1 yr G-sec auction devolved to PDs

The RBI had to devolve over 60% of the 1-year g-sec auction of Rs 40 billion to the PDs or primary dealers as the bids were too high in terms of yields. This indicates that the market does not have demand for short maturity bonds given expectations of tight money conditions.

RBI governor indicated in an interview that the central bank will have to continue to sell USD to prevent the INR from depreciating too fast. RBI has already sold over USD 25 billion in the fx markets, taking out close to Rs 2 trillion of liquidity.

RBI is also not buying gsecs in the open market given its concerns on inflation and there is no additional source of liquidity for the market apart from government spending. Continued outflows on risk aversion will worsen liquidity conditions.

High inflation is also causing cash to drain from the system with currency in circulation rising by Rs 2.6 trillion in the last 1 year given the need to hold more cash for paying for higher prices of goods and services.

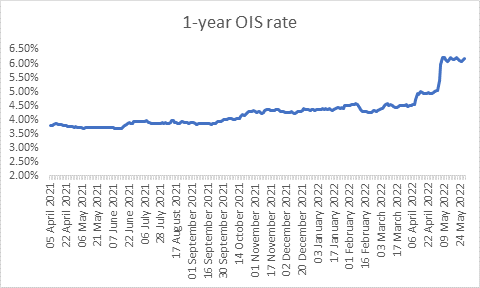

OIS yields have shot up by 200 bps at the short end indicating that liquidity is expected to tighten considerably. Bond markets will have to watch out for high volatility given such money tightening.

System Liquidity-As of 26th May 2022, systemic liquidity stood at Rs 3102.35 billion. Liquidity absorbed through standing deposit facility (SDF) stood at Rs 1266.44 billion and Rs 3058.61 billion through reverse repo operations. Liquidity injection through LTRO & TLTRO came in at Rs 867.48 billion.

Government bonds, SDL and OIS yield movements

Last week, 10-year benchmark 6.54% 2032 paper yield declined by 1 bp to 7.35%. The 5-year benchmark bond, 6.79% 2027 yield came down by 4 bps to 7.14%. 6.64% 2035 yield remained unchanged at 7.51%. Long-term paper, 6.99% 2051 yield decreased by 3 bps to 7.60%.

The spread of 10-year bond over 5-year bond rose to 21 bps from 18 bps in the previous week. The 15-year benchmark over 10-year benchmark spread remained steady at 17 bps while the 30-year benchmark over 10-year benchmark spread decreased to 25 bps from 27 bps on a weekly basis.

10-year SDL auction cut-off rose to 7.72% from 7.70% in previous week while spread increased to 38 bps from 33 bps.

On a weekly basis, 1-year OIS yield came down by 5 bps to 6.17% while the 5-year OIS yield remained unchanged at 7.02%.

We would love to hear back from you. Please Click here to share your valuable feedback