RBI is unlikely to raise rates fast enough to get ahead of inflation and this will cause bond markets to steepen the yield curve from hereon. Long end g-sec yields will rise much faster than short end yields, steepening the yield curve.

1 and 5 years OIS yields are around 6.1% to 6.3% indicating repo rate to stabilise at 6%. However, inflation is likely to stay high given that the government and RBI are pushing demand while supply lags on investments facing headwinds on high cost of goods and services.

Long term inflation expectations will stay high and long bond yields will adjust accordingly, pushing up yields on g-secs at the longer end of the curve.

Domestic inflation eased to 6.71% in July 22 from 7.01% in June 22. Although inflation touched a 5 month low, it is still above the upper band of 6% pegged by the central bank. Core inflation stood at 6.80% during Jul 22. RBI has projected average inflation at 6.7% for FY23 with Q2 at 7.1%, Q3 at 6.4% and Q4 at 5.8%. It can be implied that inflation will start to fall below 6% during Q4FY23.

In the current scenario of global rate hikes and elevated inflations, it is expected that RBI will raise policy repo rate upto 6% in next policy meeting. Although the government benchmark bond yield softened to 7.29% from 7.61% level in mid-June, bond yield is likely to maintain an uptrend in the near future with anticipation of rate hike.

| Absolute Value (FY22) | % of nominal GDP in FY22 |

Fiscal deficit | Rs 15.86 trillion | 6.72% |

CAD | USD 189.5 billion | 5.98% |

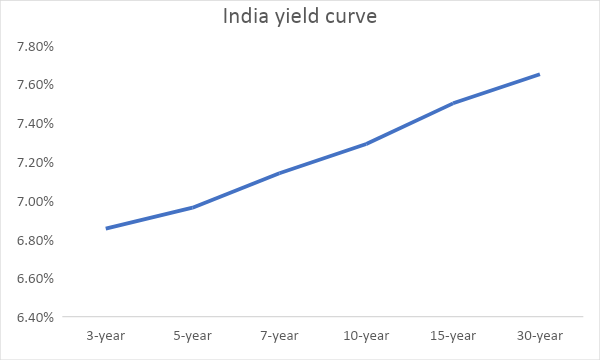

Government bonds, SDL and OIS yield movements

Last week, 10-year benchmark 6.54% 2032 paper yield came down by 1 bp to 7.29%. The 5-year benchmark bond, 6.79% 2027 yield decreased by 6 bps to 6.98%. 3-year benchmark 5.22% 2025 yield rose by 7 bps to 6.85%. Long-term paper, 6.99% 2051 yield rose by 1 bp to 7.66%.

The spread of 10-year bond over 5-year bond rose by 6 bps to 31 bps from 25 bps as compared to the previous week. The 15-year benchmark over 10-year benchmark spread rose to 21 bps from 20 bps while the 30-year benchmark over 10-year benchmark spread increased to 37 bps from 35 bps on a weekly basis.

Average 10-year SDL auction cut-off rose to 7.75% from 7.65% in previous week while spread came down to 44 bps from 46 bps.

On a weekly basis, 1-year OIS yield stood unchanged at 6.11% while the 5-year OIS yield rose by 4 bps to 6.23%.

We would love to hear back from you. Please Click here to share your valuable feedback