 2026 yield declined by 9 bps to 5.94%. 6.64% 2035 yield lost 1 bp to 7.14%. Long-term paper, 7.16% 2050 yield increased by 3 bps to 7.26%.

The spread of 10-year bond over 5-year bond rose to 84 bps from 81 bps in previous week. The 15-year benchmark over 10-year benchmark spread increased to 33 bps from 28 bps while 30-year benchmark over 10-year benchmark spread increased to 48 bps from 40 bps on weekly basis.

Average 10-year SDL auction cut-off rose to 7.22% from 7.15% in previous week while spread rose to 40 bps from 38 bps.

On weekly basis, 1-year OIS yield rose by 2 bps 4.42% while 5-year OIS yield increased by 9 bps to 5.89%.

We would love to hear back from you. Please Click here to share your valuable feedback