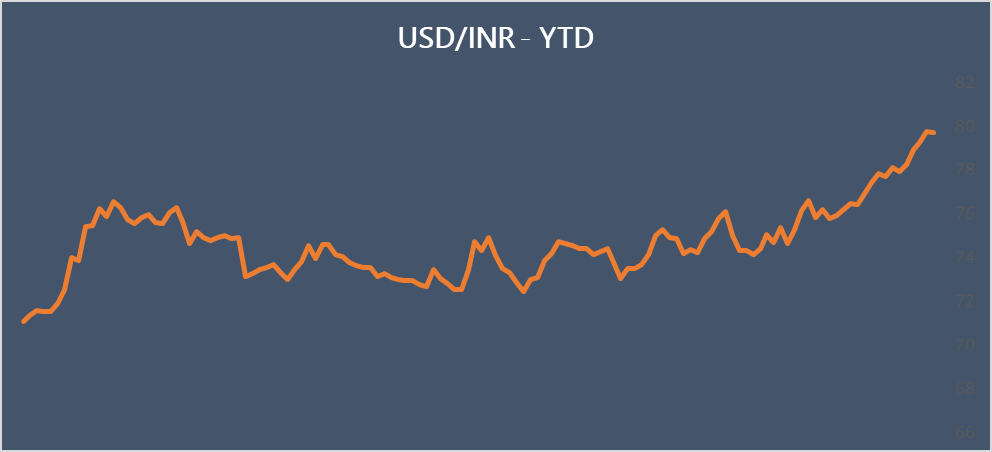

- INR ended slightly short of Rs 80 a USD mark on Friday after falling to a record low this week amid sell off in riskier assets.

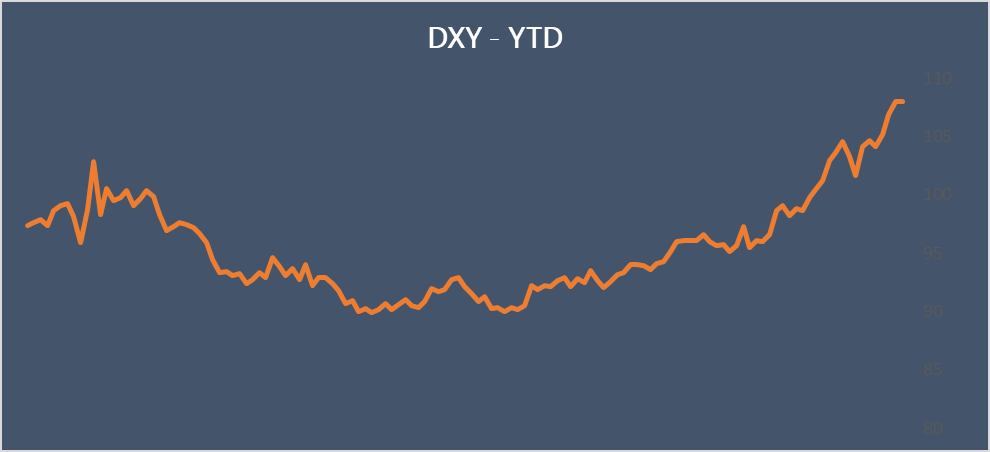

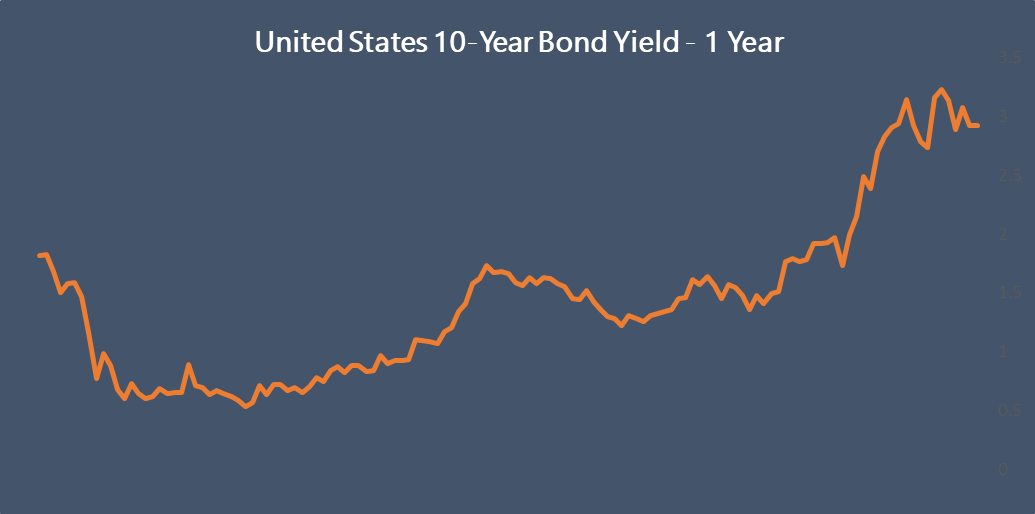

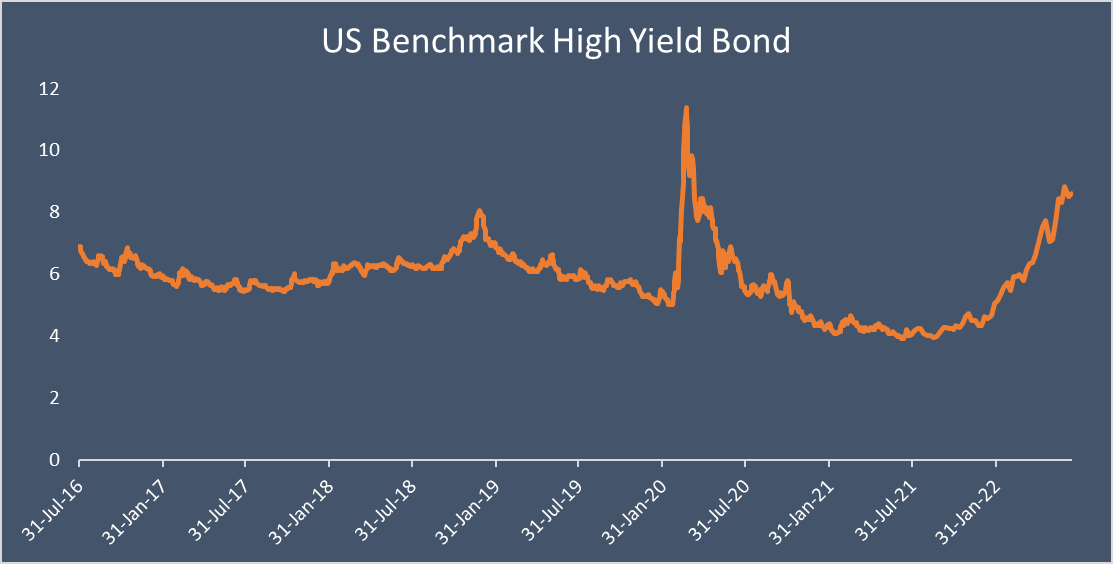

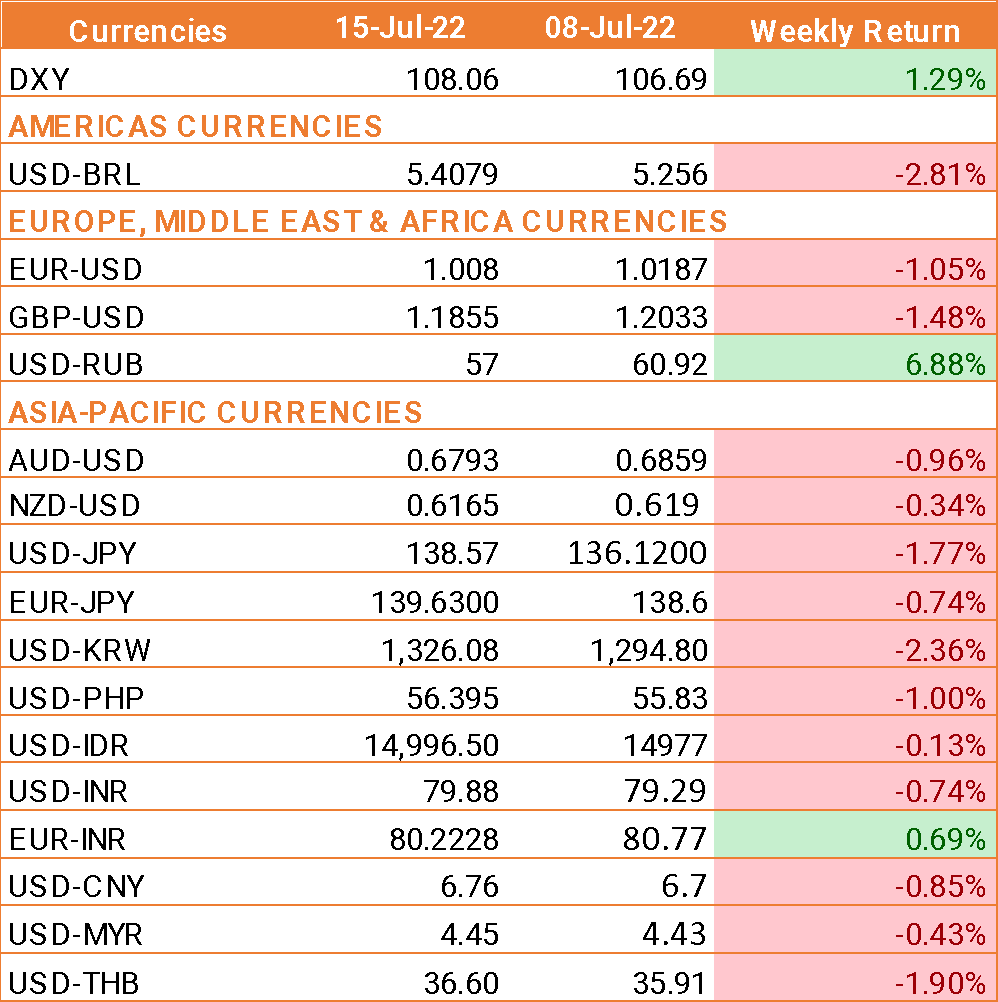

- USD exhibits broad strength as expectation of more fed rate hike builds after US inflation, as measured by consumer prices rose to 9.1% year on year in June, ahead of the 8.8% expectation.

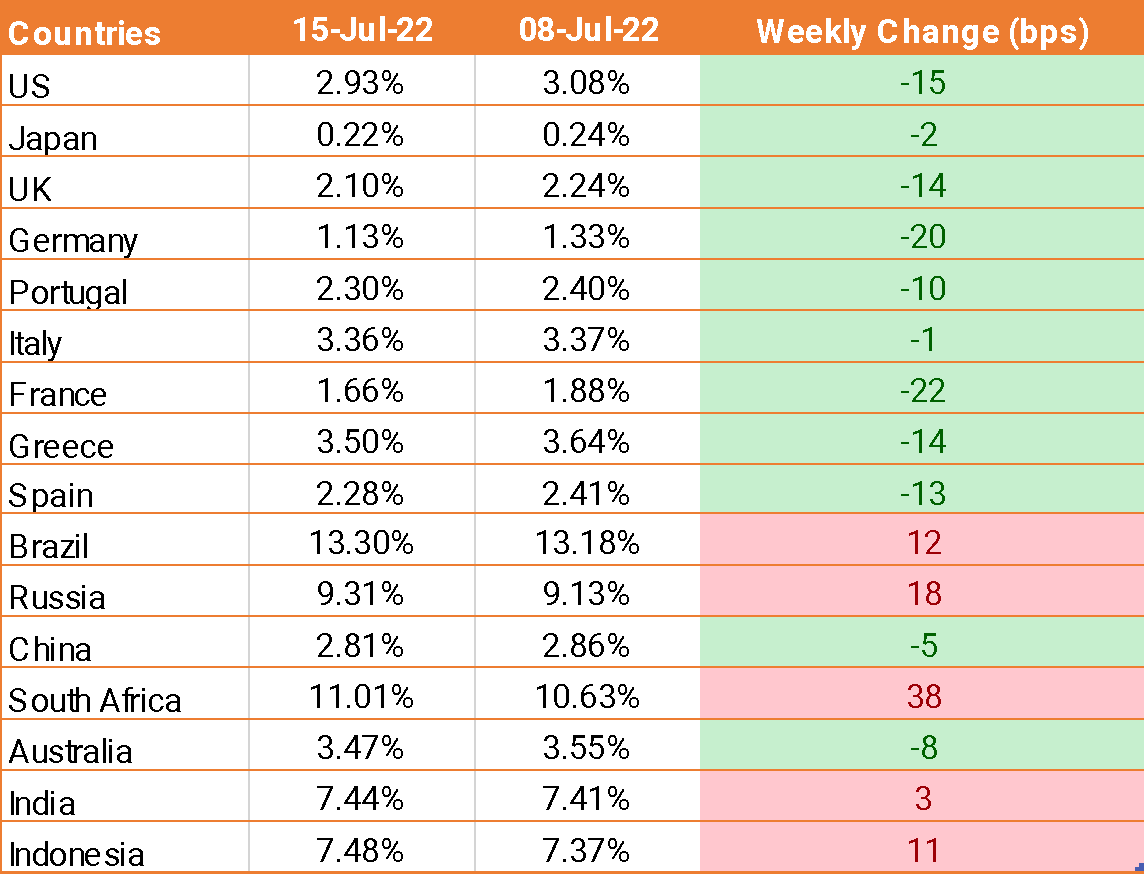

- Hawkish comments from Federal Reserve speaker Bostic further boosted expectations that Fed will raise interest rates at a faster pace. The market is now expecting a 100 basis point rate hike in July, up from 75 basis points earlier.

- India’s June wholesale inflation held above 15% but was down slightly from 15.88% recorded in September. Hot inflation strengthens the chances of another rate hike from the Reserve Bank of India.

- Data released on Thursday showed India's merchandise trade deficit widened to a record high of USD 26.18 billion in June on account of high oil imports, thus adding to the pressure on the rupee.

We would love to hear back from you. Please Click here to share your valuable feedback