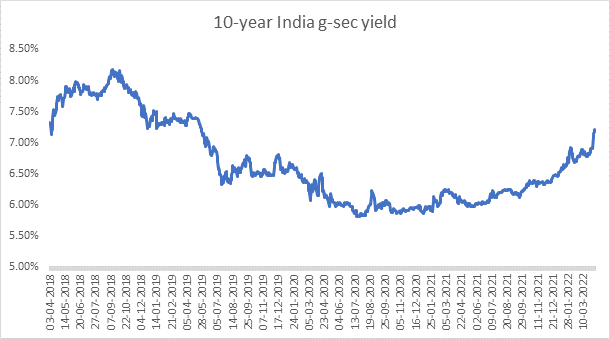

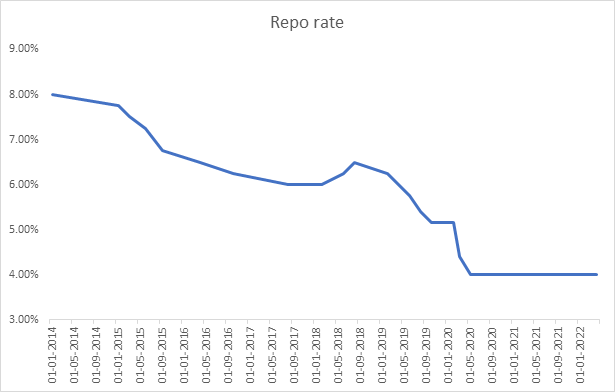

G-sec yields have risen by 150bps from lows seen post covid and this seems to be just the beginning of a rising interest rate cycle that could go on for a minimum period of 3 years. RBI has yet to raise the repo rate from record lows and also needs to step in to support a high government borrowing program, which hampers their efforts to manage liquidity. Inflation too is rising with CPI inflation at close to 7% in March 2022.

Globally too centrals banks from US to Eurozone are fighting very high inflation and interest rates will have to continuously rise for a long period of time for policy normalisation. This can lead to high risk aversion in markets that will cause further volatility in interest rates in India.

Domestic Inflation- India’s consumer inflation touched 17-month high at 6.95% in March 22 from 6.07% in previous month. The rise in inflation was driven by surge in food and fuel prices. During the month food inflation stood at 7.68% on yearly basis. Core inflation remained at 6.53% during March 22.

US Inflation- US consumer inflation soared to 41-year high level at 8.4% in March 22 driven by surge in gas price and housing and food cost.

Government bonds, SDL and OIS yield movements

Last week, 6.54% 2032 paper yield rose by 9 bps to 7.21% while 6.10% 2031 yield soared by 40 bps to 6.26%. The 5-year benchmark bond, 6.79% 2027 yield jumped by 24 bps to 6.84%. 6.64% 2035 yield rose 29 bps to 7.45%. Long-term paper, 6.99% 2051 yield decreased by 12 bps to 7.52%.

The spread of 10-year bond over 5-year bond declined to 37 bps from 52 bps in previous week. The 15-year benchmark over 10-year benchmark spread increased to 23 bps from 22 bps while 30-year benchmark over 10-year benchmark spread decreased to 31 bps from 28 bps on weekly basis.

On weekly basis, 1-year OIS yield rose by 26 bps 4.99% while 5-year OIS yield increased by 40 bps to 6.58%.

We would love to hear back from you. Please Click here to share your valuable feedback