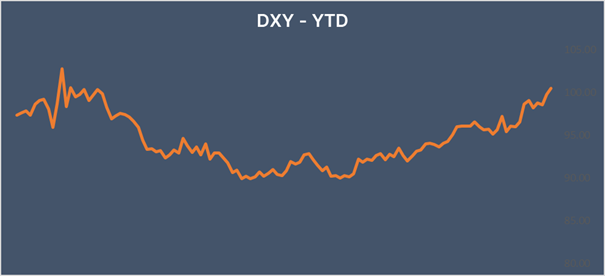

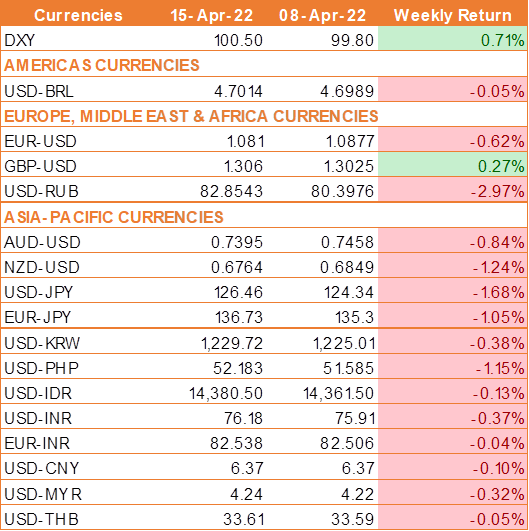

· USD rose across the board as consumer prices rose 8.5% against the 8.3% expectation year on year in March, up from 7.9% in February.

· High inflation data boosted the USD to an almost 2 years high at 100.5.

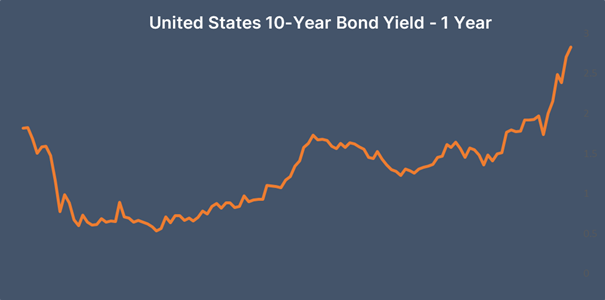

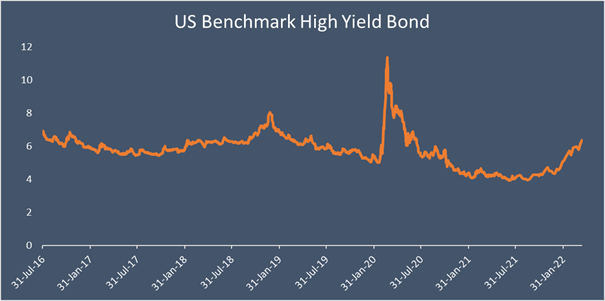

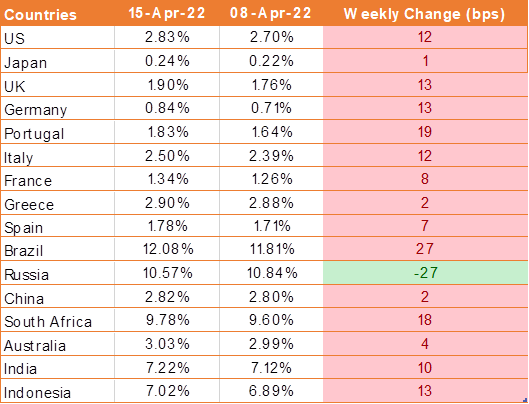

· Federal Reserve, in the backdrop of high inflation is likely to hike rates more aggressively, possibly with a 50-bps rate hike in May and another in June.

· The minutes of the latest Fed meeting showed that the Fed also plans to trim its balance sheet by USD 95 billion per month at the same time as hiking interest rates.

· St Louis Fed President James Bullard, renowned for his hawkish stance, said that the central bank needs to raise interest rates by another 3% before the end of the year.

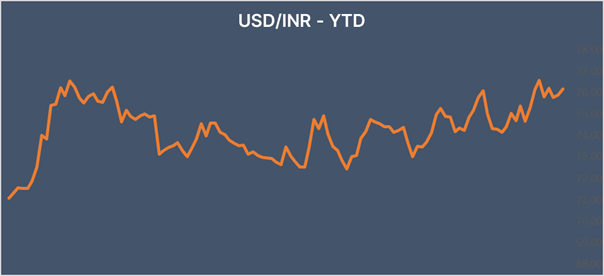

· The World Bank slashed its growth outlook for India to 8%, down from 8.7% for the current fiscal year.

· The World Bank said that it expects household consumption to be constrained by rising inflationary pressures caused by high oil and food prices amid the fallout from the Ukraine war.

· India CPI inflation rose to 6.95% in the month of March which is higher than the 6.07% reported in February.

· This is the third consecutive month that the CPI data has breached the Reserve Bank of India’s (RBI) upper margin of 6%.

We would love to hear back from you. Please Click here to share your valuable feedback