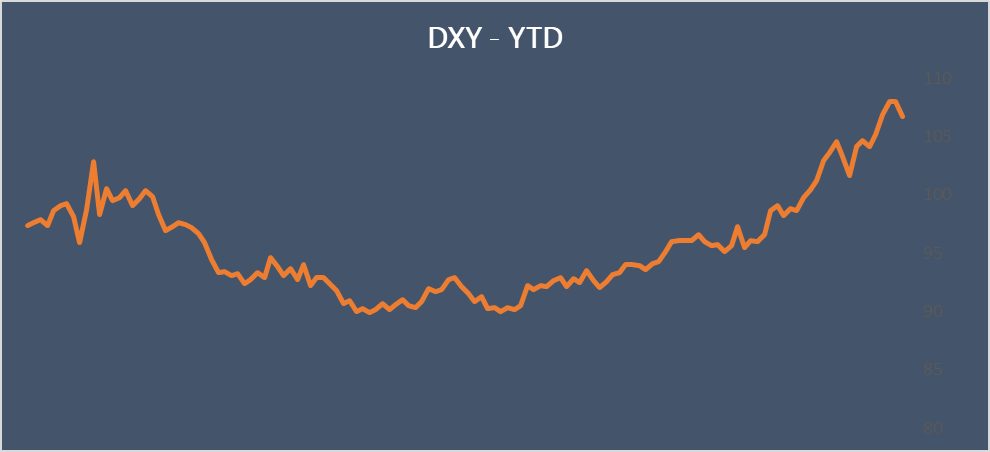

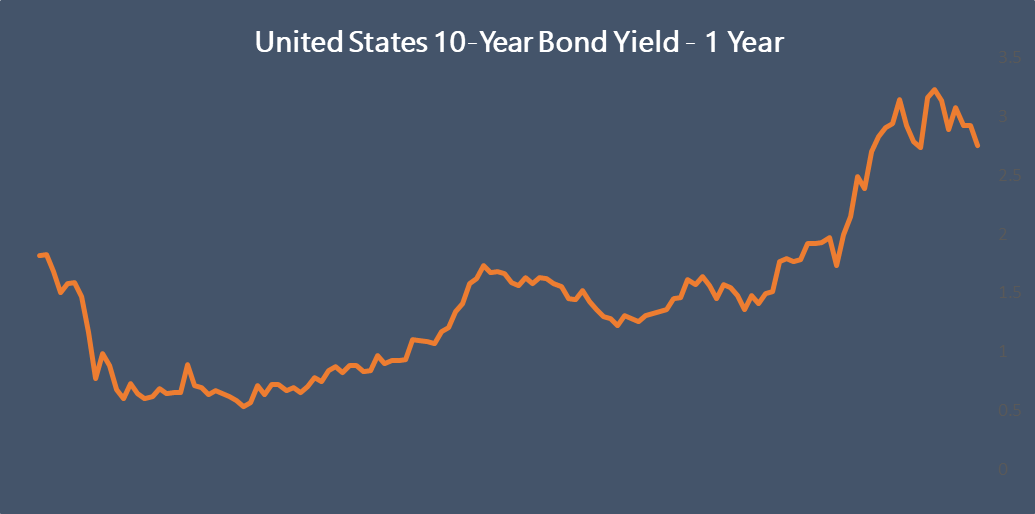

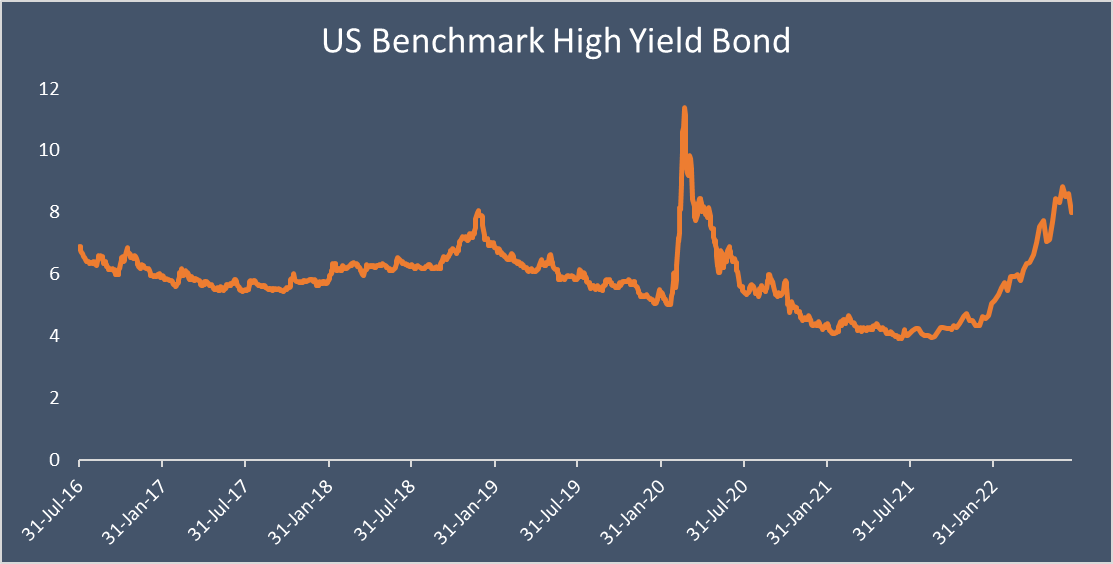

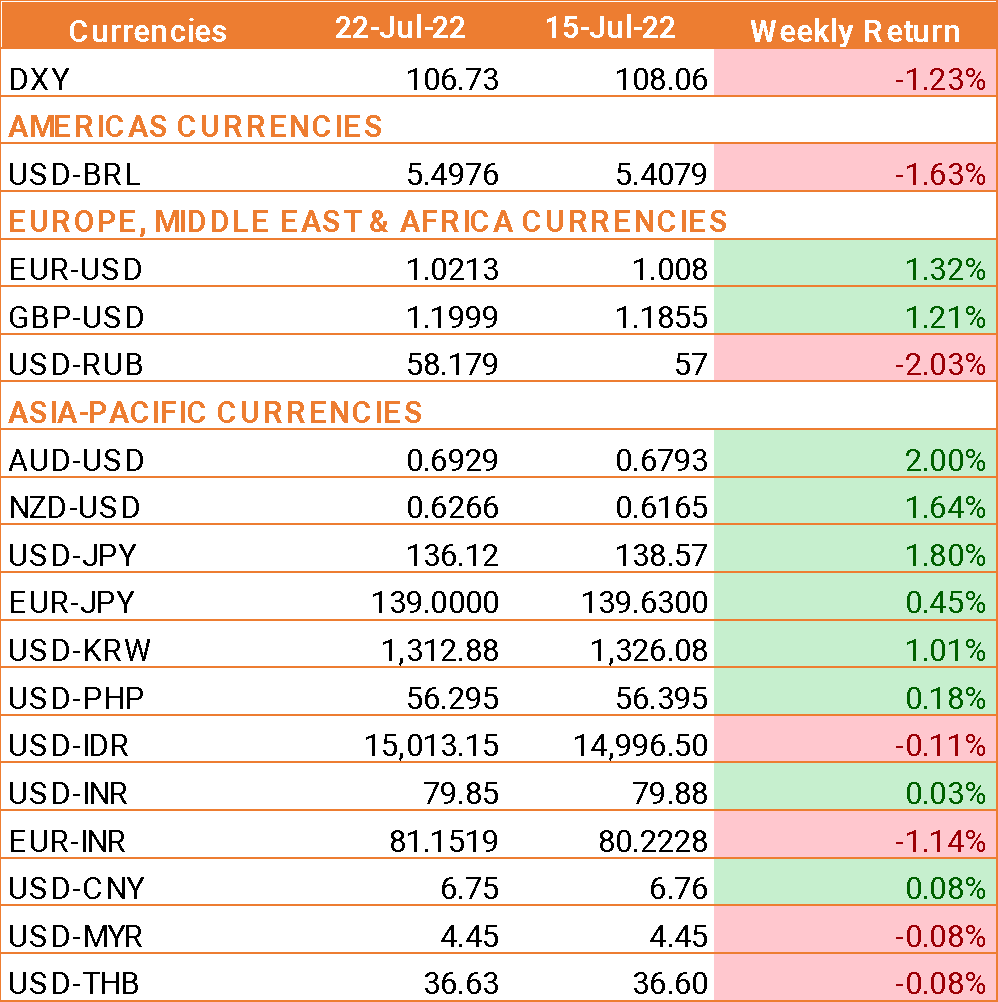

- USD falls across the board after US jobless claims indicated that weakness is creeping into the US labour market.

- US jobless claims rose unexpectedly to 251,000, up from 244,000 the previous week and well over 240,000 expectations. This is the highest level in eight months.

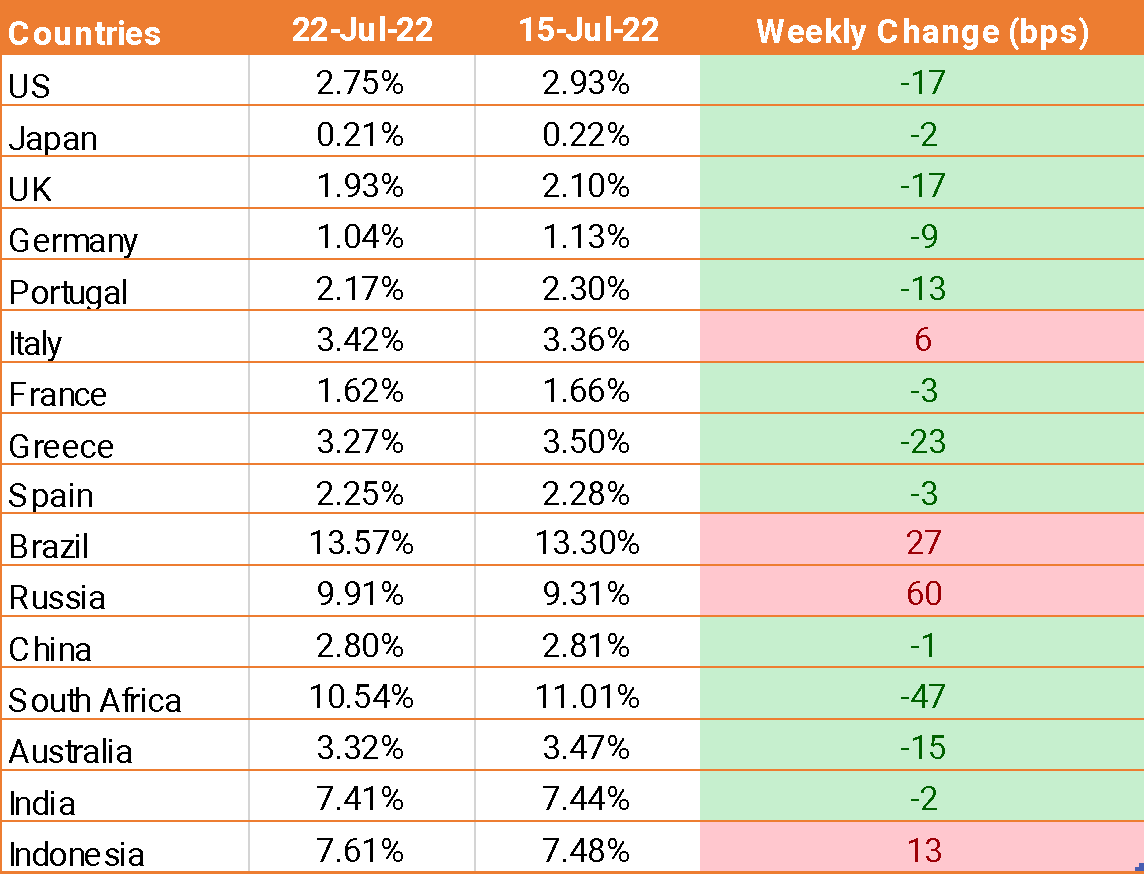

- Euro rose against the USD last week, after the European Central Bank (ECB) delivered a 50 basis points rate hike to tame inflation in its first rate increase since 2011.

- ECB policymakers also agreed to provide extra help for the 19-country currency bloc's more indebted nations - among them Italy - with a new bond purchase scheme intended to cap the rise in their borrowing costs and so limit financial fragmentation.

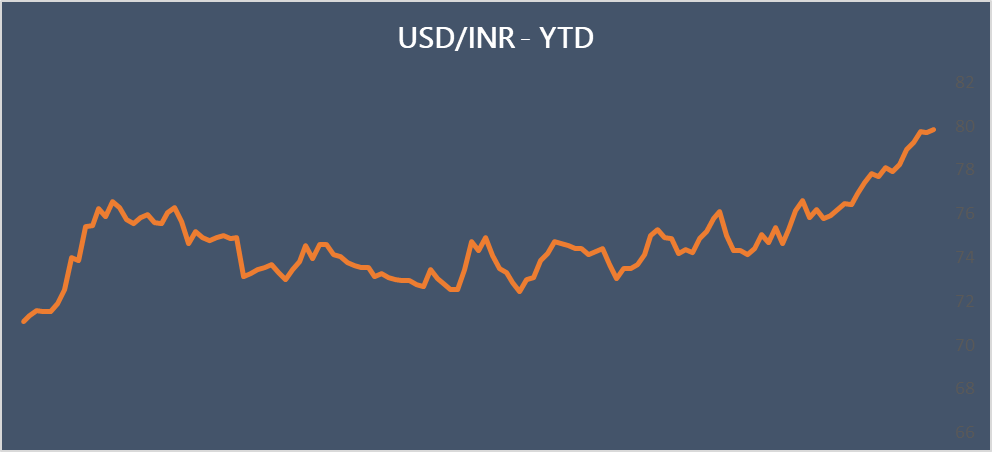

- INR ended the week marginally higher, helped by falling oil prices and due to RBI intervention.

- India's central bank is prepared to sell a sixth of its foreign exchange reserves to defend the INR against a rapid depreciation after it has fallen to record lows in recent weeks.

- The RBI's currency reserves have fallen by more than $60 billion from its peak of USD 642.450 billion in early September, in part due to valuation changes, but largely on the back of USD selling intervention.

- Federation of Indian Chambers of Commerce and Industry in its quarterly survey said that it expects economic growth of 7% in FY23, slower than the previously expected 7.4% and the central bank’s 7.2% forecast.

- RBI governor at the Bank of Baroda Annual Banking Conclave 2022, said that the central bank has no particular level for the INR in mind and would like to ensure its orderly evolution, adding that the RBI has zero tolerance for volatile and bumpy movements in the Indian currency.

We would love to hear back from you. Please Click here to share your valuable feedback