Going slow on rate hikes can pose danger to markets

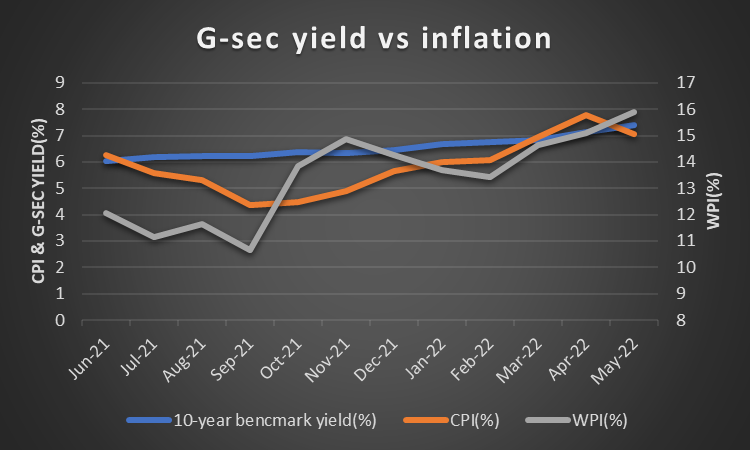

The INR is trading at record lows on fears of high trade deficit on rising import costs and capital outflows on global risk aversion. Gsec yields are trending higher from lows on the back of inflation, government borrowing and global rate hikes. RBI has raised rates by 90bps over the last 2 months and is likely to take up the repo rate to 6% as indicated by 1 year OIS yield that is trading at around 6.35%.

Given that RBI is now saying inflation is likely to cool off from October, rate hikes may not be sharp. This can give rise to a short rally in gsecs but will pose additional risks to the markets if global central banks continue on a rate hike spree on record high inflation and the INR falls sharply.

RBI is also at the risk of losing credibility on inflation forecasts, given that their estimates have gone completely wrong. WPI at high double digit levels will ensure CPI inflation does not come off.

Markets can sell off very fast if RBI goes slow on rate hikes.

Government bonds, SDL and OIS yield movements

Last week, 10-year benchmark 6.54% 2032 paper yield came down by 1 bp to 7.41%. The 5-year benchmark bond, 6.79% 2027 yield declined by 4 bps to 7.17%. 6.64% 2035 yield lost 4 bps to 7.51%. Long-term paper, 6.99% 2051 yield declined by 4 bps to 7.66%.

The spread of 10-year bond over 5-year bond rose to 24 bps from 21 bps in the previous week. The 15-year benchmark over 10-year benchmark spread remained steady at 10 bps while the 30-year benchmark over 10-year benchmark spread declined to 26 bps from 28 bps on a weekly basis.

10-year SDL auction cut-off declined to 7.82% from 7.86% in previous week while spread rose to 43 bps from 40 bps.

On a weekly basis, 1-year OIS yield stood unchanged at 6.31% while the 5-year OIS yield came down by 4 bps to 6.75%.

We would love to hear back from you. Please Click here to share your valuable feedback