The multiple benefits of a one time rate hike to 6% include

1. Given global markets rallied from big bang fed rate hike, domestic markets too will rally on expectations of policy stability going forward

2. G-sec yield curve will also stabilize on removal of uncertainty and government borrowing will go through smoothly

3. OIS rates are anyway factoring in overnight rates at around 6%

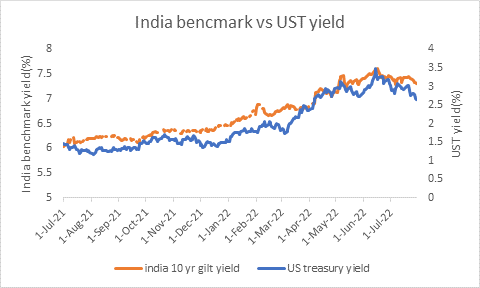

4. INR will also benefit from 6% repo rate as capital flows can stabilize on higher rate differentials

5. RBI will be seen as getting on top of inflation and this will provide macroeconomic stability

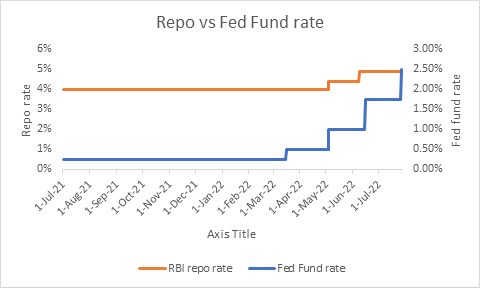

Fed Fund rate hike-Fed hikes interest rates by another 75bps in their second consecutive policy-meeting amid strong wage growth and rising inflation. UST yield curve remained inverted with 2-year UST at 3% and 10-year UST at 2.78%. Market participants widely expected 75bps rate hike from Fed as the inflation in US touched 9.1% in June 2022 and unemployment rate stood at 3.6%.

ECB rate hike-The European Central Bank (ECB) delivered a 50 basis points rate hike to tame inflation in its first rate increase since 2011.

Government bonds, SDL and OIS yield movements

Last week, 10-year benchmark 6.54% 2032 paper yield came down by 9 bps to 7.32%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 8 bps to 7.07%. 3-year benchmark 5.22% 2025 yield lost 3 bps to 6.75%. Long-term paper, 6.99% 2051 yield declined by 5 bps to 7.68%.

The spread of 10-year bond over 5-year bond declined by 1 bps to 25 bps from 26 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 22 bps from 20 bps while the 30-year benchmark over 10-year benchmark spread rose to 36 bps from 32 bps on a weekly basis.

Average 10-year SDL auction cut-off declined to 7.82% from 7.83% in previous week while spread rose to 45 bps from 40 bps.

On a weekly basis, 1-year OIS yield stood came down by 16 bps to 6.14% while the 5-year OIS yield came down by 22 bps to 6.29%.

We would love to hear back from you. Please Click here to share your valuable feedback