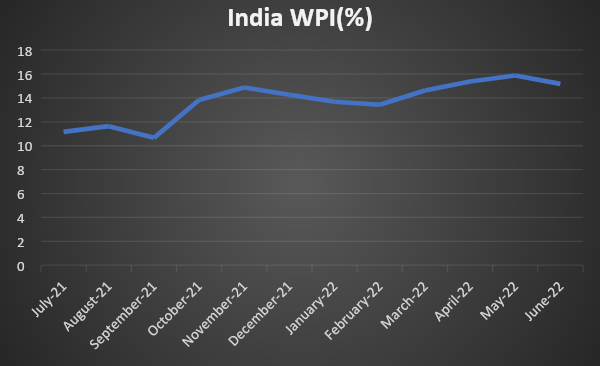

India’s wholesale inflation (WPI) stood at 15.18% in June 22. Since last one year, WPI has remained elevated as evident from above chart. In the same line, consumer inflation has stayed above 7%. Factors such as low policy rates, high crude price and high global inflation have caused domestic inflation to rise to such extents. As a result, producers will continue to pass on the input price pressures to consumers. Consequently, INR will depreciate further on the back of weak margins for corporates that will impact equity valuations causing capital outflows. The government subsidy bill will rise as the centre tries to control prices for consumers and this will cause the fiscal deficit to swell.

Import prices will rise on weak INR and inflation will stay higher.. In the view of global rate hikes and high inflation, benchmark government bond yield is likely to cross 8% in near future.

RBI confidence on inflation coming off is misplaced on high WPI numbers.

US Inflation-US consumer inflation stood at 9.1% on yearly basis in June 22 while core inflation came in at 5.9% during the month.

Domestic Inflation-India’s consumer inflation moderated slightly to 7.01% in Jun 2022 as compared to 7.04% in May 2022 driven by moderation in food inflation. Core inflation stood at 5.95% during the month.

Industrial Production-Domestic Index of Industrial Production (IIP) growth stood at 19.6% on yearly basis in May as against 7.1% in April. During the month, the manufacturing sector's output expanded by 20.6% on yearly basis.

Government bonds, SDL and OIS yield movements

Last week, 10-year benchmark 6.54% 2032 paper yield rose by 3 bps to 7.44%. The 5-year benchmark bond, 6.79% 2027 yield increased by 3 bps to 7.20%. 6.64% 2035 yield rose by 11 bps to 7.62%. Long-term paper, 6.99% 2051 yield rose by 8 bps to 7.74%.

The spread of 10-year bond over 5-year bond stood unchanged at 24 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 18 bps from 10 bps while the 30-year benchmark over 10-year benchmark spread rose to 30 bps from 26 bps on a weekly basis.

10-year SDL auction cut-off declined to 7.821 from 7.82% in previous week while spread came down to 42 bps from 43 bps.

On a weekly basis, 1-year OIS yield stood rose by 6 bps to 6.37% while the 5-year OIS yield came down by 18 bps to 6.57%.

We would love to hear back from you. Please Click here to share your valuable feedback