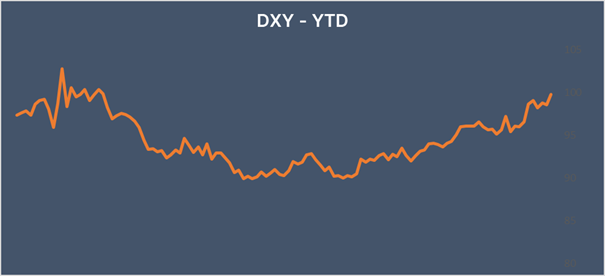

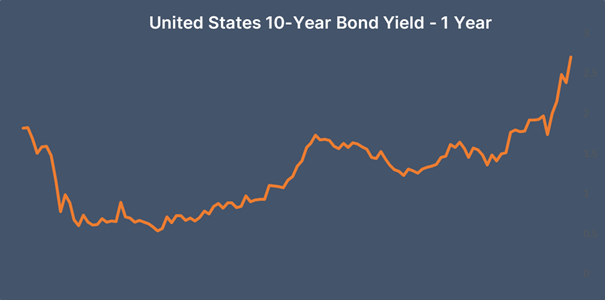

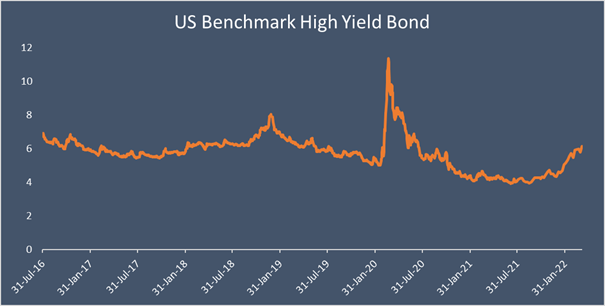

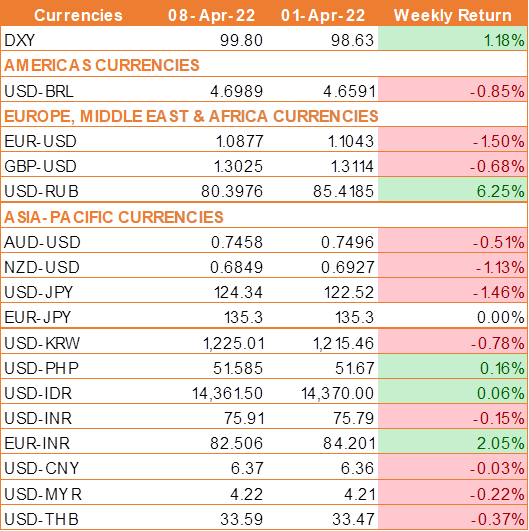

· USD rose across the board largely supported by expectations of a more hawkish Federal Reserve.

· The minutes of the March Federal Reserve monetary policy meeting showed that policymakers were broadly in agreement that interest rates could be hiked by 50 bps.

· US jobless claims data was strong, with initial claims falling to 166,000, this was the lowest level that it has been in over 50 years.

· The ISM service sector PMI showed that the dominant sector in the US saw strong growth in March of 58.3, up from 56.6 in February.

· RBI MPC decided to keep the repo rate unchanged at 4.00% and reverse the repo rate at 3.35%.

· Though the RBI monetary policy stance was retained as accommodative, the committee changed the phrasing of the stance, saying it will "remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth

· The committee scaled up its inflation projection for 2022-23 (Apr-Mar) sharply to 5.7% from the 4.5% forecast in February, while the GDP growth projection for 2022-23 was cut to 7.2% from 7.8% earlier.

We would love to hear back from you. Please Click here to share your valuable feedback