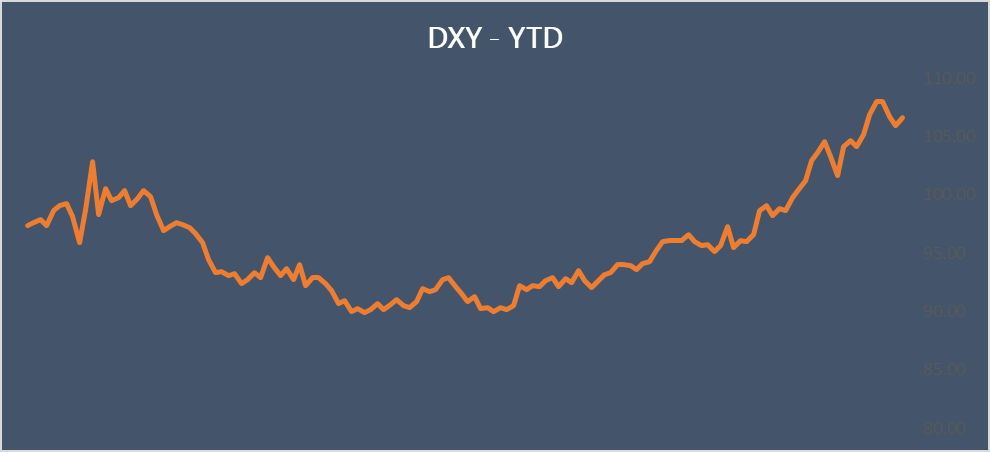

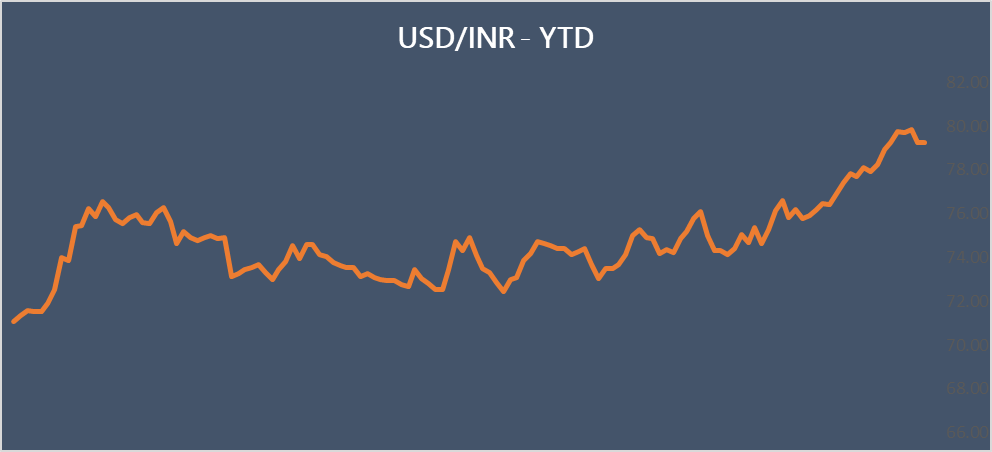

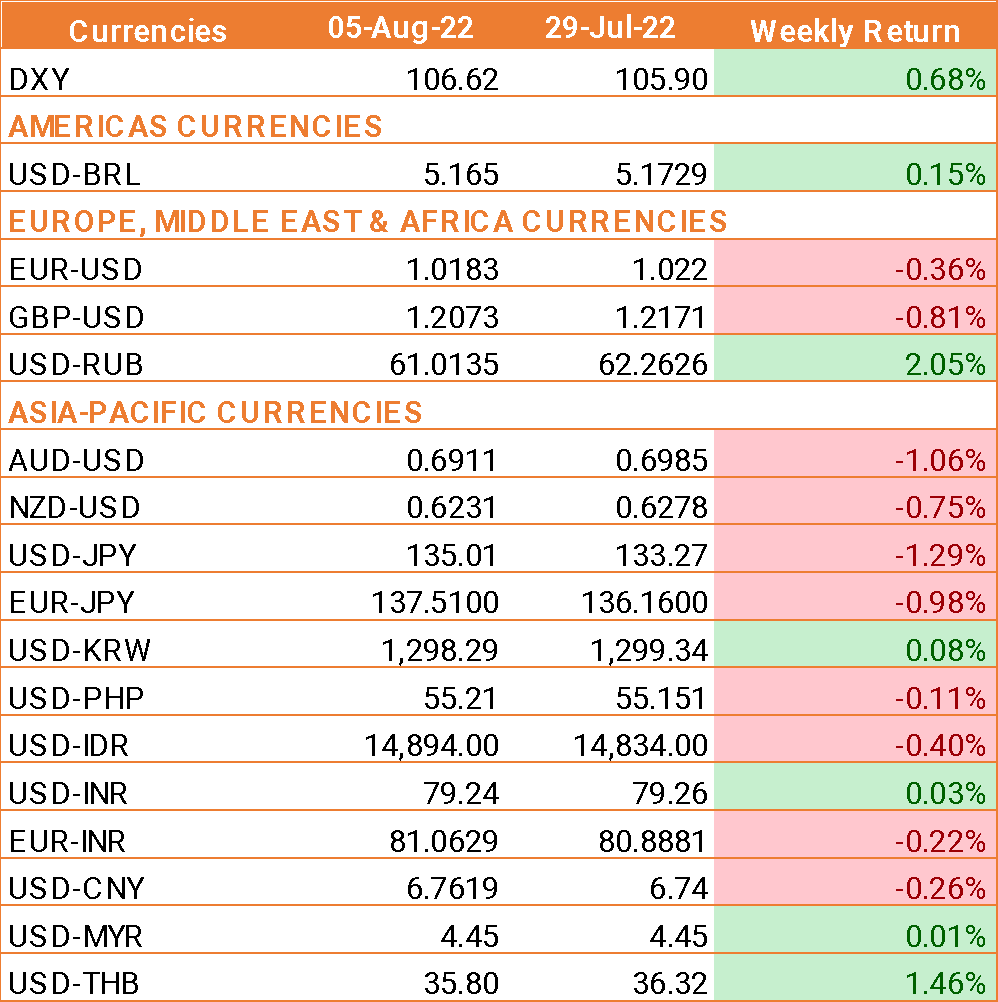

- USD exhibited a broad ee rally after a stronger-than-expected U.S. payrolls report suggested the Federal Reserve may need to continue aggressively raising interest rates in the near term.

- U.S. job growth unexpectedly accelerated in July, the non-farm payrolls rose by 528,000 during the month versus the revised figure of 398,000 in June. Market had expected the reading to slide to 250,000. The unemployment rate also ticked slightly lower to 3.5%.

- US weekly jobless claims increased more than the market expectation to 260,000 up from 254,000.

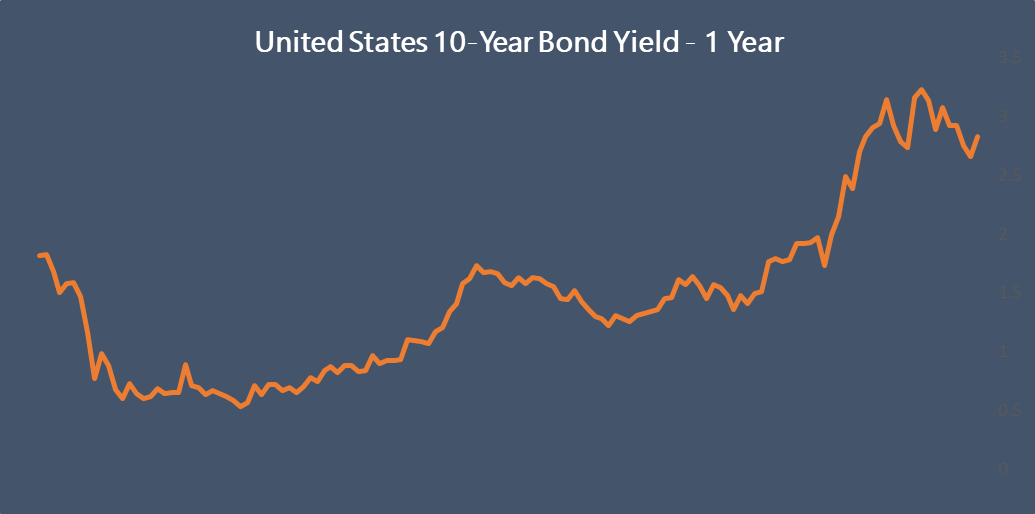

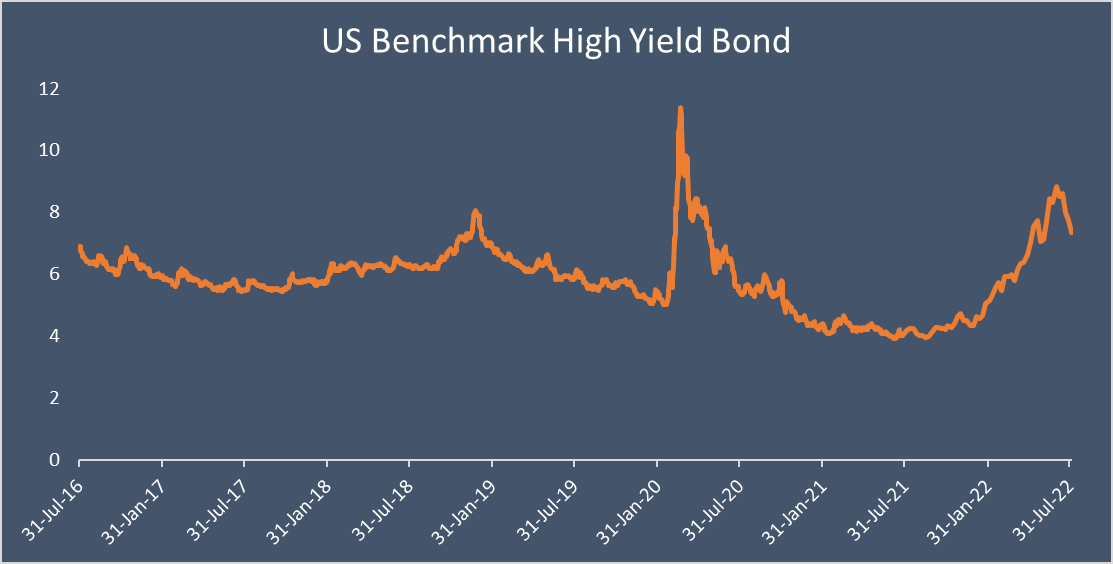

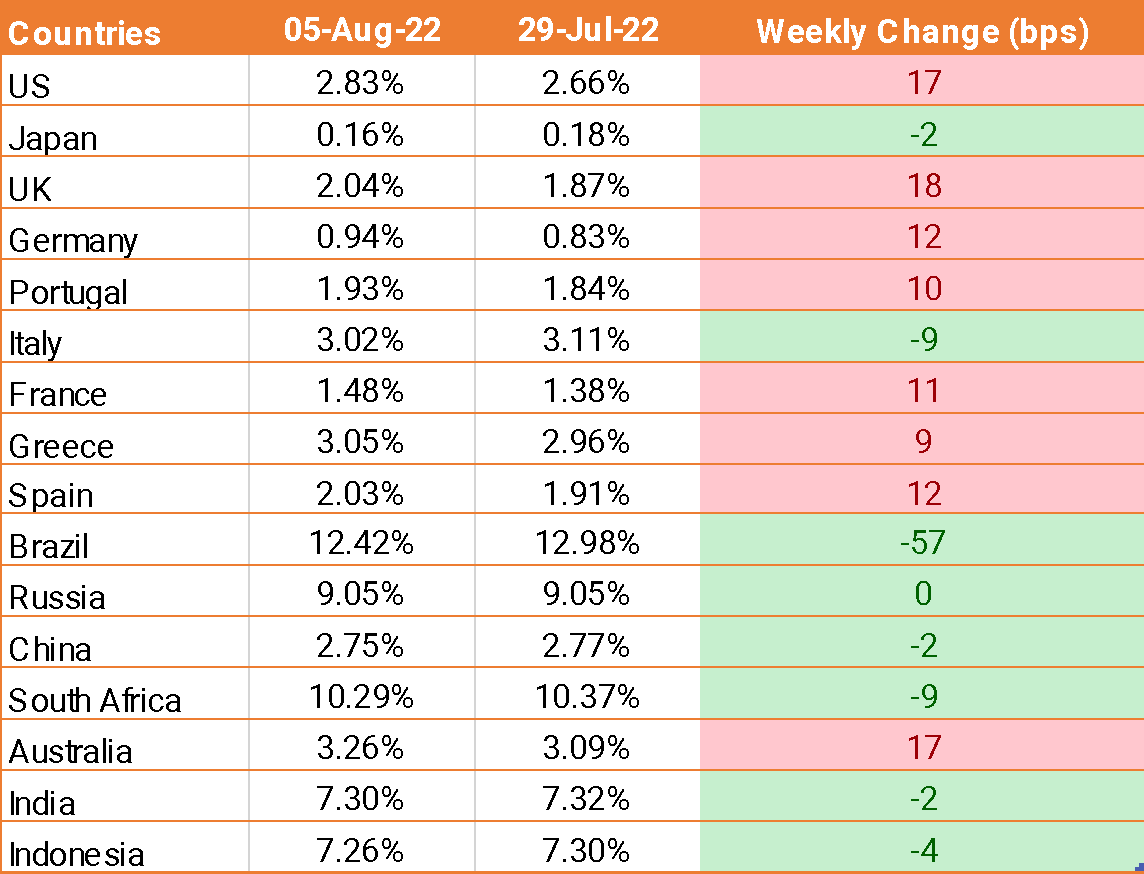

- Fed last week raised its policy rate by three-quarters of a percentage point. The U.S. central bank has raised that rate by 225 basis points since March

- INR ended the week higher as RBI raised the key interest rate by 50 basis points to 5.4% up from 4.9%. This is the second consecutive 50 basis points hike by the RBI, which aims to ensure inflation remains under control.

- India trade deficit widened in July to USD 31 billion compared to USD 26.18 billion in the previous month.

- India’s services sector slowed down to 55.5 in July, pointing to the slowest rate of growth in four months.

We would love to hear back from you. Please Click here to share your valuable feedback