In the first half of fiscal year 2022-23, Union Government will borrow Rs 8450 billion, which is 56.52% of the total budgeted borrowing of Rs 14950 billion for full fiscal year. From 8th April 2022 to 30th September 2022 RBI is scheduled to conduct 26 weekly auctions for government securities. It can be noted here that, during H1FY22, GOI had borrowed Rs 6713.57 billion. States too are likely to borrow around Rs 4 trillion and together the supply of bonds will be too heavy for the market to absorb.

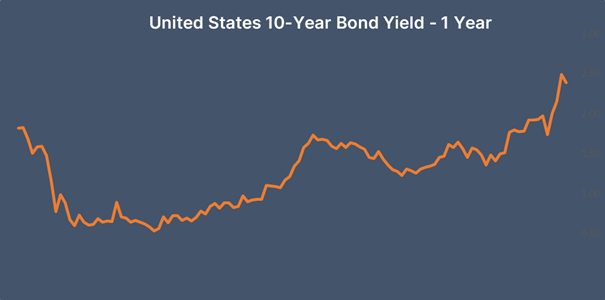

RBI is scheduled to hold its first policy for the fiscal year 2022-23 and the MPC will have to address the issues of an inverted UST yield curve, widening current account deficit and the heavy g-sec supply. The UST yield curve inverted with 2 year and 5-year treasury yields trading higher than the 10-year treasury yield. The inversion is because of the Fed being way below the inflation curve and will need to tighten policy aggressively, which could push US economic growth down.

Such an inversion in 2007 led to the credit crisis that destabilised financial markets across the globe and took the INR to record lows on the back of capital outflows. RBI may have to raise interest rates fast to keep markets from high volatility.

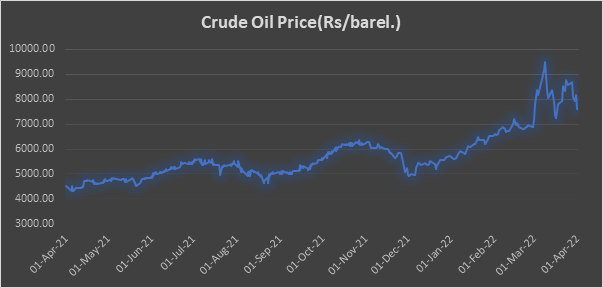

CAD rose to 2.7% of GDP at the end of quarter ended December 2021 against 0.3% of GDP a year ago. CAD rose sharply on account of higher trade deficit due to high oil prices and is likely to be higher in the March 2022 quarter as oil prices increased on account of Russia- Ukraine conflict. Rising CAD has a negative effect on the INR especially if there are capital outflows on the back of FIIs selling equities and bonds on risk aversion.

Government bonds, SDL and OIS yield movements

Last week, 6.54% 2032 paper yield rose by 3 bps to 6.84% while 6.10% 2031 yield increased by 3 bps to 6.86%. The 5-year benchmark bond, 6.79% 2027 yield lost by 1 bp to 6.33%. 6.64% 2035 yield rose 4 bps to 7.16%. Long-term paper, 7.16% 2050 yield decreased by 4 bp to 7.23%.

The spread of 10-year bond over 5-year bond rose to 51 bps from 47 bps in previous week. The 15-year benchmark over 10-year benchmark spread decreased to 30 bps from 31 bps while 30-year benchmark over 10-year benchmark spread decreased to 43 bps from 46 bps on weekly basis.

Average 10-year SDL auction cut-off rose to 7.34% from 7.24% in previous week while spread rose to 52 bps from 41 bps.

On weekly basis, 1-year OIS yield declined by 4 bps 4.48% while 5-year OIS yield decreased by 6 bps to 5.97%.

We would love to hear back from you. Please Click here to share your valuable feedback