Fed and ECB may have completely got it wrong

The toughest work for any global central bank policymakers is to get the inflation in the targeted zone, but it's not just that simple. Numerous factors can change the course of the inflation rate, the policymaker uses monetary policy (Interest Rates) as the main tool to control the inflation rate trajectory. Developed countries like the US and Eurozone are witnessing decade high inflation growth. Domestic inflation forecast was revised upwards during the latest RBI policy-meeting and crude oil trading above USD 100 per barrel would act as a catalyst to CPI growth.

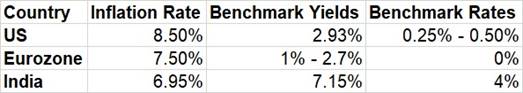

Fixed-income passive products like bank deposits and debt mutual funds are offering way below yields than inflation growth rate. Losses occurring from these products are mounting and get compounded every year. Following table shows country wise latest inflation print, benchmark government bond yields and interest rates. Bond investors in the US and Eurozone would struggle to earn yields higher than inflation, given the wider spread. However, Indian investors are better-off compared to the western country investors as the spread between G-sec yields and inflation rate is positive. FD rates and short-term/ultra-short term debt funds are underperforming, and AA & A rated corporate bonds are outperforming.

Following table shows top gainers and losers, considering 6% average domestic inflation.

As the accumulated losses due to underperforming yielding assets from previous year & current year would lead to huge delta of returns that would be required to beat losses against soaring inflation. For a domestic investor it is still manageable as the Indian corporate bond market does provide opportunities to make up for previous year losses and beat current year inflation. However, western country investors would have to take up risky assets which provide high yields in order to beat inflation. It is nearly impossible for them to make up for previous year losses and beat current year inflation rate as the accumulated losses are high.

Do check our latest video on “7% strategy for bonds”

On the currency front, DXY began moving higher in mid of 2021 as the Fed hinted that it may be ready to begin quantitative tightening. Currently it breached 2-decade highs and peaked near 104 levels. One of the primary reasons for such a sharp rally is change in the US interest rate cycle and steep sell-off in the yen that launched USD/JPY to fresh multi-decade highs. The USD/INR pair is trading at 76 levels despite sharp appreciation in the dollar index

Government bonds, SDL and OIS yield movements

Last week, 10-year benchmark 6.54% 2032 paper yield declined by 3 bps to 7.14%. The 5-year benchmark bond, 6.79% 2027 yield rose by 2 bps to 6.83%. 6.64% 2035 yield lost 3 bps to 7.33%. Long-term paper, 6.99% 2051 yield decreased by 4 bps to 7.42%.

The spread of 10-year bond over 5-year bond declined to 31 bps from 36 bps in the previous week. The 15-year benchmark over 10-year benchmark spread remained steady at 19 bps while the 30-year benchmark over 10-year benchmark spread decreased to 28 bps from 29 bps on a weekly basis.

20-year Punjab SDL auction cut-off stood at 7.48%.

On a weekly basis, 1-year OIS yield rose by 8 bps to 5.05% while the 5-year OIS yield increased by 4 bps to 6.61%.

We would love to hear back from you. Please Click here to share your valuable feedback