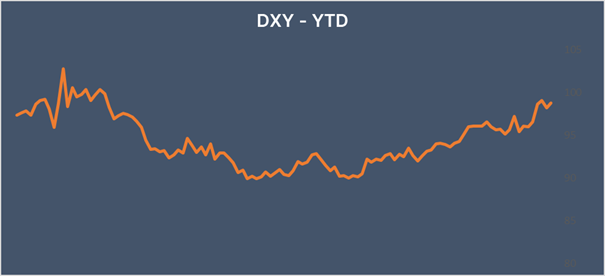

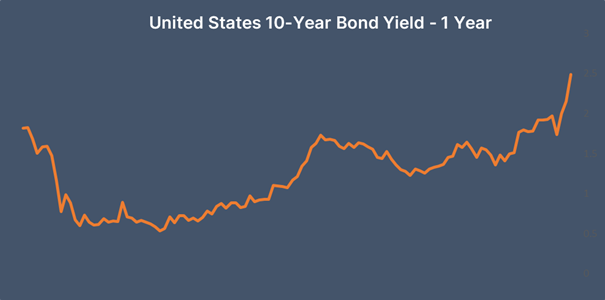

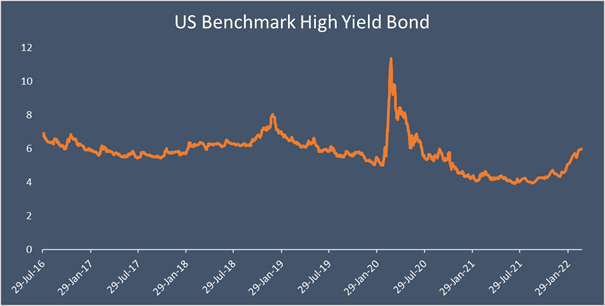

Data supports bigger rate hikes by Fed

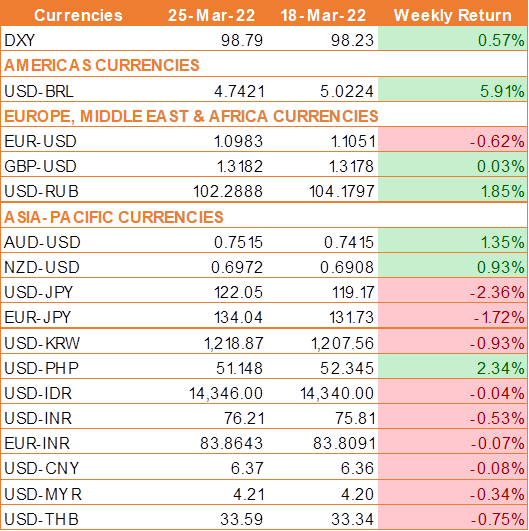

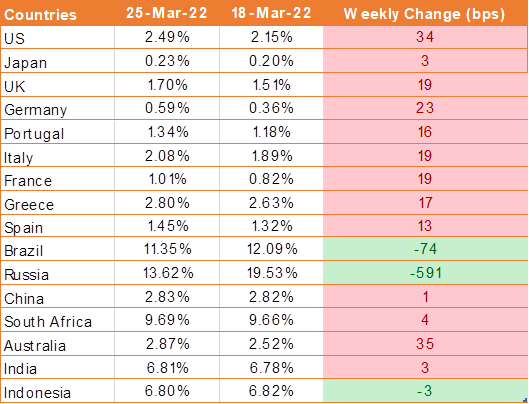

USD trades higher last week after Federal Reserve officials have been out in force supporting a more hawkish stance from the US central bank in order to tame elevated inflation. US economic data was also upbeat boosting demand for the USD.

Data released shows that US business activity unexpectedly rose in February on the back of robust demand for both manufacturing and services. The US composite PMI came in at 58.5, up from 55.9 in February.

Federal Reserve Chair Jerome Powell doubled down on his hawkish message from last week’s FOMC meeting. Powell said that the central bank was prepared to hike rates by 0.5% if that is what is needed at the next meeting.

On Thursday, Chicago Fed President Charles Evans said he would be comfortable raising rates at every Fed meeting through next March by 25 basis points each time but is "open-minded" about a possible 50-basis-point hike.

Fed Governor Christopher Waller said the state of the U.S. housing market should help shape monetary policy and there seems to be no cooling insight for higher home costs, although Minneapolis Federal Reserve Bank President Neel Kashkari on Thursday said he has penciled in seven quarter-point interest rate hikes this year and warned against overdoing it.

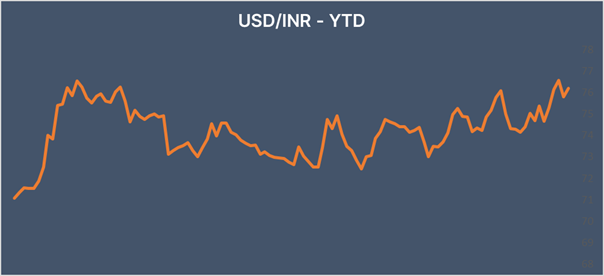

INR falls amid elevated oil prices

INR ended the week lower as oil prices have been volatile. Oil rallied 4% after Russian President Putin said that hostile countries must pay for their gas in the Rubles. West Texas Intermediate rose to USD 118 a bbl in early trade today and has since eased back slightly, helping risk sentiment.

India imports over 80% of its oil need meaning that it is very vulnerable to changes in oil prices.

We would love to hear back from you. Please Click here to share your valuable feedback