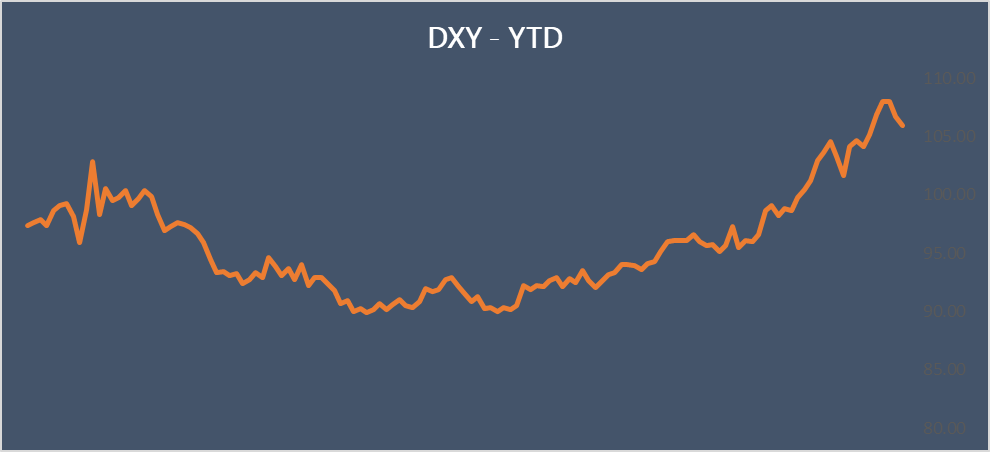

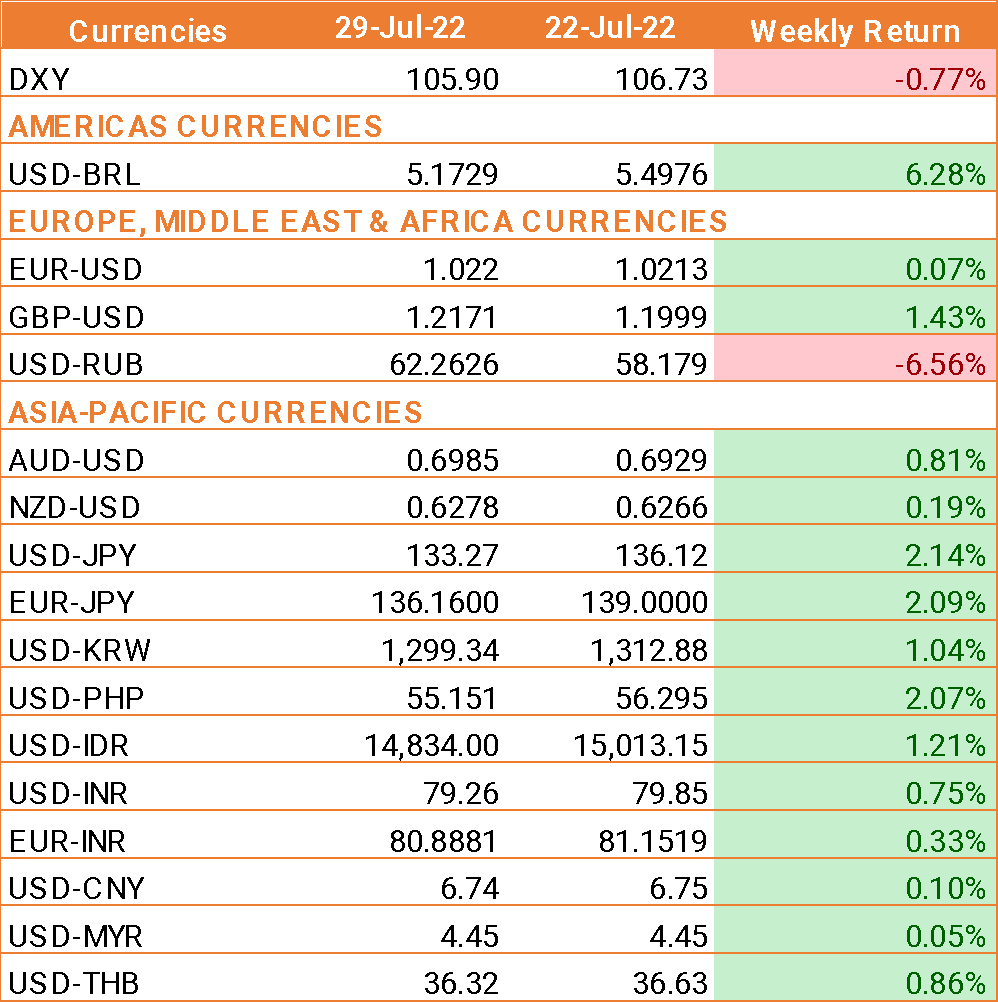

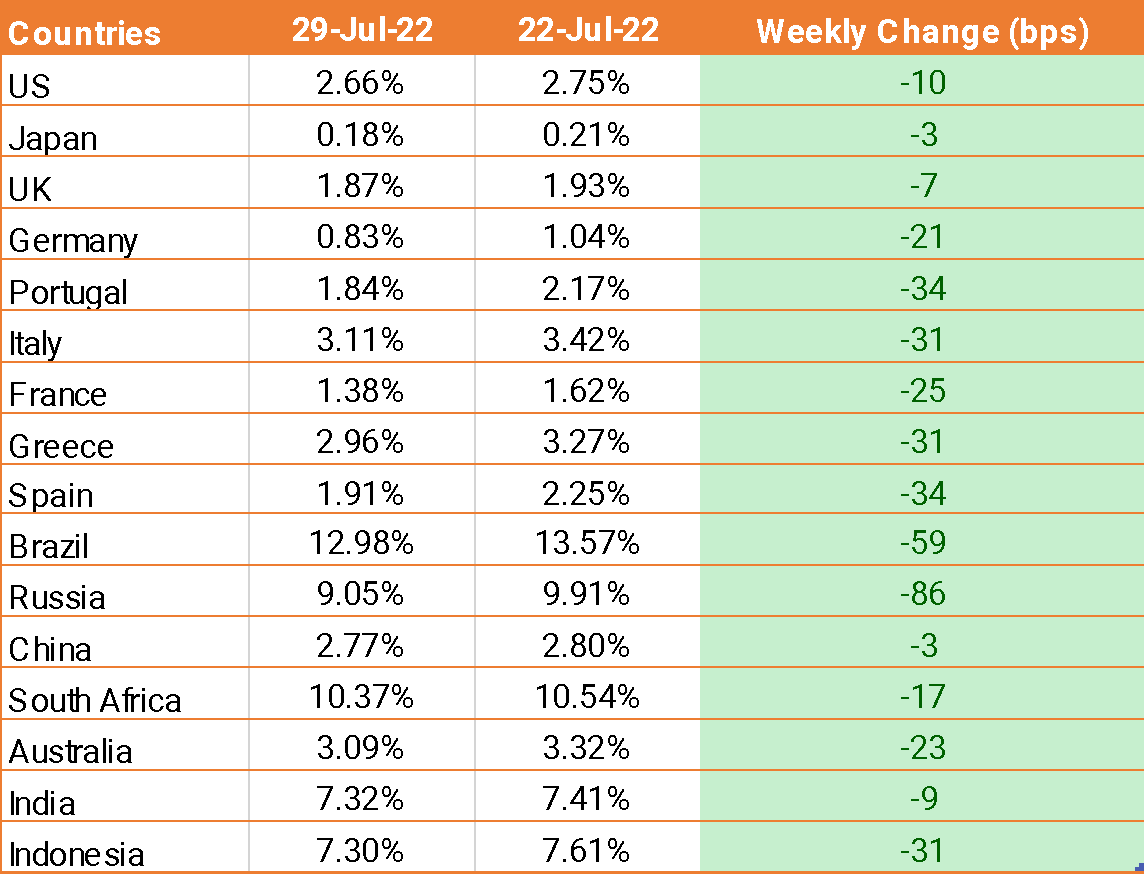

- USD fell across the board after the Federal Reserve raised interest rates by 75 bps, as expected, for the second straight meeting.

- Federal Reserve Chair Jerome Powell noted weakness starting to show up in the US economy, particularly in spending and production. Powell said that the Fed will no longer be giving forward guidance given the uncertainty in the US economy.

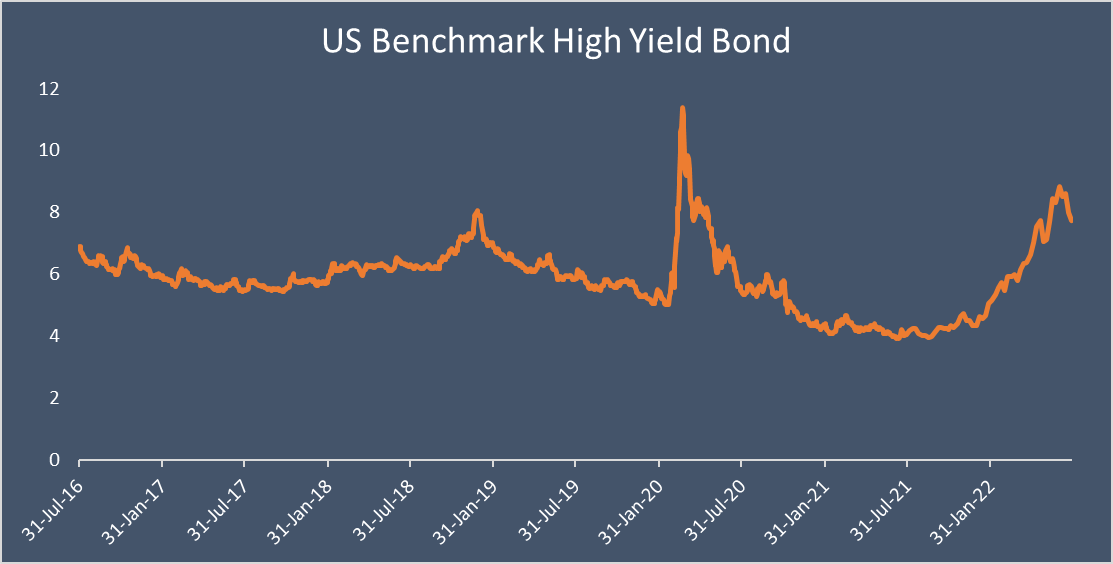

- U.S. consumer spending beat expectations in June. Consumer spending jumped 1.1% last month ahead of expectation of 0.9% and data for May was revised higher showing 0.3%, up from 0.2%.

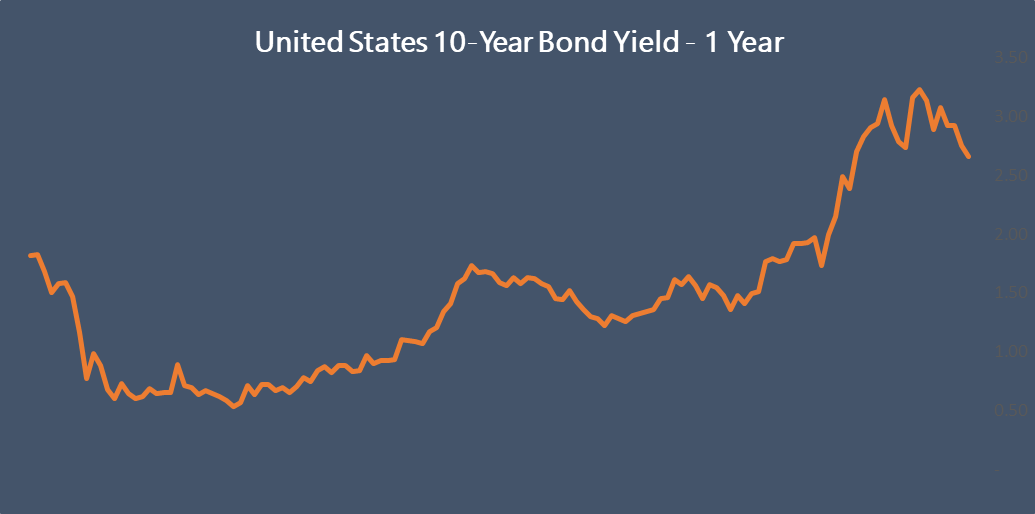

- The US economy fell into a technical recession in the second quarter of the year, contracting by -0.9% annually, down from -1.6% in the first three months of the year.

- The personal consumption expenditures (PCE) price index jumped 1.0% last month, the largest increase since September 2005 and followed a 0.6% gain in May. In the 12 months through June, the PCE price index rose by 6.8%, the biggest gain since January 1982.

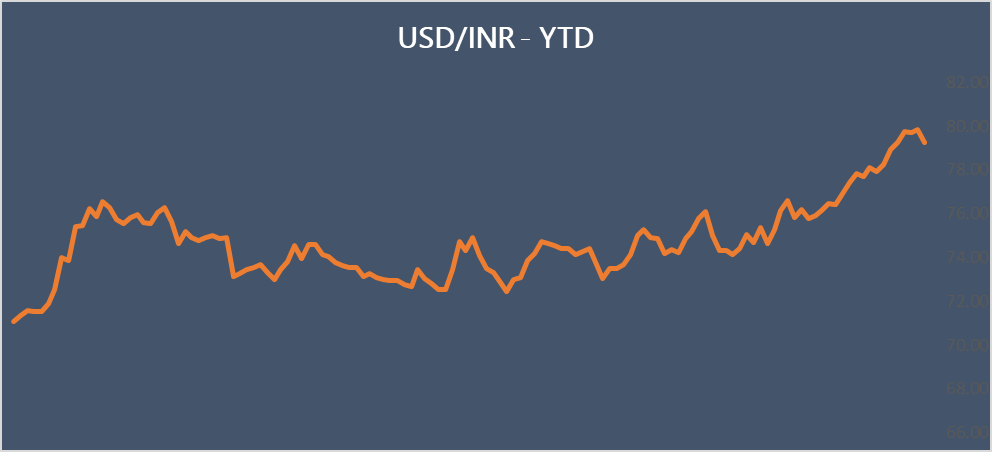

- INR is capitalizing on the weaker USD as it continues to rise from all-time low levels.

- The International Monetary Fund cut the Indian growth forecasts to 7.4% from 8.2% and cuts global growth forecasts again to 3.2% in 2022 down from 3.6% previously forecast, hurting risk sentiment.

We would love to hear back from you. Please Click here to share your valuable feedback