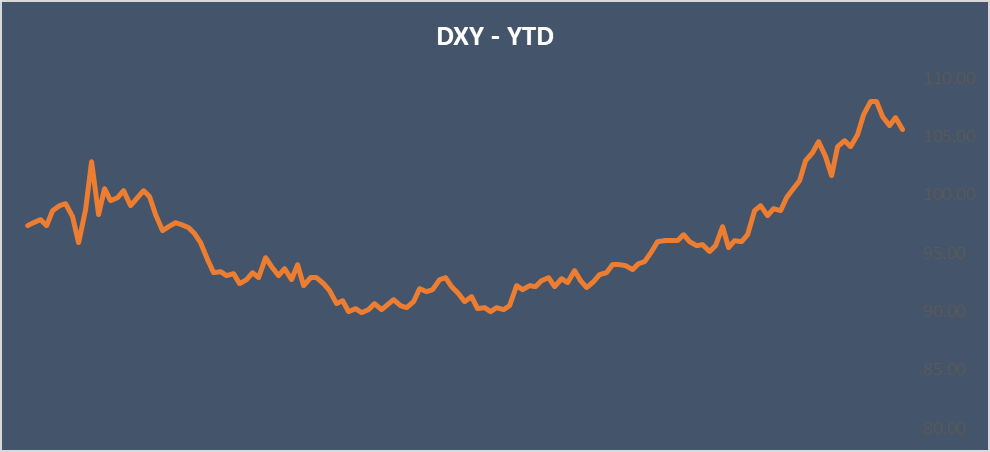

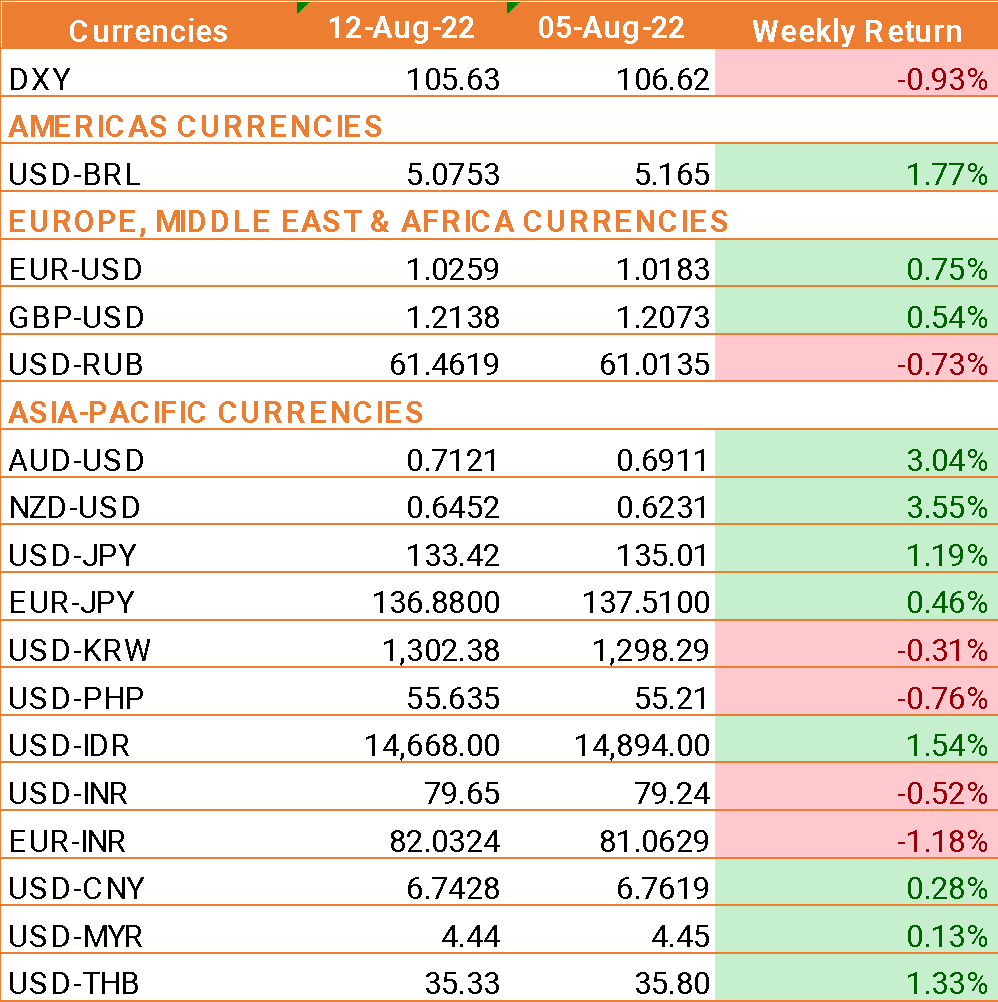

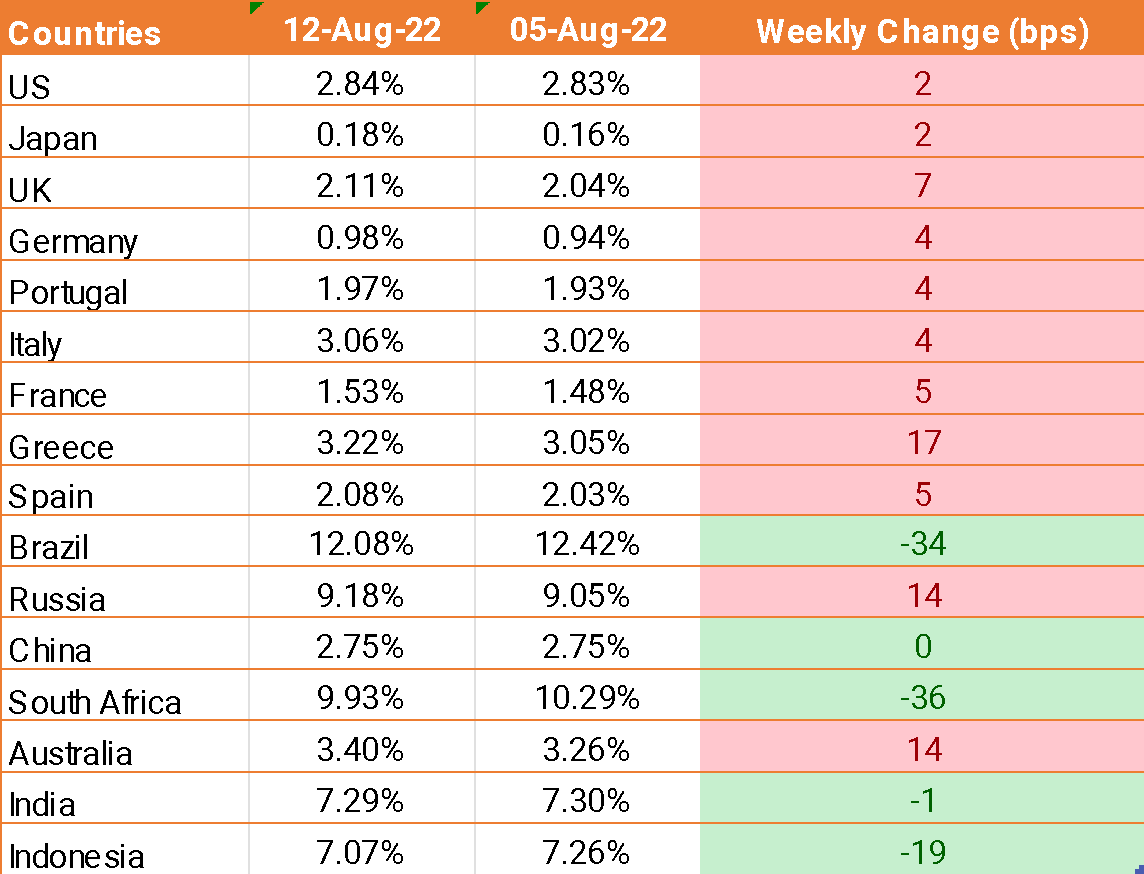

- USD traded lower last week as U.S. inflation was not as hot as anticipated in July.

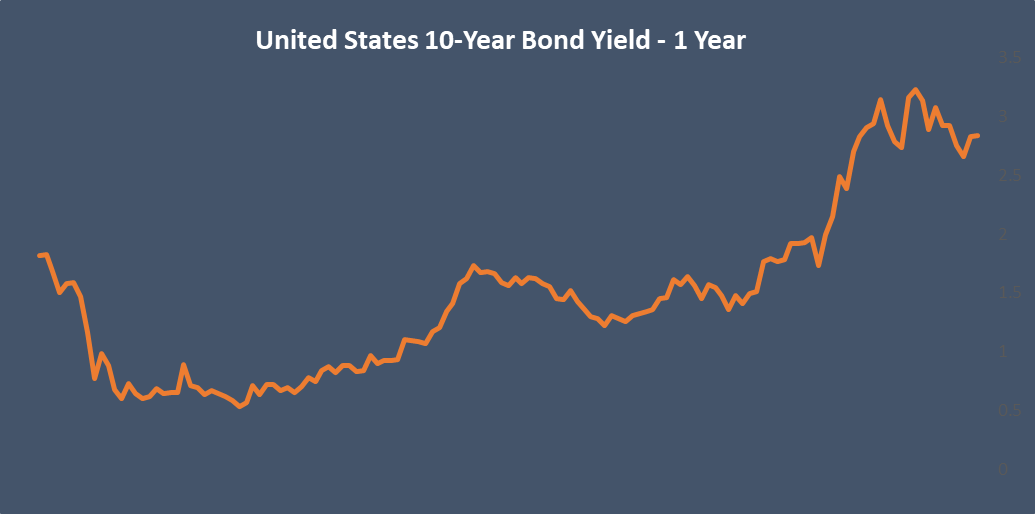

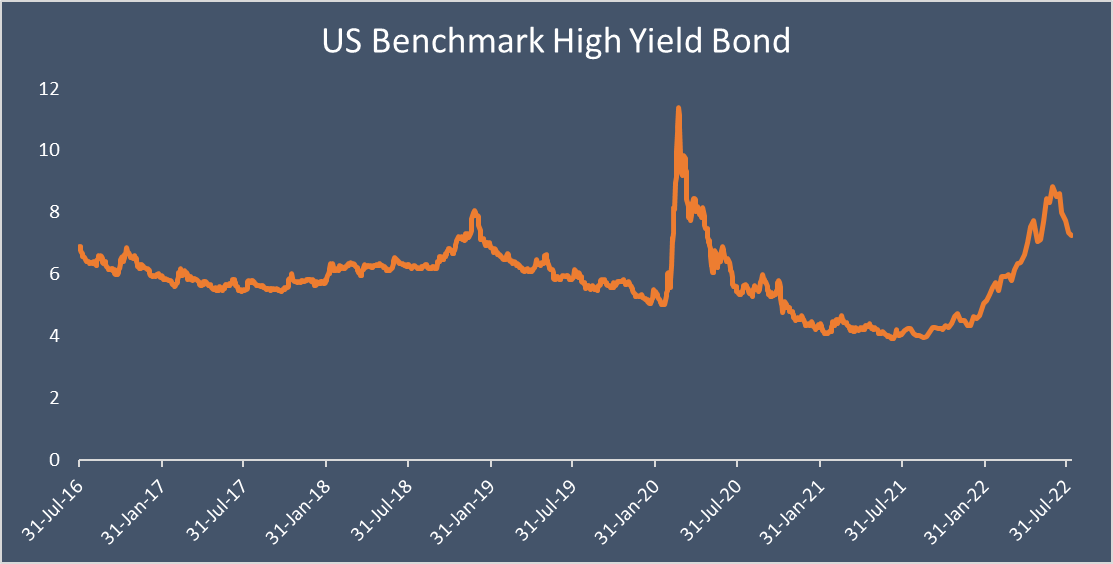

- US inflation data, the headline CPI inflation eased in July to 8.5% from 9.1% in June.

- Fed Governor Michelle Bowman said on Saturday that the U.S. central bank should consider more 75 bps hikes at coming meetings to bring inflation back to 2%

- U.S. weekly jobless claims rose to 263,000 signalling that conditions in the labour market are tightening.

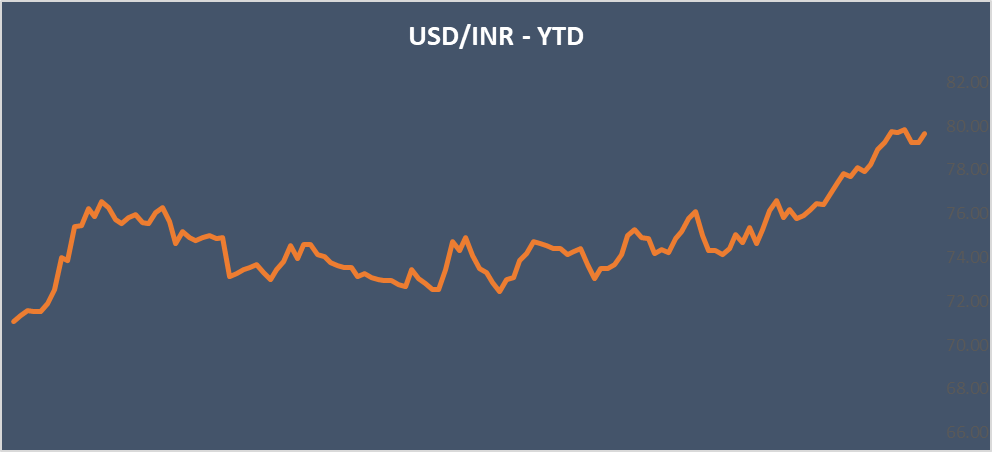

- INR ended the week lower against USD

- India’s retail inflation, which is measured by the Consumer Price Index (CPI), eased to a 5-month low 6.71% in the month of July, down from 7.01% in June.

- Import growth figures from China increased less than expected fuelling worries over stagnant demand in the world’s second-largest economy.

- China’s export beat forecasts in July as they rose by 18% compared to a 17.9% increase in June. Imports rose by 2.3% from a year earlier missing forecasts for a 3.7% increase.

We would love to hear back from you. Please Click here to share your valuable feedback